When it comes to mobile app monetization, some types of apps tend to make the most money. This is so for several reasons. To start with, these apps target lucrative markets like gaming. Mobile gamers are projected to increase by 8%, reaching 137 million users by 2027. High download rates in the segment translate to substantial revenue (sometimes simply through ads alone).

These apps also mostly use the hybrid monetization model, which involves tapping multiple monetization methods. Take lifestyle apps, for instance. Lifestyle apps can generate revenue through in-app purchases, subscriptions, and partnerships with other companies, in addition to monetizing via ads. This model allows for a diversified revenue stream and better overall profitability.

Lastly, these apps keep their target consumer behavior in mind, catering to users willing to spend money on apps. For example, a good share of users of healthcare apps are prepared to pay to achieve their fitness goals.

| Revenue source | Description | Examples |

|---|---|---|

| Subscriptions | Recurring payments on a weekly, monthly, or yearly basis | Netflix, Duolingo |

| Advertising | Revenue from impressions or clicks | Casual games, social apps |

| In-app purchases | One-time or repeat purchases inside the app | Game currencies, boosters |

| Transaction fees | Percentage taken from each transaction | E-commerce and marketplace apps |

So, let’s see the types of mobile apps that make the most money and the different monetization strategies they use. (Even if your app serves a niche market, you can still apply monetization ideas from these top-grossing app segments to monetize your app better.) Here goes.

The 9 types of apps that make the most money

1. Mobile games

The average revenue per user (ARPU) in the mobile gaming app segment is expected to hit US$57.64 this year (and US$64.26 by 2027). And given that a gaming app, on average, has about 160 monthly active users, there’s definitely money in the niche.

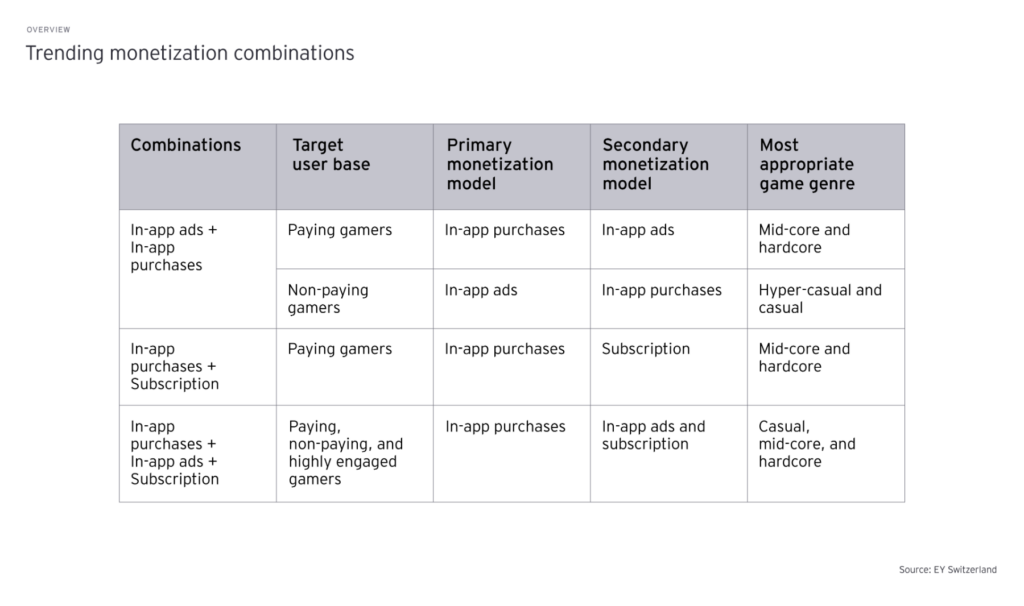

So, how do mobile gaming apps monetize? The majority of mobile gaming apps follow the free-to-play (FTP) model, so they’re free to download. The most popular monetization methods are ads and in-app purchases, with progressing in the game being the most effective driver for in-app purchases. Other reasons driving in-app purchases across the three main spender categories — high-value spenders, mid-value spenders, and low-value spenders — include in-game currencies/gems, limited-time offers/deals, and extra energy/lives/hints, among others. In general, subscriptions aren’t gaming apps’ primary monetization model:

Also, as such, there are no “most popular” subcategories in the mobile gaming apps segment, as hypercasual apps across all kinds of subcategories tend to do well. This means you’ve got the opportunity to choose pretty much any subcategory for building your gaming app. However, gaming user behavior across the app funnel varies greatly between subcategories. For example:

- Casual games can find users more easily, but you’ve to rely mostly on ads for monetization.

- Acquiring (and converting) casino game app users, on the other hand, can be expensive.

- Lifestyle games also come with a high cost per install.

It’s important to factor all these in when planning your gaming app.

2. Social apps

Social media apps too make a lot of money. However, like the entertainment apps we’ll see in the next section, the social media app space is extremely competitive, and the most popular titles take the majority of the revenue.

That said, the social media app landscape isn’t just about the most popular social networks. There’s a place for niche apps connecting all kinds of communities. You’ve niche social media apps for connecting communities like political enthusiasts, those belonging to the same religion, or those leading a certain kind of lifestyle (digital nomads, for instance). Think of these loosely as niche “interest-based social networks.”

Such social apps can be profitable through various revenue methods, such as ads, subscriptions, or in-app purchases, depending on their target audience and purpose. Many social apps also let users monetize their content/digital products.

You also have many “hybrid” social apps in this segment. While these apps target a specific area (stargazing, for example), they make “community” a big part of their app. By striking a balance between their core features and their general social networking features, they let users pursue their interests while connecting with like-minded individuals as part of a broader community. Such apps attract a diverse user base and can generate a good revenue through a combination of different monetization methods. To succeed, however, these apps need to know how to effectively monetize their user engagement.

3. Subscription-based entertainment apps

When it comes to subscription-based entertainment apps, you’re mainly looking at content streaming apps. However, while these apps generate some of the highest revenues in the mobile app space, building one may not be for most developers or even for many of the established app studios, for that matter. That’s because of how their business model works. You’re looking at content production, licensing, and other complex logistics.

In addition to all that, the most popular apps that take away all of the niche’s revenue already have loyal users. Think Netflix, Spotify, and Hotstar, to name a few. So you can understand why this segment doesn’t see that many new entrants.

But even though this segment isn’t for everyone, any app that uses subscriptions for monetizing can learn from these apps’ monetization strategies.

4. E-commerce and marketplace apps

Yet another app segment that sees good revenue is eCommerce. As new audience segments emerge, you’re getting to see several new entrants in the space. In fact, identifying underserved niches and catering to specific interests or demographics are how the new entrants are actually differentiating themselves from the existing mainstream apps and attracting and retaining dedicated user bases for themselves. Because otherwise, this, too, like all the other profitable niches in this list, is saturated with many big players. The newer entrants basically tap trends that are likely to hold.

One such trend is opting for clean, sustainable, and socially-conscious choices. More and more new eCommerce apps are carving out a place for themselves by targeting this lifestyle, offering curated selections of all-natural, organic, and sustainable products, catering specifically to consumers who are looking for clean and sustainable options. By focusing on this niche market, these new entrants are able to differentiate themselves from larger etailers and appeal to a dedicated customer base seeking environmentally friendly products. Clean beauty/skincare is just one example.

These apps make money in many ways:

- Subscriptions

- Ads from partner brands

- Transaction fees

This trend toward conscious consumerism is only expected to grow as more people prioritize sustainability in their purchasing decisions, so this category should see more apps.

5. Dating apps

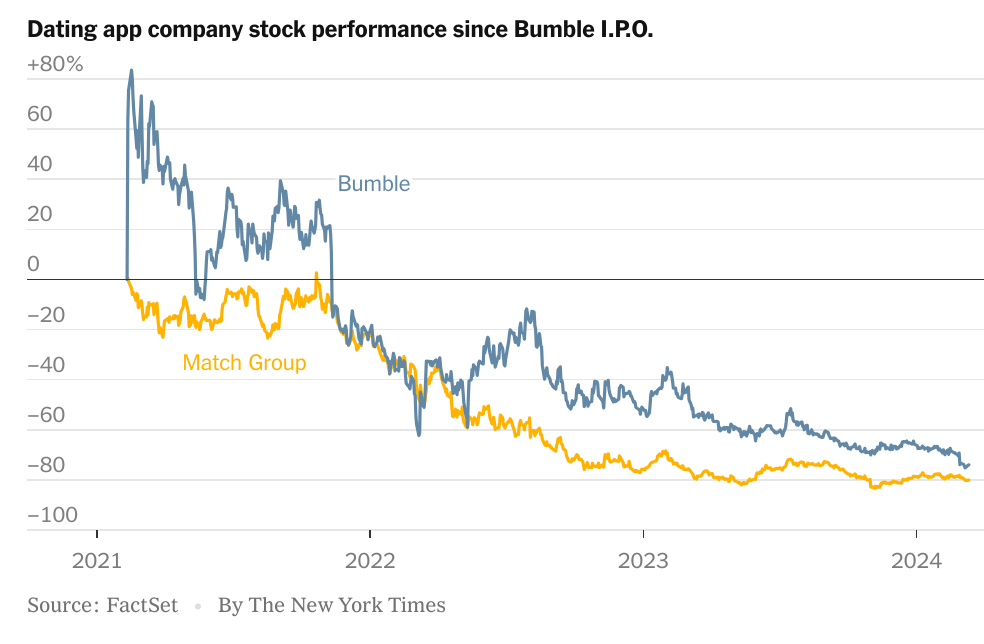

While both the top apps in the niche (Tinder and Bumble) have seen a slump in their market value, the dating niche still remains promising. Before we see how dating apps monetize, let’s understand the demographic shift that’s causing the slump. When the dating apps first grew, they targeted millennials… and most millennials are now married. This story explains what’s happened really well:

“Millennials, the nation’s largest generation, were prime dating age when Tinder first rolled out, but more and more of them have married in recent years, a decision that usually results in people quitting the apps. Now the primary users are from Gen Z, a younger — and smaller — demographic with less disposable income. That generational shift poses a challenge for the dating app industry.”

To navigate this challenge, dating apps are having to experiment with how they monetize. Traditionally, dating apps have made money through 1) straightforward premium subscriptions, 2) in-app purchases for additional features like spotlights, and 3) advertising. The bigger apps also sold their own merchandise.

However, there’s now a need to experiment with these revenue streams. These apps are, in fact, looking to experiment with all kinds of products, from weekly premium plans and fully la carte plans to digital goods like digital flowers. They’re also looking to make their paying customers pay more by providing newer and better dating experiences.

If you’re considering entering this lucrative dating app niche, research your target demographics’ spending behavior. It will help design a monetization model that aligns with your audience’s spending capacity, preferences, and habits.

6. Finance apps

Finance apps are yet another mobile app type that makes a lot of money. With finance apps, you’re mainly looking at apps for expense tracking, investments, and payments. You also have general financial management apps with features across expense tracking, investments, payments, and more.

The finance app segment is profitable because its users are willing to pay for personal finance management. In its Personal Finance Mobile App Market Outlook report, Fact.MR, a market research provider, surveyed users from 30+ countries like the US, Canada, UK, and Japan and found that about 40% of them are willing to pay for a personal finance mobile app.

When it comes to monetizing finance apps, app makers use many different approaches. Some finance apps monetize with advertising so they can keep their app free. It’s common to add ads for credit cards, loans, and policies in these apps. Other apps offer a freemium model, offering a limited or ‘lite’ free version with a premium version that’s available via different subscription plans. Some apps also go with the paid mode, catering to just paying users. Another strategy is selling aggregate data to fintech businesses. While this can be a lucrative option, potential risks and ethical considerations are important to factor in. It’s also crucial to ensure that the data is in an aggregate form and isn’t personally identifiable to maintain user trust and stay on the right side of the data protection regulations.

The finance app niche is not just about profitability, but also about innovation. Adding cutting-edge technologies such as AI, machine learning, and blockchain is helping app makers offer personalized experiences, improved returns, and enhanced security to their users.

7. Fitness apps

Valued currently at US$6.86bn, the fitness apps segment is expected to grow at an impressive 9.99% annual growth rate and hit US$10.04bn by 2028. With an average revenue per user at $17.84, the niche caters to users willing to spend on the apps.

While, again, this niche is super competitive, like the others on the list, one thing about it is that even the newer apps see quite a few downloads. This is probably because users want to try new apps to achieve their fitness goals. For example, if you look for gym log apps, while you’ll see dozens of apps with millions of downloads, you’ll also see apps with thousand or five thousand users.

This indicates that there’s still room for more apps, as users are willing to experiment with newer ones. So, if you can develop a high-value app, you can build a small but loyal user base who’ll also happily pay for it.

Speaking of monetization, fitness apps monetize through various methods. Some offer a free version with ads. Others require a subscription for access to premium features or the premium version that unlocks everything the app has to offer. In-app purchases for personalized coaching are also common monetization strategies. Fitness apps also offer one-time purchases to users so they can unlock features that they want to for a simple one-time fee—for example, to access a new workout regime. This helps users get more value from an app without having to commit to costly subscription plans. And for apps, such in-app purchases means seeing better revenue per user.

8. Mental health apps

Okay, so mental health apps belong to the fitness apps category. Yet, they stand out because of the market size they address—the mental health apps sub-segment is set to grow at a compound annual growth rate of 15.2% and reach US$14.72b by 2030.

Under the mental health category, you’re looking at all the apps that help users:

- Manage depression, anxiety, and stress

- Practice meditation

- Prioritize mental wellness

Of these, the meditation category has apps like Calm and Headspace, which are market leaders in the mental health app industry. These apps have seen significant success, with an average ARPU of US$40, set to hit US$60 by the end of 2027. Their success can be easily attributed to their user-friendly interfaces, high-quality content, and effective marketing strategies.

Like fitness apps, even new mental fitness apps find their share of users, as users are open to trying newer apps for more enriched experiences. For example, mental health apps with AI (for example, with a virtual “friend”) are popular with users. It’s worth noting that many of these apps are relatively new, hinting at the exciting potential for further innovation.

In general, mental health apps monetize via subscription plans, in-app purchases for premium features, partnerships with healthcare providers/brands, sponsored content and advertisements. These apps can also generate revenue through data analytics and insights provided to healthcare organizations or other businesses. Since this is “selling data,” monetizing with this method needs compliance checks and navigating user trust issues, among other things.

9. AI-powered apps

As chatGPT became mainstream, a host of app makers cashed in on its popularity to launch AI-powered apps. Just add “AI” to your search phrases and look up any niche, and you’ll see that every niche now has apps that use AI in some form to offer distinguished user experiences. Even the bigger players are adding AI to their apps to offer better app experiences.

Many things work for AI apps. AI-powered apps can offer more value. Telling a productivity app’s AI assistant what you want to do and having the assistant create a list of tasks you just need to tick off to get it done translates to a great user experience. AI-powered apps offer better engagement too. AI-powered apps use their users’ data to offer personalized app experiences. And personalized experiences translate to better engagement. Additionally, AI-powered apps can continuously learn and improve over time, delivering even more relevant app expriences to users in the long term. This means you’re looking at better retention.

The monetization model for an AI app will largely depend on the niche and audience segments its targeting.

Wrapping it up…

As you can imagine, mobile apps that make the most money target the most competitive app segments. Unlike niche apps, capturing a share of such saturated markets is challenging. Differentiating your app can be difficult unless it offers unique value.

Additionally, you’ll need to be prepared to invest more in your app’s visibility. Relying solely on organic discovery methods, like in-store search, won’t likely work. Beyond the discovery stage, too, you’ll also have to invest in experimenting with your in-app products, pricing, and paywalls to encourage more users to upgrade to paid plans or make in-app purchases. Finally, you’ll also need to tap growth strategies, such as PR and holiday marketing, to further boost your user acquisition and revenue campaigns.

Overall, making an app profitable in a competitive segment, where the most popular titles capture the majority of profits, is not as easy as breaking into a niche market. But it’s not impossible!

About Adapty: If you’re looking to break into a competitive app segment, consider adding Adapty to your marketing mix. With Adapty, you can add in-app purchases (including subscriptions) to your app in just a few hours and experiment with different monetization models. Additionally, you can run tests on your products, paywalls, and pricing strategies. Adapty also features a no-code paywall builder to simplify your monetization experimentation. Adapty even comes with built-in analytics to provide insights into your users’ spending behavior across their entire lifecycle. Top-grossing mobile app businesses, app studios, and independent developers trust Adapty for their revenue management. Even Bumble uses Adapty!