How much does an app make: Adapty’s ultimate app revenue & VAT guide

August 30, 2023

24 min read

With more and more mobile developers earning millions from their products, a question like “How much do apps make?” loses its naivety and becomes a legitimate business interest. Of course, no specific number can be named — the overwhelming majority of apps on mobile platforms collect virtual dust, with just a relatively small part being the top earners in their field. Nevertheless, new publishers pop up every day: and in a market that will grow 13% year to year, there’s always a place for a new player.

That’s why we decided to develop the ultimate app revenue guide that answers all the basic questions about the industry, and then some. Adapty is the best solution to grow mobile in-app purchases, and our expertise comes from thousands of clients enjoying our platform, as well as millions of A/B tests being launched on it monthly. With this guide, we plan to give you enough information to come up with a sound business plan for your future app.

First, we will get and learn the difference between proceeds, revenue, and profits. Then, we will see what parts of your product’s income are given to the partners and governments, and how to account for that. And for the final kick, we will check out several ways to boost your incoming cash flow, including optimizing pricing strategies and tracking financials. This way you will learn not just how much money can you make from an app, but how you can make more. Let’s go!

Revenue vs. Proceeds

Adapty helps developers monitor and optimize their subscription-based business models, which is crucial for growing both mobile app revenue and proceeds. But to be able to do this, we first need to make sure we understand and know the difference between the two terms.

Revenue and proceeds are two financial terms that, while related, have distinct definitions and applications. Revenue is the total amount of money your service earns from all sources possible: ads, in-app purchases, and subscriptions. It’s essentially the gross income a business makes before any expenses are deducted.

Proceeds, on the other hand, refer to the net amount a developer receives from their app after all direct costs related to a transaction have been subtracted. The two basic direct costs we need to keep in mind are the App Store commissions and taxes, both of which we will cover later in this guide.

Consider the App Store or Google Play Store. When a developer sells a $10 app, the revenue from that sale is $10. If the App Store takes a 30% cut (and it usually does), or $3, the proceeds that the developer gets would be $7. While the revenue indicates the total sales, the proceeds provide a more accurate measure of the developer’s actual earnings.

Understanding the distinction between these terms is vital for app developers, particularly those operating on a subscription-based model. The total mobile app revenue can provide insight into the app’s market appeal and the effectiveness of marketing strategies. Meanwhile, the proceeds can inform the developer about the real profits being made, accounting for app store commissions and other direct costs.

Adapty provides comprehensive subscription analytics to help developers track and interpret these numbers. By offering insights into key metrics like revenue, proceeds, and conversion rates, Adapty empowers developers to make informed decisions about pricing, marketing, and app development strategies. With a clear, data-based picture, developers can better strategize on ways to increase their app’s profitability and long-term success.

Understanding VAT

As we mentioned earlier, App Store commissions and taxes are the two key direct costs every app developer should be wary of. Not only do they take the biggest cut off your app revenue, but they are also the hardest to change or influence. Let’s start, however, with the most popular tariff.

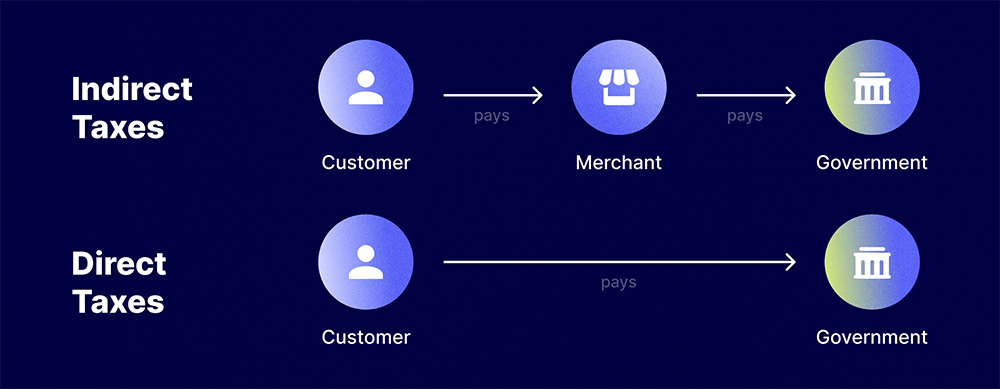

Value Added Tax (VAT) is a consumption duty levied on a product whenever value is added at each stage of the supply chain. Its key principle is to tax the end consumer of goods and services while offering businesses a way to reclaim the money they have paid. This way the VAT is ultimately paid by the consumer, and not by the businesses involved in production.

With app sales and in-app purchases, VAT is applied based on the location of the user and is based on their country of residence. When a customer makes a purchase, the listed price they see already includes any VAT due. The App Store then deducts this VAT amount before the developer receives their proceeds.

For example, if a user in Italy purchases an app for €10. The VAT in his country of residence is 22%, so €2.2 of the purchase price is considered VAT. The developer’s net revenue is the remaining €7.8, from which the App Store takes its commission. In most cases, it’s 30%, so the final proceeds are €5.46.

Understanding VAT and how it impacts the net mobile app revenue from app sales is crucial. It aids in setting appropriate pricing strategies and accurately forecasting earnings from different markets.

Collecting VAT for apps

Yes, App stores like Apple’s App Store and Google Play Store are in charge of collecting and paying VAT on your behalf. Technically, you “sell” your app to them, and they provide it to the end user, so they’re the last party responsible. The stores automatically add the VAT onto the price of apps and in-app purchases based on the customer’s location, collect the payments and send them to the relevant states.

Therefore, developers don’t have to manage VAT collection directly. The proceeds you receive have already had taxes and store commissions deducted. Important to remember, however, that the prices the end users see have the commission and the VAT included. That’s why a flexible pricing strategy here is crucial and should consider local taxes, as well as any other income taxes your company might need to pay. Speaking of which…

Taxes on app income

As we saw before, taxes significantly impact the net earnings from app sales and in-app purchases. When calculating how much apps make, companies must consider these taxes to learn their actual profits. And if VAT is fixed and is calculated, collected, and paid by the app stores, other taxes are solely the developers’ responsibility and can prove to be tricky.

Ignoring these deductions can lead to an overestimation of profits, inaccuracies in financial forecasting, and potential difficulties in sustaining the business.

In this part, we give a quick rundown of the most common taxes an app developer studio might have to pay. Needless to say, actual numbers might differ based on the country your company is located in, and the council of a professional accountant is advised.

Other taxes app developers should pay

App developers and publishers are subject to various types of taxes based on their business operations and location. The ones that most companies are subject to are the income tax and the sales tax.

The income tax is levied on the net profits made by the business. In our case, remember, the net profits come after the App Store commissions and the VAT. Given our Italian case, the income tax will be calculated against €5.46 out of every €10 of your mobile app revenue. The tax rate charged depends on the country and sometimes the state in which the business operates.

The sales tax may apply to app sales and in-app purchases. In many cases, app stores handle sales tax collection and remittance the way they do the VAT, but developers should still be aware of how these affect their revenues. If the sales tax is collected by the store, it’s also deducted from the gross revenue; if not, you are in charge of calculating, collecting, and paying the tariff. Sales taxes differ greatly, so be sure to learn the specifics.

Tax optimization for app developers deserves a separate guide altogether. For quick advice, however: in some jurisdictions and industries, app publishers can apply for the status of an innovative company or a startup, which usually implies lower or even zero sales tax and a simplified tax collection altogether. You would benefit from learning what options are available in your country of residence.

Remember, failure to comply with tax obligations can result in significant penalties and damage to your business’s reputation. Therefore, understanding and meeting your tax responsibilities should be the top priority. The knowledge of how much your app makes is useful not just for a business model, but for the stability of the whole company.

App Store commissions and fees

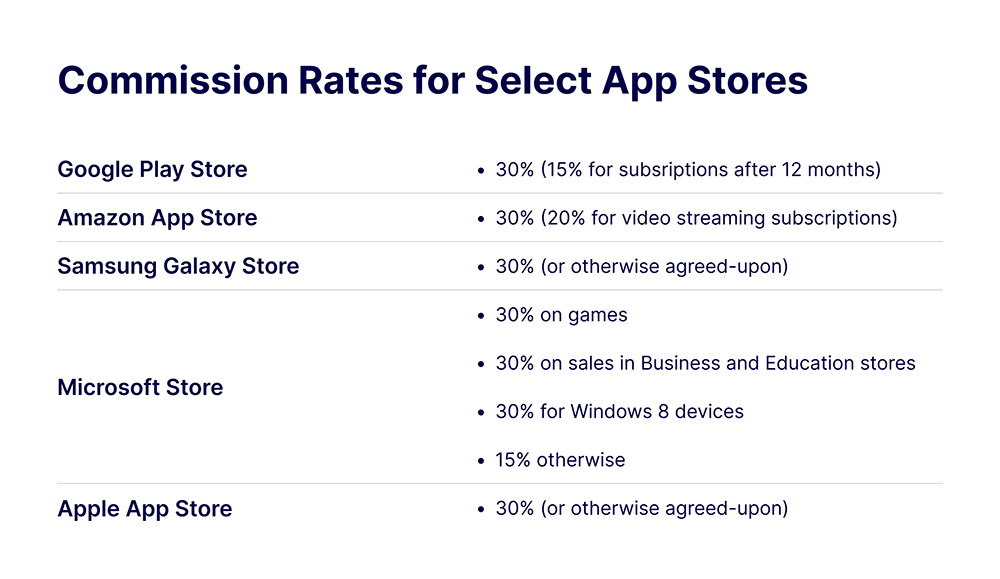

Commissions are the second direct cost all app developers should know. Introduced together with the App Store back in 2006, the sizeable cut is still a matter of heated debate. One of the most famous is Epic Games v. Apple, where the developer of one of the world’s most popular – and profitable – mobile games sued the smartphone producer for the behavior it deemed anti-competitive.

And knowing the actual numbers, you might understand their frustration. Typically, both Apple App Store and Google Play Store charge a commission of 30% on app purchases, in-app purchases, and subscriptions. If it seems big to you, that’s because it is; however, this is the rate you should keep as the go-to for all your app revenue calculations.

To soften the blow, both platforms have introduced reduced commission rates for smaller developers and subscriptions that are retained for over a year. For instance, under Apple’s App Store Small Business Program, developers earning less than $1 million per year pay a reduced commission of 15%. And both in App Store and Google Play, after a subscriber has been active for a year, the commission drops to 15%.

Let’s take an example. If a developer sells an app for $10, the app store would take a commission of $3 (at the standard 30% rate), leaving the developer with $7. However, if the developer is eligible for the reduced 15% rate, the commission on a $10 sale would be $1.50, leaving the developer with $8.50.

Reducing App Store fees

The 30% commission is a significant cut of the profits, and most developers try to find a way to pay less. The go-to way is to follow the mobile platforms’ own rules: that is, stay a low-earning company or attract customers to be long-term subscribers. And while the first option is a sad business forecast, the second is an option we strongly recommend.

In fact, Adapty was designed specifically for subscription-based apps that care about long-term results. It allows you to constantly adapt paywall offers that convert more people into paying customers, and keep customers loyal for several years. It’s one of the few solutions whose benefit can be clearly measured in money: For every loyal customer, you save 15% of the commission on the annual or monthly subscription.

Here are some other options:

- Combining Several Pricing Models. Developers can use several pricing models like freemium, paid apps, in-app purchases, or subscriptions. A freemium model attracts a large user base, and then premium features are used to monetize it through in-app purchases or subscriptions.

- Optimize Pricing. When choosing prices for the app and the in-app purchases, consider the target market’s purchasing power, competitor pricing, and the value provided by the app, as well as local taxes and fees.

- Direct User Billing. Although it has its complexities, some developers choose to bill users for their services directly, bypassing App Store fees. This approach has stringent guidelines and restrictions, especially with Apple, which is known for blocking apps that give a possibility to circumvent the system.

However, for some of us, the changes are coming. Starting with iOS 17, Apple is rumored to allow sideloading — installing apps not from the App Store — for users in the European Union. In theory, this would allow developers to charge for them without the 30% fee — but with the taxes remaining.

2024 subscription benchmarks and insights

Get your free copy of our latest subscription report to stay ahead in 2024.

The best solution for understanding commissions and taxes

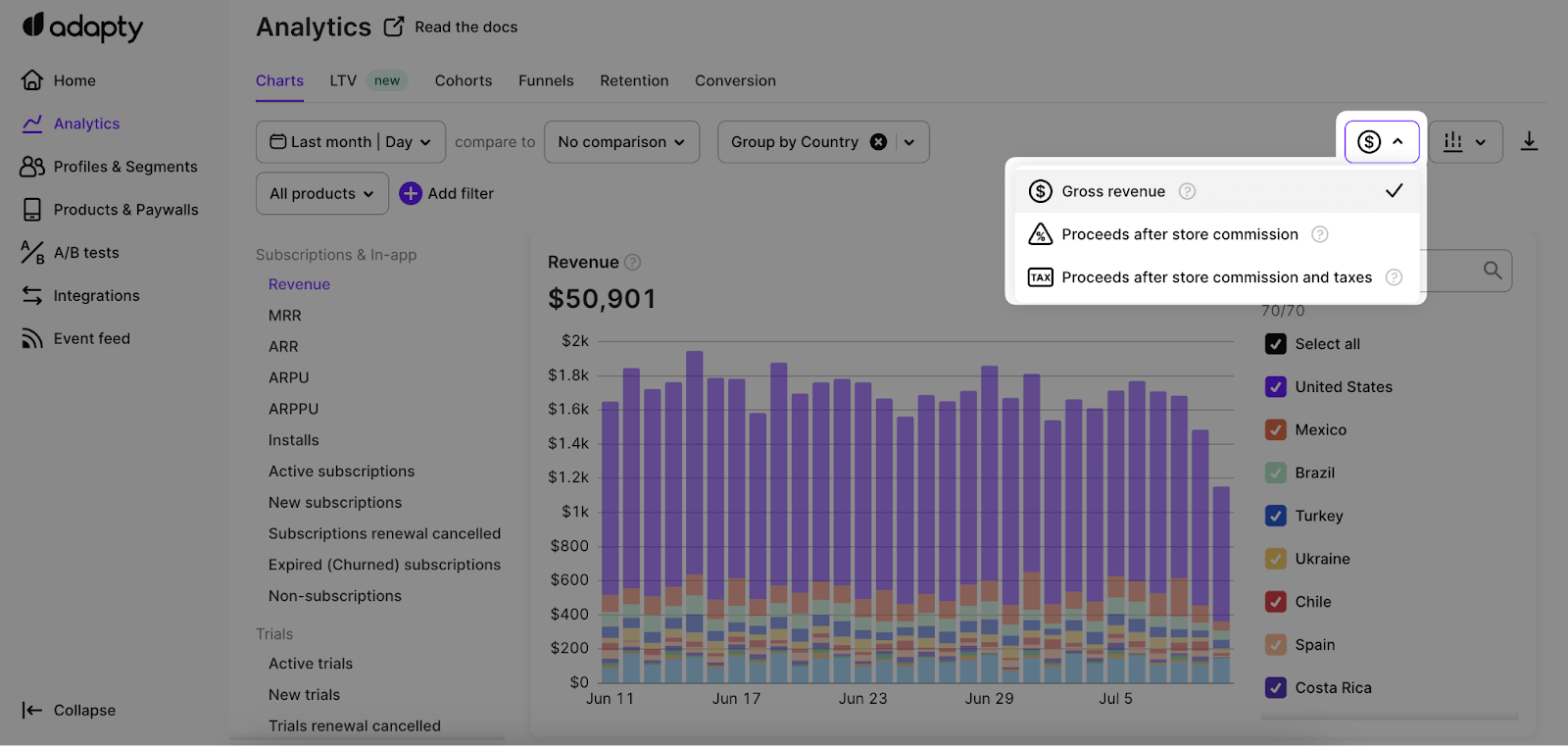

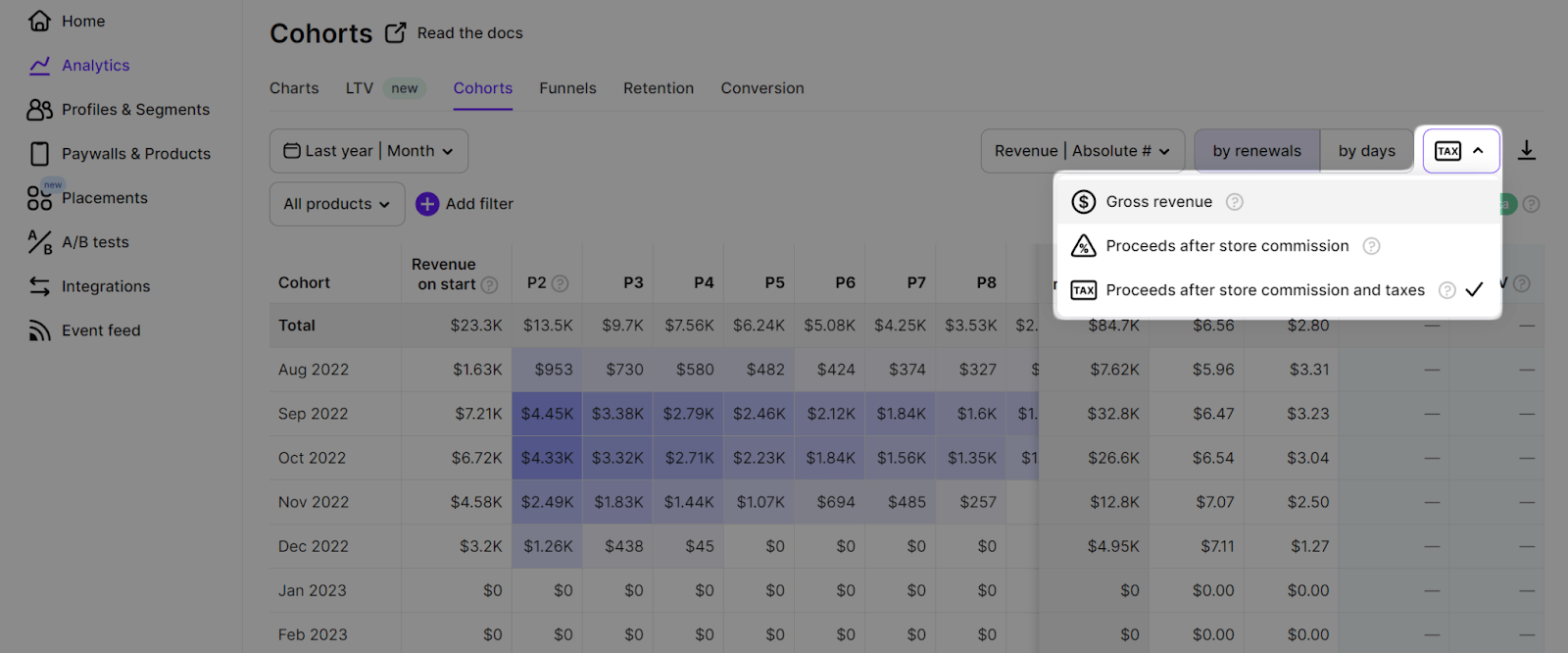

Revenue, as a metric, is too general, as it shows the overall earnings of the app, and sometimes it may be challenging to understand the net income and plan your financial strategy as a result. That’s why Adapty allows you to check the revenue in 3 formats:

- Gross revenue

- Proceeds after store commission

- Proceeds after store commission and taxes

Gross revenue basically shows the overall earnings from your app, meaning that fees and taxes will be excluded from this amount later.

The Proceeds after store commission option displays the revenue amount after deducting the store commission fee.

Consequently, Proceeds after store commission and taxes is the net income, with all the commission fee and taxes already deducted.

The most important aspect here is that this 3-way viewing is applied to all revenue-related metrics, such as Revenue, MRR (Monthly recurring revenue), ARR (Annual recurring revenue), ARPU (Average revenue per user), and ARPPU (Average revenue per paying user). Cohorts and LTV tabs also allow viewing of the data with regard to the store commission and taxes.

Find out more about Adapty’s subscription analytics and take your growing strategy to the next level.

Pricing strategies and impact on earnings

Are apps profitable? Yes, if you use the correct pricing model. It must strike a balance between being attractive to users and ensuring business viability. A price too low attracts users but limits revenue, while a high price can deter potential customers. The right price should cover costs (including app store fees and taxes), allow for profit, and reflect the app’s value to users.

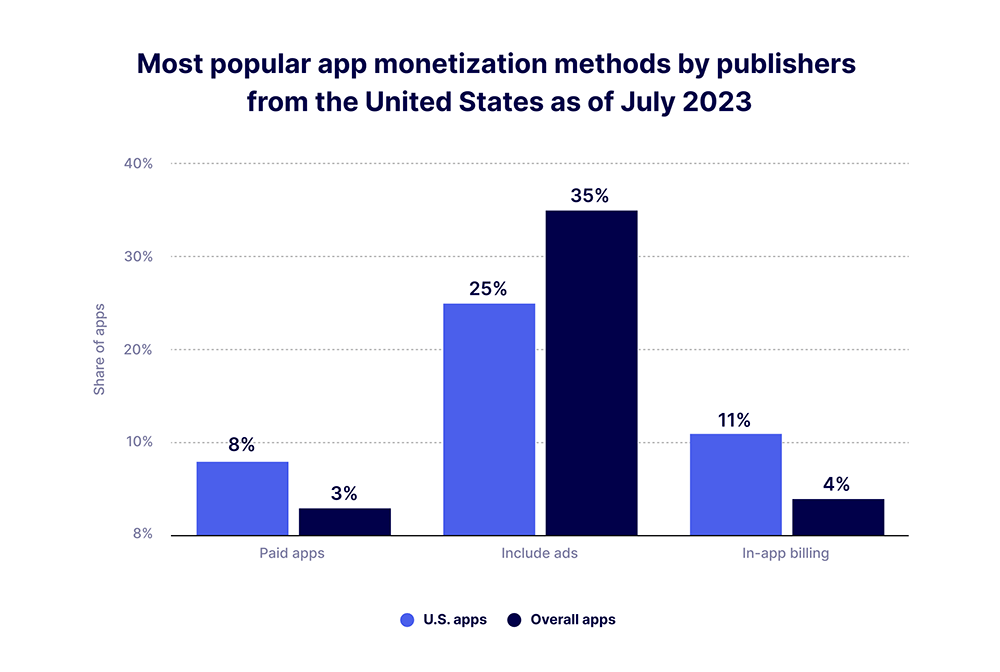

Most pricing strategies differ based on the app type: subscriptions are more profitable for apps offering continuous services, while a one-time purchase could be ideal for professional applications. Most games generate revenue from in-app purchases, and a lot of casual apps use a freemium model. Here’s a quick rundown of the most popular pricing strategies.

Different pricing models

There are varying app monetizing strategies, each with its own strengths and weaknesses:

- Freemium. The go-to option for most: the base version of the app is free, but users can pay for premium features or content. Such apps quickly attract a large user base due to the easiness of the free installation, but it relies on a portion of users seeing enough value in the premium features to pay for them.

- Paid. Easy to understand: pay for the app and use it for free later. This way you get immediate revenue per download, but the initial cost might deter potential users. There is also no recurring revenue unless you offer additional in-app purchases.

- Subscription. Subscription-based apps charge users a recurring fee, usually monthly or yearly, for access to the content. This model provides a consistent and predictable revenue stream. However, it requires developers to continually provide value to users, and marketers and UX designers to constantly experiment with paywalls and other offers. Luckily, Adapty is designed to do just that — and extremely well.

Choosing the right pricing model depends on the type of your app, its target audience, and its value. You should find a delicate balance of how and how much your app makes, joggling between user acquisition, retention, revenue generation, and tax optimization.

How pricing models affect revenue, income, and taxes

As we’ve discussed before, subscriptions allow you to save with the lower App Store fees that start after 12 months of payments from an active user. That’s why more and more apps switch to subscriptions as their general pricing model.

Both paid apps and in-app purchases include the same App Store fees and taxes like VAT. However, with sideloading you will probably be allowed to collect payments by yourself. This way you won’t have to give 30% of your revenue to the mobile system — but you will have to collect and pay sales tax and VAT by yourself.

Tips for maximizing app earnings

Increasing how much your app makes is a never-ending process, with practices and lifehacks coming in style and losing their efficiency in a matter of months. Here are some long-term strategies to maximize both your mobile app revenue and proceeds.

- Improve App Quality and User Experience. Goes without saying, yet is often missing. Prioritize intuitive design, ease of use, speed, and reliability. Use user feedback and data to identify pain points and make necessary improvements. An app or a game that’s joyous to use is also joyous to pay for.

- Implement Complete Acquisition Strategies. Running ads for your app on social media doesn’t always cut it. Be sure your acquisition campaign is all-encompassing: utilize App Store Optimization (ASO) to make your app more discoverable, leverage owned media, and include influencers to reach your target audience.

- Regularly Update and Optimize App Pricing. Prices, currencies, taxes, and other economic factors change swiftly, and you should act accordingly. Always be on the lookout for the macroeconomic situation in your key markets so you know you’re not missing out on the currency differences or making your audience pay too much.

- Explore Additional Monetization Strategies. In addition to direct app sales or in-app purchases, consider other monetization methods. In-app advertising can generate revenue, especially for free apps with a large user base, and partnerships or affiliate programs are a nice way to grow both revenue and the user base. For more on this, read our article on recurring income.

Tracking and analyzing app financials

Data is king, and monitoring and analyzing an app’s financials is vital for maintaining a profitable and sustainable business. A thorough analysis reveals trends and insights like the most profitable user demographics or most successful marketing campaigns, which guide future decision-making.

App Stores provide a lot of data for app developers to track and analyze, from average app revenue and proceeds, to churn rates and benchmarks. They also explain where and how much money your app makes, albeit their payments calendar is a bit tricky. For a clearer picture of the payout dates, check out our Apple Fiscal Calendar guide.

Adapty is another great way to track financials, especially if you plan on having a subscription-based app. Our cohort solution allows the teams to not just see the purchases, but to analyze which product and audience segment perform better. By breaking down the proceeds by day and by renewal time and knowing what works and what doesn’t, you can adjust the app’s pricing strategies accordingly.

Conclusion: Make an app that makes money

Understanding the intricacies of app earnings – including revenue, proceeds, VAT, and other taxes – is crucial for any app developer aiming to maximize income and ensure business sustainability. A comprehensive grasp of these concepts allows for accurate financial planning, strategic pricing, and effective tax management.

VAT, taxes, and app store commissions significantly impact your net earnings. Being aware of these deductions and accurately calculating your net proceeds is key to setting appropriate pricing strategies and forecasting your income. Moreover, understanding and complying with tax obligations can prevent costly penalties and secure your business reputation.

Accurate financial planning is not only about managing costs and taxes. It also involves continually optimizing your pricing strategy, improving your app’s quality, implementing effective marketing strategies, and exploring additional monetization methods. These efforts contribute to higher user acquisition and retention, boosting your app’s profitability.

Adapty is a powerful tool for financial planning and optimization that will save you from calculating commissions and taxes from your app’s revenue. It provides subscription analytics and marketing tools to help app developers increase revenue and understand their users better. With the insights shared in this article and obtained from our service, you can understand how apps make money – and how they can make more.

FAQs

Recommended posts