Your app is an asset, and most assets can be monetized. One can make money with an app by putting a price tag for the download, offering a subscription, using one-time in-app purchases, or putting ads inside. One can also consider selling.

It might seem strange at first, but we think you should see your app as something representing value. Getting such a mindset would be a good start.

In this article, we’ll cover major questions and reasons behind why you should sell your app. We’ll see where to sell, who to sell to, and how investors usually evaluate apps.

Whether you’re an app developer or product owner, understanding the value of your app is crucial in this dynamic market. If you’re looking to optimize your conversion rates and enhance in-app subscriptions, consider scheduling a free demo call with Adapty. We provide insights and tools to maximize your app’s potential and revenue, even if you decide eventually not to sell your app.

If an app makes money, why sell it?

There might be numerous reasons:

- You’re tired of the project;

- Life circumstances have changed;

- The team collapsed;

- The market has changed.

However, the most common reason is project fatigue and the desire to move on. Applications, like any business, don’t work on their own, although I know some exceptions. They require constant support and updates, at the very least. An operational application requires regular purchases of traffic, optimization of the sales funnel, etc.

When you sell a project, you get X * monthly net profit in advance. Depending on the revenue, this can be excellent money that will allow you to either buy something or start a new project from scratch.

Can I sell my mobile app?

Knowing Apple, some may think that it might be illegal to sell an app. In reality, it doesn’t break any rules, as app sale is listed as one of the reasons for the transfer:

You transfer an app when you’ve sold the app to another developer, or you want to move it to another App Store Connect account or organization.

What does an app sale technically look like?

You give your application to the buyer and they give you the money (or whatever approach you agree on). When buying, there are a few things to consider:

- Sign a contract. As a buyer, you need to protect yourself if the seller used the work of other programmers improperly. Otherwise, there is a risk that you will receive a code that you can’t use. We suggest that you hire a lawyer to do that.

- Check the source code. Make sure you’re getting the source code app code.

It is essential that when transferring, you preserve as much information as possible, namely, reviews and customers (subscribers). They will persist in any case. The selling process itself takes place in one of the two following ways.

First, you can sell your app only and transfer the application to another developer’s account, but your app should meet specific requirements. Apple explains the procedure and provides a complete list of criteria; we’ll mention the highlights.

- No version of the app can use an iCloud entitlement or use a Wallet capability.

- The app must have at least one version that has been released to the App Store.

- In-app purchase product IDs on the app can’t be the same as product IDs on any apps in the recipient’s account.

Note that if you initiate an app transfer or accept a transfer of an app, you will no longer be eligible to participate in the App Store Small Businesses program.

You can transfer the app’s ownership to another developer without removing the app from the App Store. The app retains its reviews and ratings during and after the transfer, and users continue to have access to the future updates. Additionally, when the app is transferred, it maintains its Bundle ID – it’s impossible to update the Bundle ID after a build has been uploaded for the app.

If your app doesn’t meet the criteria, the only way to sell it is to transfer the entire developer account to the buyer. If you have any other apps associated with that account, you’ll need to, if possible, move them out of the account, or sell all your apps together. Note that the scheme with the entire account may negatively influence the price tag since it limits the buyer’s options in the future. Plus, you’ll still need to change your bank.

In any case, everything comes to the code repository being handed over to the buyer. The buyer needs to check that the code they’re receiving builds precisely into the app, and it works. This is how Apple puts it:

If you transfer your app, you will continue to have access to the information for payments and sales that occurred prior to the transfer. You will not be able to access the information for sales after the transfer has been completed. The recipient of the transferred app will only receive payment and sales information for transactions that occurred after the transfer.

Let’s suppose you are prepared, and let’s proceed next.

Where to sell?

There are two options:

- Use a dedicated platform (marketplace);

- Sell directly.

Let’s look at both.

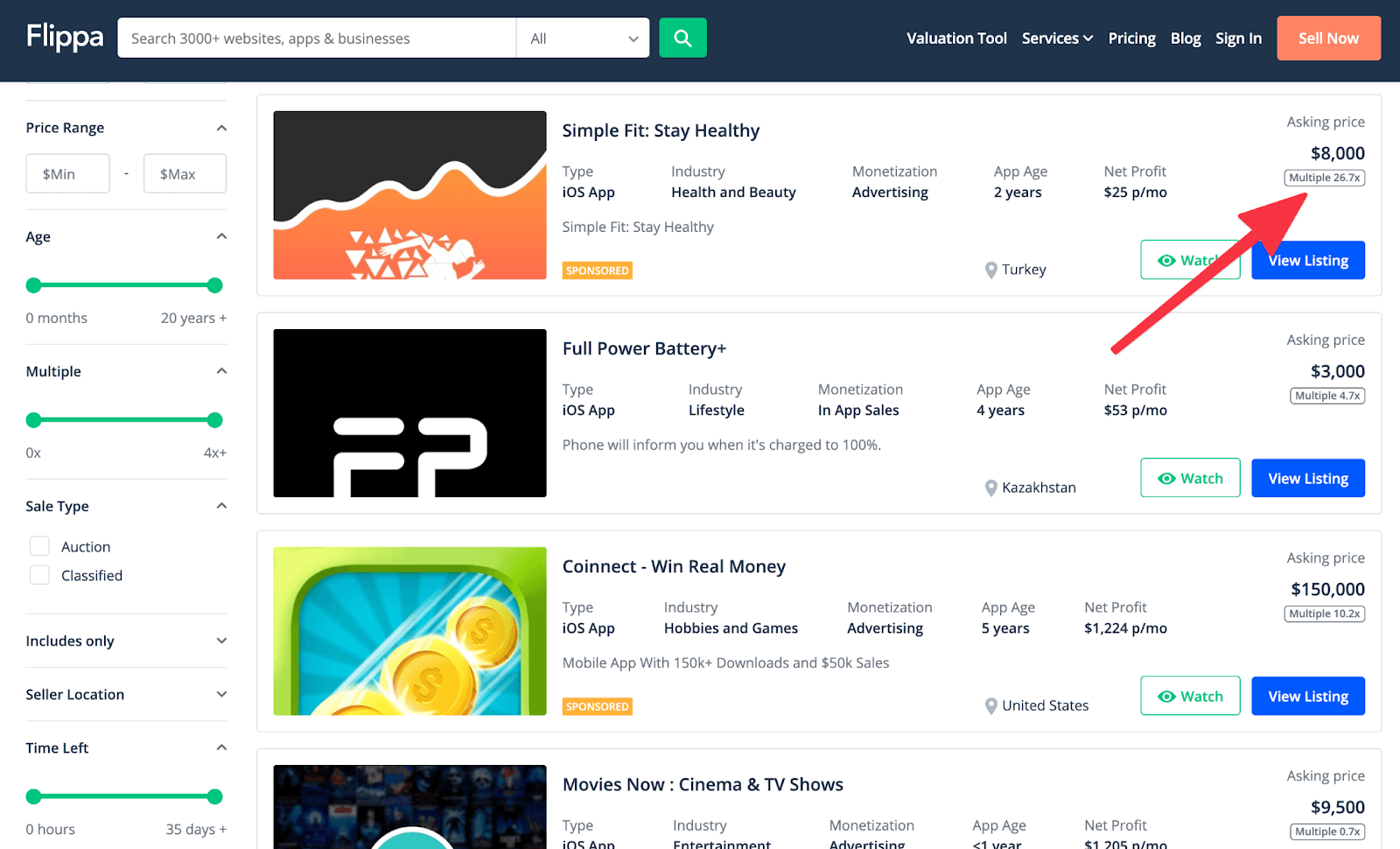

Flippa is the most popular marketplace out there, but you can also consider AppFlip, Sell My App and AppBusinessBrokers. The platform serves as a mediator and allows you to do everything smoothly and safely so that all parties remain happy. Typically, marketplaces operate on the success fee model for a deal, usually paid for by the seller. For extra money, you can buy all standard documents like contracts and NDAs. The success fee is approximately 10 percent.

If you feel confident and are not afraid to be deceived, then selling directly is also OK.

Marketplace comparison table

| Marketplace | Audience Type | Fees / Commission | Pros | Cons |

|---|---|---|---|---|

| Flippa | Wide range, indie developers | ~10% success fee | Large audience | High competition |

| AppFlip | App-focused marketplace | Varies | App-specific tools | Smaller traffic |

| SellMyApp | App templates & complete apps | Listed fee + % | Good for niche apps | Not for high enterprise |

| Direct sale | Direct to companies | No marketplace fee | Higher control | Negotiation complexity |

How do I evaluate my app?

That’s a tricky one. Business books would say, “your product is worth as much as someone is willing to pay for it”, but it doesn’t really help. First, you have to estimate if someone is willing to pay for your app, and you’d better do it unbiased.

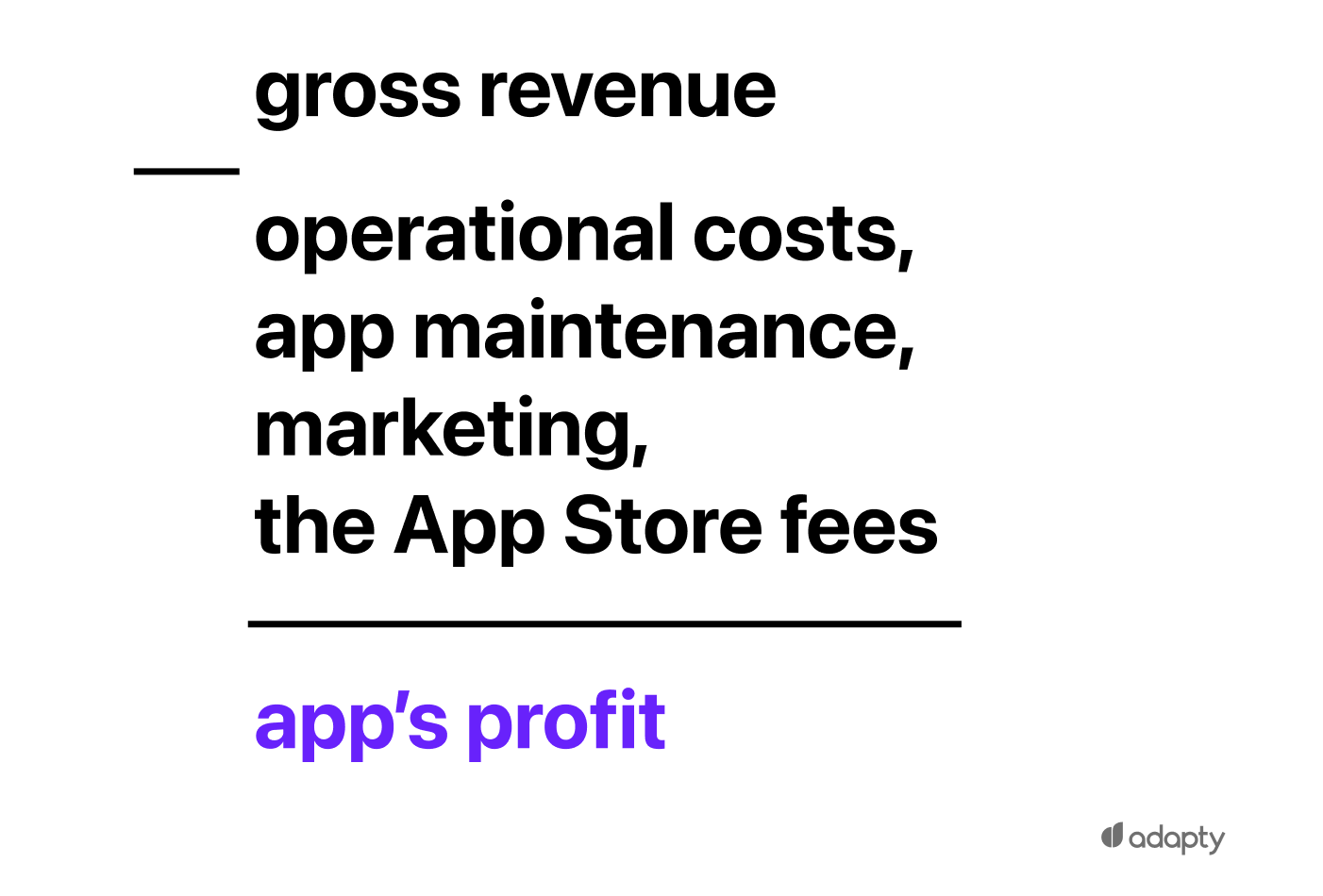

The subscription app is rated as an operational business. That is, the seller will take your annual or monthly profit and multiply it by a factor. Usually, this coefficient varies from 1 to 3 for a year or 12-36 for a month. Important: you should count the revenue after deducting the Apple’s commission, traffic, and other operating systems costs.

Evaluation example:

You have 1,000 subscribers in your application, each pays $10 per month. You are enrolled in the Apple Small Business Program. Then, you get 0.85 × 1000 × 10 = $8,500 per month. Suppose you spend 30 percent on traffic and another 20 percent on everything else, then the net profit will be 0.5 × 8,500 = $4,250. Thus, the application can be sold for $51,000–$153,000. Sounds good already.

However, some applications sell and buy at a much higher price. In general, these are strategic purchases that go through M&A – enormous deals where the developer team is transferred to another company.

Remember: you can bargain in both directions, although sometimes it’s better to lose a bit, but free up a lot of time in the future.

| Factor | Why It Matters | Buyer Focus |

|---|---|---|

| Revenue | Higher revenue means higher sale price | Cash flow certainty |

| Growth Rate | Shows future potential | Scalability |

| Churn | Indicates retention quality | Predictable revenue |

| App store rating & reviews | Social proof & quality signal | Trust and credibility |

| Tech stack & documentation | Easier maintenance | Less integration risk |

Besides revenue, what else is important for selling?

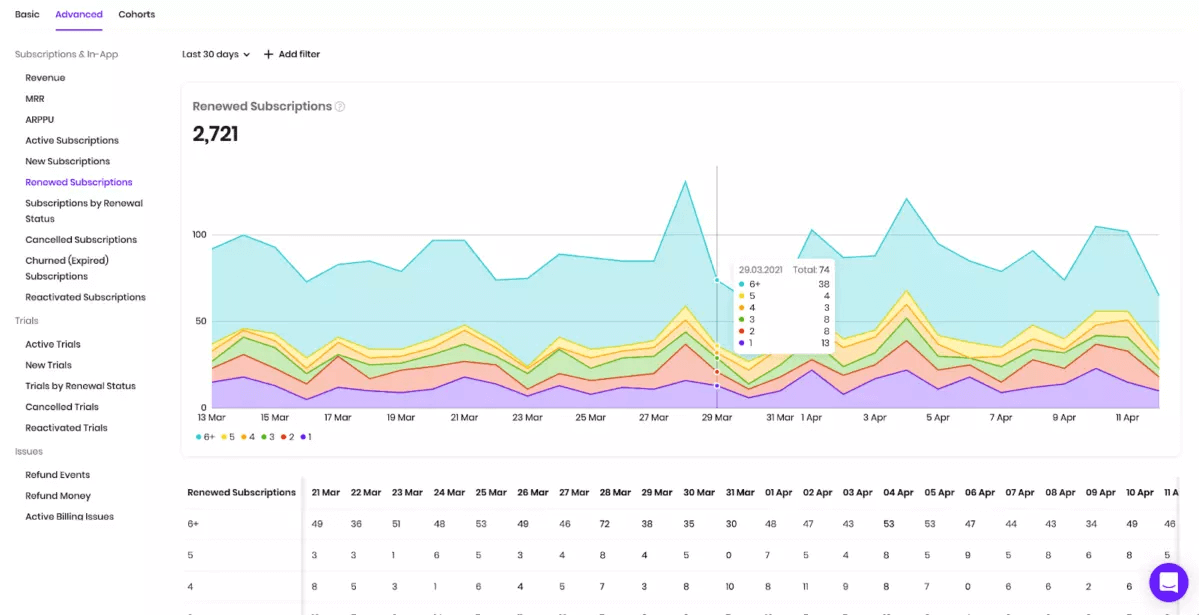

If we are talking about subscriptions, then one of the most important metrics is churn rate and “subscriber tail length”, which shows who contributes more to your revenue – new users or long-time users. Let’s look at two graphs that do a good job illustrating it.

First, distribution by renewals:

We could see that the majority of the app’s user base is made up of older users (teal trendline), not new ones. This means users see value in the product; they stay and pay for longer.

There is another point. If you look only at the last month’s revenue, there is a risk that the developer has bought a lot of traffic and dramatically increased revenue. To save yourself, you need to look at the net profit.

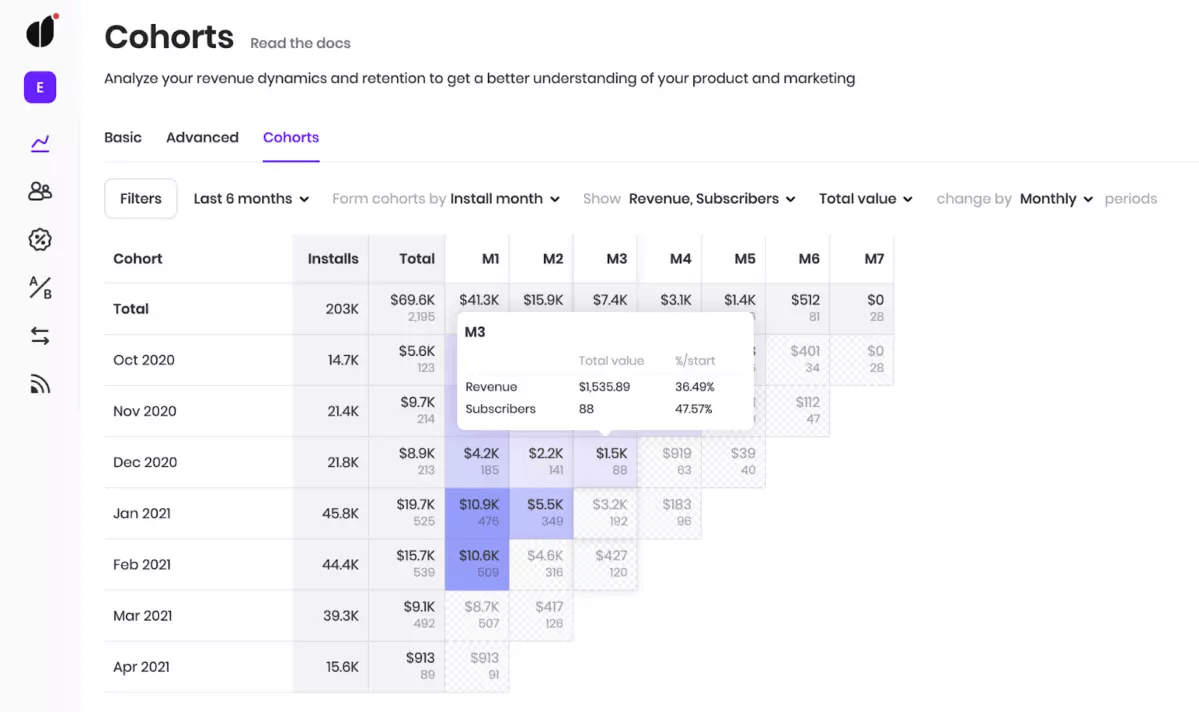

Second, cohort analysis. Cohorts clearly show how long users stay in the app and how quickly they fade out:

An example of visualizing the degradation of cohorts in Adapty.

With the understanding of historical dynamics (that is, conversions in the sales funnel), you can build a simple model for estimating future revenue and accounting for risks.

How to prepare your app for sale

Preparing your mobile app for sale is just as important as choosing the right marketplace or buyer. A well-prepared app reduces perceived risk for buyers, speeds up due diligence, and often leads to a higher valuation.

1. Clean up the product and codebase

Before listing your app for sale, make sure the product is stable and well-maintained. Fix critical bugs, remove unused features, and clean up legacy code where possible. Buyers are more likely to pay a premium for an app that is easy to understand, maintain, and scale.

Clear code structure, meaningful naming, and basic documentation go a long way in building buyer confidence.

2. Organize technical documentation

Prepare documentation that explains:

- App architecture and tech stack

- Third-party services and SDKs

- Backend infrastructure and hosting

- Build and deployment processes

Even lightweight documentation helps buyers assess technical complexity and estimate future development costs.

3. Get your analytics and financials in order

Buyers will want to verify performance claims. Make sure you can clearly present:

- Revenue by month and by monetization model

- Active users, retention, and churn

- Subscription metrics such as MRR, ARPU, and LTV

- User acquisition channels and costs

Having accurate, transparent data builds trust and speeds up negotiations.

4. Review legal and ownership details

Confirm that you fully own the app and its assets. This includes:

- Source code and intellectual property rights

- App store accounts and developer profiles

- Contracts with freelancers or agencies

- Licenses for third-party libraries and assets

Resolving legal issues in advance helps avoid delays or deal breakers during due diligence.

5. Improve your app store presence

Your app’s store listing is often the first thing buyers review. Aim to:

- Maintain a strong rating and recent reviews

- Update screenshots and descriptions

- Remove outdated or misleading information

A polished app store profile signals quality and ongoing support.

6. Reduce operational dependencies

Try to minimize reliance on personal accounts, manual processes, or undocumented workflows. The easier it is for a buyer to take over operations, the more attractive your app becomes.

Where possible, automate reporting, billing, and customer support workflows.

7. Prepare for a smooth ownership transfer

Familiarize yourself with app store transfer requirements and prepare a clear handover plan. This may include transferring developer accounts, backend access, analytics tools, and third-party services.

A smooth transition reduces risk for buyers and increases the likelihood of closing the deal.

Can a mobile app be a venture business?

Venture capitalists expect a high return on investment, at least 10x the risk premium. This is how foundation economics works.

Unless your application looks like an excellent addition to some large company, has many users, and is growing super fast – this is hardly a venture business. It’s better to think of such a product as an operational business, which is often vastly more convenient.

If the company can’t exit via M&A or IPO, the investor’s money will be returned through dividends. Let’s see how this can happen.

Suppose you attracted $1M of investment. A year later, you began to receive $1M in revenue per month, with $500K expenses (traffic and operating systems). This leaves us 0.7 × 500K = $350K monthly profit. Let’s assume 30% of the net profit – $105K – will go to dividends. Further on, each investor receives money in proportion to their share; suppose you gave 20% to one investor -> the investor will receive $20K per month or $240K per year in dividends with an initial investment of $1M. It turns out to be risky because the market can change, and it is not very profitable for the investor.

This is just an example, but the numbers in the real world rarely differ even 2x from those I provided.

There is a class of non-operational applications that have become the industry standard and can be considered huge players. These companies can be sold; they can, in theory, go public, as many people use their products. Recent examples include Clubhouse: no monetization, many users, although investors believe in it.

Investing in an application is OK. The main thing is to understand what it can turn into. It is often more profitable and less stressful for founders to bootstrap and make a cash cow without investment.

What about Android?

It’s not much different, to be honest. One thing to bear in mind is that iOS users tend to have a higher average income and spend more money on apps than Android users. This may impact the value of your app and the types of buyers who are interested in purchasing it.

There may also be some differences in the legal requirements and transfer process depending on the specific terms of the sale. It is recommended that you consult with a legal or financial advisor. To put it simpler – everything is the same as for an iOS app, but the check size will most likely be smaller.

How does Adapty help?

Adapty can be the truth-teller for your application. We will calculate all the important metrics at the user level ourselves. Thus, we simplify the due diligence process at times for both the investor/buyer and developers. The built-in analytics in App Store Connect and Google Play don’t allow obtaining detailed information at the user level and realistically estimate the application’s economics. We receive information directly from vendors, so the service cannot be cheated.

If you are just starting, you can begin working on purchases in a couple of hours (as well as read about analytics and attribution). If you are already using a different or your own solution, you can seamlessly move to ours and focus on business and business only.