To develop an app from scratch, you’d need a lot of time and human resource. Alternatively, you can buy a ready-made app and build up on it. There’s a lot of nuance and risks to consider with this option, though.

In this article, we’ll discuss how to approach purchasing an app, which metrics to look at, how the deal will be done, and what you must never neglect.

Why buy a mobile app

An app is a business: you invest in its development to earn even more.

Here are the most common reasons for buying an app.

1. You’re experienced with the mobile traffic market and can acquire new subscribers for a lower cost than the apps’ current owner.

App monetization requires a constant flow of new subscribers. This means you need to have a systematic approach towards configuring and optimizing ads, as well as improving your paywall conversion rate. An experienced team can make a profitable business out of a money-losing app.

2. You have access to relevant marketing channels or traffic sources.

Examples include app review websites or even other apps where you can place ads. It’s quite notable those involved with selling or buying apps often include companies that own traffic networks, as well as CPA and media buying agencies.

3. You can improve the app from the product standpoint.

Sometimes an app just needs to be polished a bit to be transformed into a quality product loved by users and earning money. If you have an experienced team, you can certainly try finding an underrated app and improving it drastically.

4. You want to strengthen your own product or acquire a competitor.

You already have a solid app asset. Why not expand your audience by acquiring smaller apps sharing the same category? Mobile games make the easiest example here: If you buy a game similar to yours and then help the users move over to your project, this will solidify your game’s position and protect it from potential competitors.

If you’re an app developer or app product owner focused on acquiring applications with a vision to enhance their conversion rates and in-app subscriptions, Adapty is your strategic partner! By scheduling a free demo call with us, you’ll explore how our solutions can help you significantly elevate conversion rates and revenue for the app you intend to buy, ensuring a profitable app purchase. Whether it’s improving your paywall conversion rate or optimizing ads, make your app acquisition journey rewarding with Adapty!

Why apps are sold

Depending on the reasons behind the app’s owner looking to sell it, you can get very different deals.

1. Unrealistic expectations.

Those new to the mobile app business market often come in expecting to build an app, set up monetization tools, and lay on the couch watching their bank account grow. They are then surprised to learn that subscriptions will be refunded, the app requires updates and maintenance, reviews demand attention, and the traffic is constantly to be acquired and monetized. The developer then thought back to the sweet carefree days of being an employee and decided to get rid of the app.

2. Lack of resources.

There’s a point where the developer realizes that for the app to continue growing, they’ll need money to acquire new users and hire more people to maintain the app and create content. It’d also be great to do a redesign, polish the interface, and more. Further growth requires investments, but no one wants to deal with a no-name developer. It’s often easier to sell the app than to look for a team and investors.

3. Burnout.

The developer has simply got weary of their app. They then wanted to switch fields, find a job, or proceed to working on their next idea. They looked towards moving on but didn’t want to neglect the app, which is why they decided to sell it.

4. Irrelevant asset.

This happens if the app was initially developed to supplement some other business and ended up no longer needed because of the main business collapsing. For example, gym owners decided to develop a health app with trainer-curated recommendations, workout plans, a step counter, and more to make their gym more appealing to customers. Then the pandemic hit, and the gym had to close down. To compensate for the losses — at least partly — the owners have no other choice but to sell the app.

5. Team conflict.

That’s a trivial yet quite common reason. The founders couldn’t find a common ground and decided to part ways. They had to sell the app to someone else and share the money.

6. The app is in the red.

If the app isn’t monetized and the developer is running out of money, it’s sometimes easier to sell it than seek extra funding.

7. Speculation.

Some specialize in buying apps, making them profitable, and then reselling them. Be cautious if you suspect that’s your seller’s occupation — they may very well be deceitful with the data they provide.

8. Money emergency and personal reasons.

Sometimes the seller may have deeply personal reasons. For example, they may need to buy a new home, afford costly medical treatment, or pay their debts.

What to consider when buying an app

The founders’ & the brand’s or app’s reputation

This step is obvious yet is often overlooked for this very reason. Despite being a mass product, mobile apps face heavy limitations imposed by their chosen niche. If the developer or team behind the app has done dubious things in the past — even if that was with some other apps — this will haunt the app and have negative impact even after the app is transferred to other developer accounts. Google the names, look for reviews, and ask around in the community.

The developer’s reputation in the app marketplace

Stores rank developers by how much they trust them. If the developer has launched similar web view apps infested with suspicious ads, their reputation is likely lacking. Once the app is transferred from their account to yours, you can face problems with update reviews or even get your app blocked. That’s why it’s crucial to check the developer account’s history before buying one of their apps.

The app’s conformity to application store guidelines

Sometimes the app is no longer passing the reviews following some policy or guideline change introduced by the application store. While it doesn’t get removed from the store, the developer won’t be able to publish any updates. Overall, if the app hasn’t got any updates for a long time, it should be considered a red flag. Ask the seller about it and make sure no update issues are present. Otherwise, you’ll end up with a frozen asset.

The company’s and its shareholders’ legal stand

Make sure the asset that’s listed for sale actually belongs to the seller. No matter whether you’re using a marketplace or broker services, or negotiating directly with the developer, there’s always a chance the seller has illegally got hold of the app. Arguments, investigations, refunds, and even court hearings aren’t exactly pleasing to deal with. To make sure, it’s best to consult your lawyer. You should also try searching the seller’s or their company’s name, as well as see who the domain belongs to and check the developers’ social media accounts.

IP rights

The app can be patented as a utility or design, or maybe its name is a registered trademark, or maybe the trademark is being registered at this very moment. By buying an app, you also buy the rights to all the names and patents related to it. Right and patent transfers are a quite tedious procedure, but it’s always better to get it done right away lest any problems arise in the future.

Business Economy

The most common and obvious risk is that the owner can — and is even likely to — hide at least some parts of the whole picture from you. When you’re buying an app that’s already earning any money, the seller will always — or almost always — attempt to sweep problems under the carpet. They’ll likely try to make the numbers look better or even outright manipulate the data.

When buying a mobile app, the key risk is to unwittingly end up buying a business that’s in the red. If you don’t see any catches in the app’s business economy, it means you must be looking the wrong way.

How to audit revenue

Mobile apps are most often sold as templates you’re supposed to build your own project with. However, we’re here considering buying an app as a ready-made business with its own economy. Otherwise, if the app’s not being monetized, it must mean it has no monetization potential. In this case, why buy it?

The subscription model is often considered the most reliable monetization technique, even though apps with AdMob-based monetization are more often seen on sale. However, content apps will earn much less with their in-app traffic than with the subscription model. For a better option, you could buy a content app that relies on ads and introduce subscriptions instead.

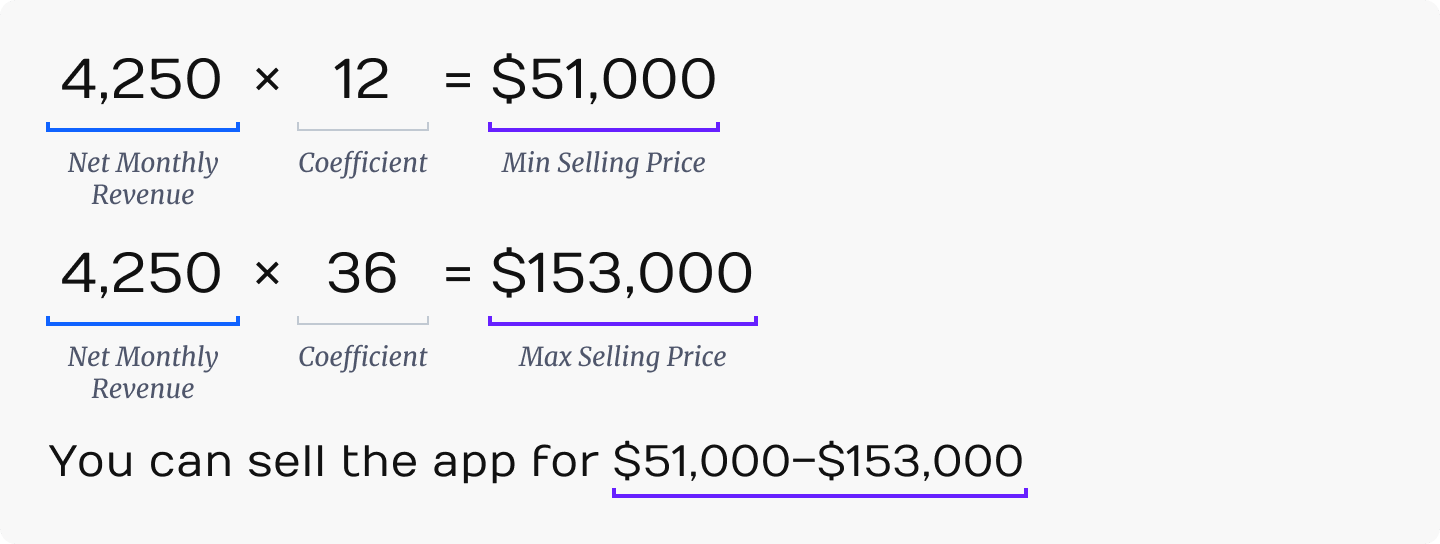

To evaluate an app, you could use this simple formula:

monthly revenue*the coefficient, where the coefficient is a period ranging from one (12) to three (36) years.

Example: you have 1000 subscribers paying $10 per month, and you’re also a member of the Apple Small Business Program. With that, you’re earning 0.85 * 1000 * 10 = $8500 per month. Let’s assume you spend 30% of that money on traffic and 20% more on everything else. In this case, you’ll end up with a net revenue of 0.5 * 8500 = $4250. Therefore, you can sell the app for $51,000 to $153,000. Sounds good.

For digital assets (sites, web apps, etc.), the period length depends on the average lifetime value. Therefore, users with longer subscription plans will potentially increase the app’s value, while a high refund rate will potentially diminish it. It isn’t that straightforward, though, so let’s look into the details.

An app can be earning little to nothing right now while having a large user base and high monetization potential. At the same time, an app can show impressive dynamics, but that’s only because the developer had heavily invested in acquiring traffic before they listed their app for sale. In this case, revenue will plunge in just a few months.

To sum up, there are two kinds of apps. The first one is monetized and earning money here and now. The second one is either not monetized at all or hasn’t been monetized long enough for you to make any reliable conclusions. Be highly careful when working with the latter type.

Monetization timeline

Another important thing to consider is the monetization timeline. It’s important to forecast the app’s potential revenue dynamics for at least a year ahead. An app that’s been around for one or more years may have impressive user behavior stats. What if it’s only been monetizing for a month, though? It’s quite obvious that introducing monetization to a free product always changes the customer’s behavior for the worse. The longer the app’s being monetized, the better. That’s why you’d better avoid considering buying apps whose monetization history spans less than three months—or be overly careful about considering these.

You’ll need to make a forecast for revenue and spending. There are two kinds of expenses, namely, marketing and operating. Operating expenses are easy—you need money to maintain the app’s functionality. Permanent expenses largely stay the same. Even if you make a mistake here, the actual costs will hardly be overwhelming.

Apart from operating expenses, there are also variable ones. These are defined by the app’s niche and content. For example:

The sports app A features custom videos made by a professional athlete or trainer. With paid subscription, the user can watch these videos and repeat after the trainer. This subscription costs $9. The sports app B has workout plans taken straight out of a shabby 1950s magazine. The developer simply scans the pages and puts them into the app. This subscription also costs $9.

Which app’s content takes more money to produce?

It’s pointless to go into too much detail here. You could make up as many cases as there are possible situations in everyday life. Some fill their app with ready-made content available on the internet for free, and some create their own. Once you buy the app, you’ll have to work on the content yourself and invest into crafting it. It’s always better to evaluate these costs in advance.

You could also arrange an assistance period with the developer, which should be included in the agreement. However, if you feel you might need assistance with managing the app, it’s better to consider whether you should buy it at all.

Marketing expenses

App monetization requires continuous user acquisition, which involves extra marketing expenses. Before buying an app, ask the seller about the average subscriber acquisition cost. If the seller says they’re mainly relying on Facebook ads for user acquisition, ask to see the ads manager stats data or even request guest access as screenshots are easy to manipulate. This way, you’ll see the real user acquisition costs and evaluate how much you might need to invest in future.

Note: If you aren’t sure you can properly estimate potential marketing expenses just from seeing the seller’s stats, reach out to those professionals who specialize in buying and selling apps. For example, the AppCapital company does app evaluation and can help you access potential risks.

Keep in mind that the developer (or seller) can have traffic channels you don’t. For example, they could be promoting the app via some of their other projects. Once these traffic sources are cut, the stats will take a visible hit.

App revenue is composed of three parts: namely, new subscriptions, rebills, and organic subscriptions. Doing the math for the app’s revenue isn’t that hard. It’s harder to forecast what will happen to those subscriptions in half a year, a year, or multiple years. And it’s much harder to devise a course of action that would keep the subscriptions profitable.

How to evaluate the app’s economy with Adapty

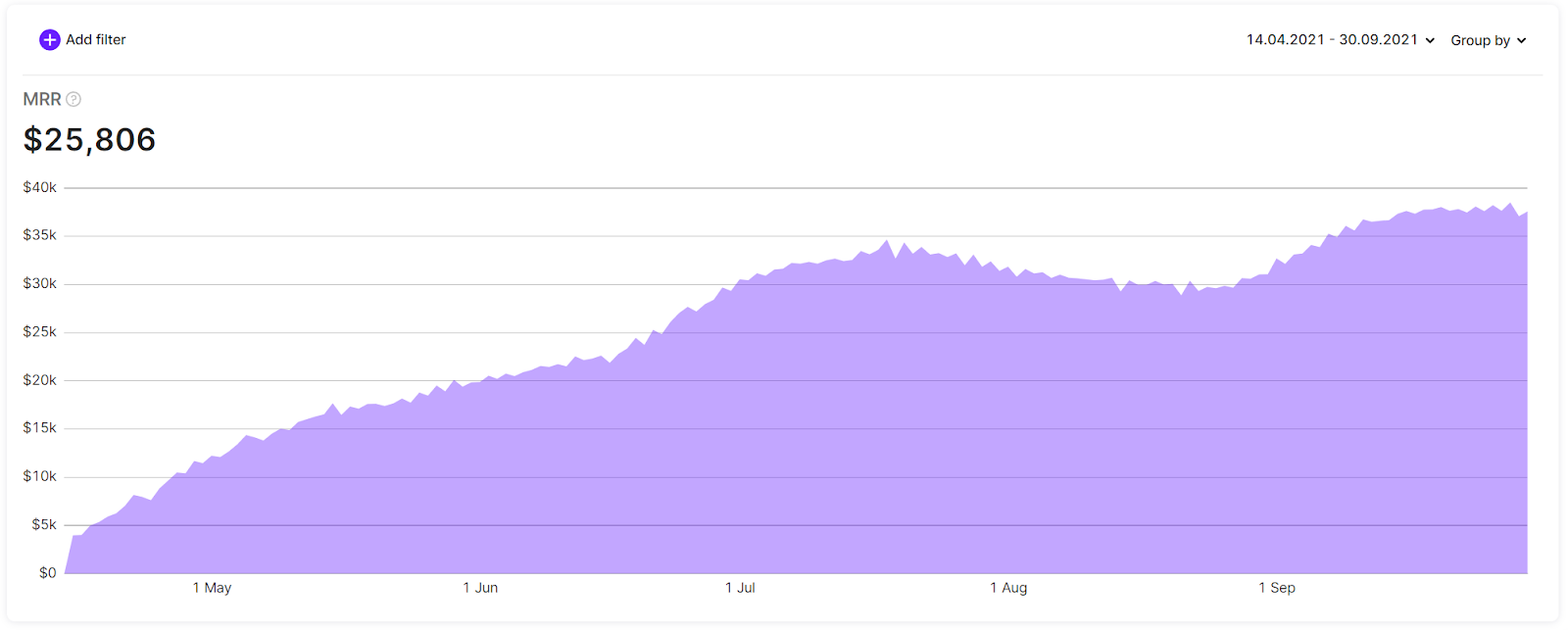

The best-case scenario is that the developer is our client here at Adapty. This makes forecasting future revenue and predicting monetization growth points a quite trivial task. Revenue dynamics matters much more than the number of zeros per se. Here’s why:

The MRR chart illustrates the monthly revenue growth. It might seem like a good sign. However, the revenue growth is actually caused by the number of subscribers growing. If the subscriptions won’t automatically renew or the refund/unsubscription rate will grow with them, then MRR growth per se can’t be considered a positive metric.

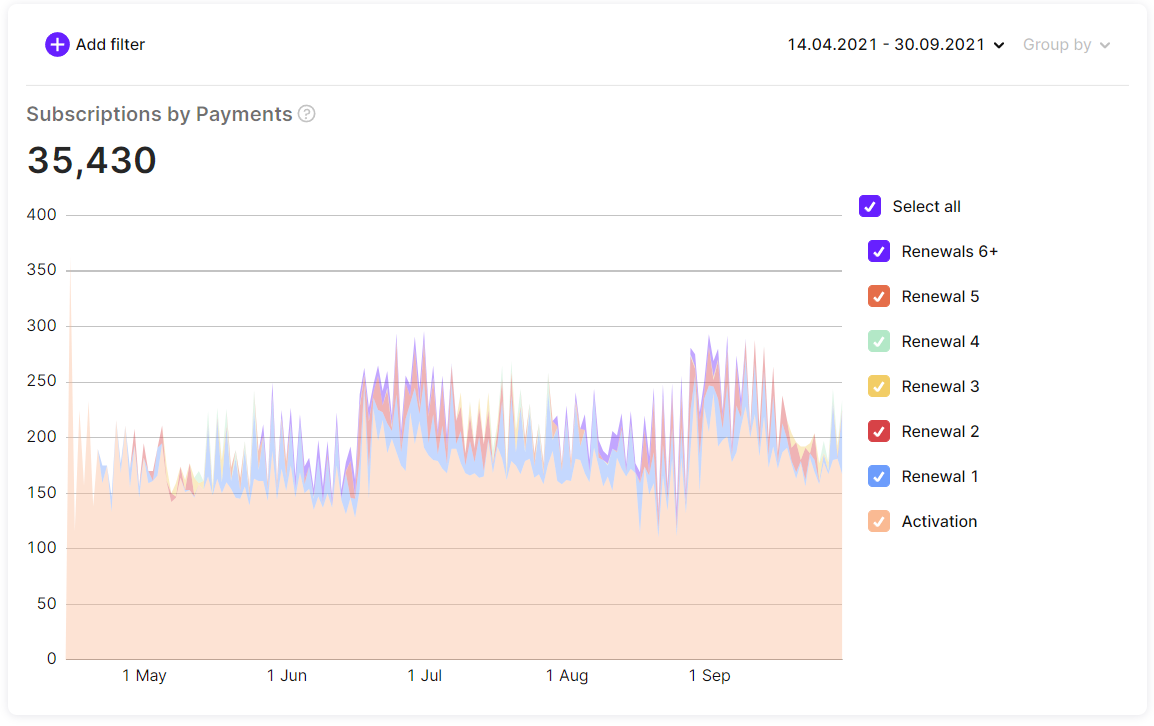

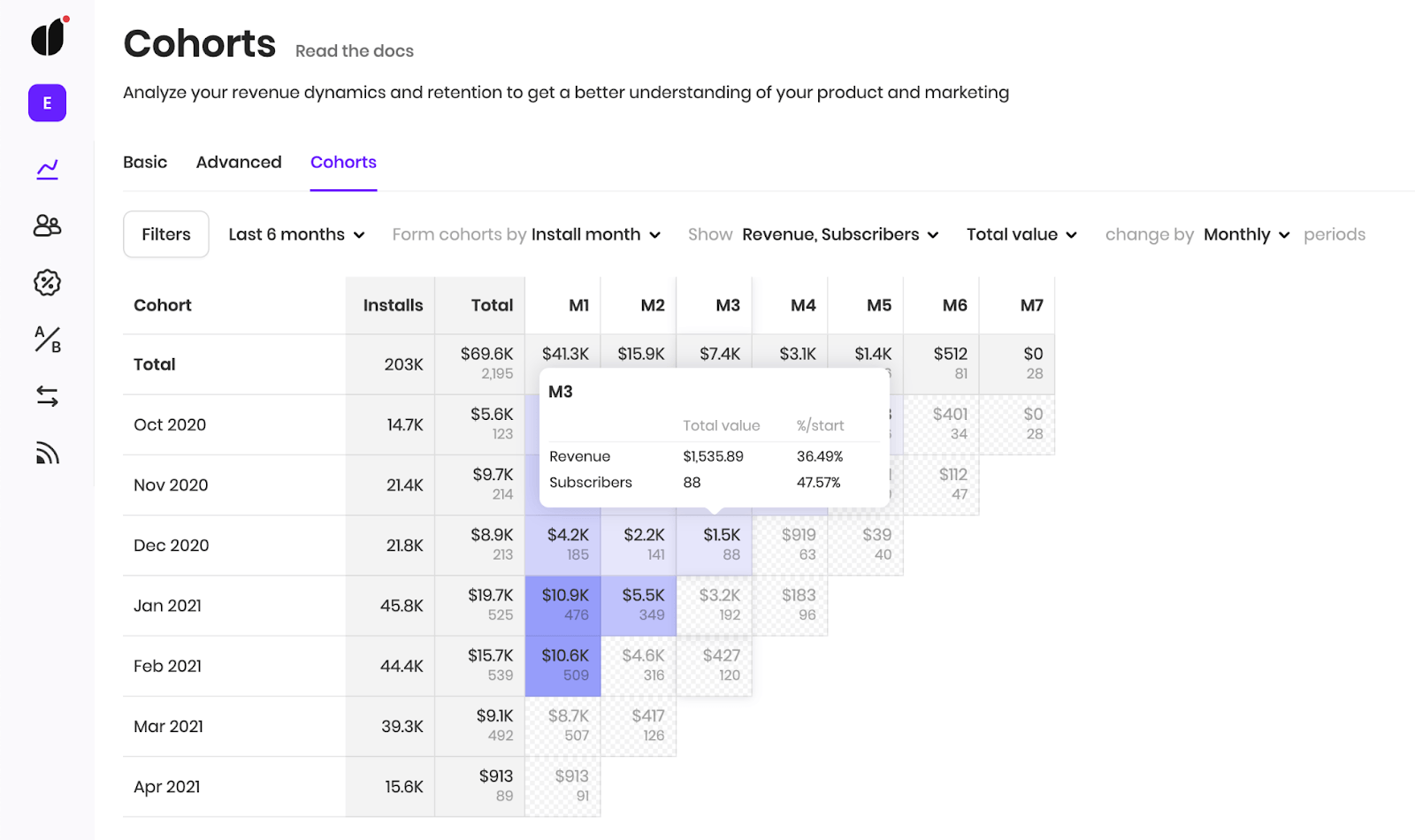

Now, let’s look at the chart showing payment events. It’s clear that out of 35 thousands events, only 6 are rebills, and most of the revenue comes from fresh subscriptions. That certainly isn’t a good sign: once the developer stops spending money on acquiring more traffic, revenue will plummet. If the payment base is composed of long-term loyal subscribers, though, that’s another thing entirely. Cohort dynamics shows how much the customers care about the app and for how long they are ready to pay for using it:

The developer can try pulling off various tricks, but the monetization data can’t lie. Therefore, you should prefer apps that don’t leave you in the dark and give you the whole picture on their monetization.

If you have the data, you can make a model forecasting for how long the current subscriptions will remain active, calculate the LTV and CAC metrics, and compare it to the traffic data provided by the developer.

Red flags

A subscription-based app’s revenue is usually composed of three parts: rebills, organic subscribers, and paid traffic subscribers. Everything’s clear with rebills: the longer the subscription is renewed, the better. Be more careful with organic traffic. With mobile apps, organic subscriptions are most often manipulated or manufactured by incentivized traffic. Usually, both incentivized users and bots are involved. This traffic will inevitably plummet over time. What time? That depends on how heavily the developer has been investing in traffic manipulation.

TIP: Be careful with apps that rank #1 for high and medium-value search terms. Even the #2 and #3 spots are more reliable with possible risks considered. As a rule of thumb, an app that continuously holds the #2 or #3 spot over a year is better than an app that’s ranked #1 since a week ago.

Paid traffic. From our experience, it’s quite rare to have a developer properly report on paid traffic present in their app. First, analytics tools still aren’t perfect. Second, most people aren’t expecting in advance they’ll have to sell the app in future. Accounts sometimes get lost or blocked. Request all the info the developer can reliably give and try to see if the numbers check out.

App purchase and transfer

The sale must be supplied with signing an agreement. The best thing to do is to hire a lawyer who’ll help design a bilateral contract and make sure that the buyer will also get all the patents, IP rights, and more.

If the app is being sold on a marketplace or via escrow, the liaison will usually do all the paperwork. Marketplaces usually rely on charging success fees, which are up to 10% of the selling amount (can be over this amount). You can try negotiating with the developer outside the marketplace, but this poses a certain risk.

Once you have a common ground, you both sign an agreement. Then, the seller can either transfer the app from their developer account into yours, or transfer their entire developer account over to you.

In the former case, the app must be eligible for transfer — both the App Store and Google.Play have strict and detailed guidelines in place outlining which apps are eligible and which aren’t. It’s crucial that both the seller’s app and the buyer’s account be eligible under those conditions. Paid subscriptions, ratings, and reviews will be transferred with the app in any case. The right thing to do is to also acquire the domain, the app’s website, and the administrator’s email address with all the accounts relevant to the app. Don’t worry about the revenue: all pre-transfer transactions belong to the seller, and all post-transfer ones belong to the buyer.

If the developer’s account is transferred instead, it’s the seller’s duty to make sure the account only keeps those assets that are part of the deal. Just don’t forget to change the billing info in the profile.

With the app, the developer also transfers the repository with its source code to you. Make sure the repository actually contains the code your app is using. If unsure, ask a developer you trust. Once you pay the seller and receive the app and the accounts from them, the deal is considered closed.

Where to buy

You can buy apps on marketplaces — via brokers or directly from the developer. There are teams that specialize in buying undervalued apps, improving, and reselling them. There are funds that do the same on a larger scale.

The most popular marketplaces are Flippa и AppBusinessBrokers. (The latter sometimes sells the same lots found on Flippa but at a higher price.) You can use filters to only see profitable apps. For app templates and unfinished apps, check out SellMyApp, CodeCanyon, and Codester.

Mobile apps are often sold as businesses, so you’ll find sellers on any marketplace where you can search for “online business” or “ready-made business.”

Final calculations

To sum it up, buying an app is a complex affair that requires a thorough and delicate approach. However, the benefits of this kind of purchase may be tremendous. So if you firmly decided to look into the app market, find out how much money your potential application may bring using our subscription calculator that will provide a rough estimate of the app’s revenue based on your data.

Unlock the full revenue potential of your acquired apps with Adapty! Schedule a free demo call and explore how we can assist in optimizing conversion rates and in-app subscriptions, ensuring that every app you buy is a profitable venture. Leverage our expertise to transform your app acquisitions into lucrative assets.