How to calculate and interpret Customer Lifetime Value (LTV)

Updated: September 6, 2024

20 min read

Customer Lifetime Value (LTV) is one of the key metrics you should know if you want your app to grow strong and last long. It’s not just about making quick money; it’s about building lasting relationships with your customers. LTV shows how much a customer will spend with your product over time — and how much you will learn.

Of course, knowing the metric is one thing. Making sure it constantly grows is a completely different skill. In this guide, we go through the nitty-gritty of the LTV for SaaS products in general and subscription apps in particular: how to calculate it, how to benchmark it, and how to grow it. We hope to arm you with actionable insights and inspire you to work on your product. Let’s get started!

Customer Lifetime Value (LTV)

Customer Lifetime Value (sometimes abbreviated as CLV, but LTV is a more common term) is all about how much money a business will make from a customer over time. It’s not just about one sale or subscription but the total cash a customer brings in while they are with your product: from the registration to the day they delete the account.

It’s important to look at how long customers stay and how much they pay during that time. Aiming for long-term relationships means focusing on good customer experiences and constant improvements. Happy customers stay longer, meaning more money for the business.

That’s why in most companies, LTV guides decisions on how to make the product better, where to spend money on marketing, and what keeps the customers around (or makes them leave and stop spending). Knowing this crucial metric helps you spend money wisely, making sure you’re investing in things that keep customers paying.

For Software as a Service (SaaS) companies (and that’s what subscription apps are to the end customers, essentially), knowing their LTV helps see the big picture. It’s not enough to just get new customers; keeping the existing ones engaged and returning to the app is key. Unlike traditional sales models, where a product’s value is realized in a single transaction, SaaS models thrive on ongoing subscriptions and customer engagement over time. LTV shines a spotlight on the long-term value of each customer, measuring not just what they spend today, but what they will contribute financially throughout their relationship with the service.

Why is LTV important for subscription apps?

Understanding LTV for subscription apps helps publishers grasp the true value of their customers beyond the initial sign-up or monthly subscription fee. It encourages companies to focus on long-term customer satisfaction, product improvement, and service excellence. And this long-term perspective is the key: retaining a customer in a subscription model is often more cost-effective than acquiring a new one. High LTV signals a healthy, sustainable business model where customers find continuous value in the service, leading to ongoing revenue streams.

Lifetime value should also inform strategic decisions regarding your app. For instance, if analysis shows that improving customer support or adding certain features can significantly increase LTV, developers can allocate resources more effectively to these areas. By focusing on increasing the lifetime value of each customer, developers can ensure a steady income flow and invest in future expansion with greater confidence. This emphasis on customer retention over mere acquisition helps build a loyal customer base, which is crucial for long-term success in the competitive app marketplace.

That’s why LTV is not just another industry metric; it’s a guiding principle. It underscores the importance of viewing customers as long-term partners rather than one-time buyers. In a business model reliant on subscriptions and customer loyalty, understanding and optimizing LTV is fundamental to nurturing customer relationships, making informed strategic decisions, and achieving sustainable growth.

What metrics do you need for LTV?

Calculating LTV for a subscription app setting involves several key metrics. Tracking them is important in itself, precisely because they can signal important changes in LTV.

Average Revenue Per User (ARPU) calculates the average amount of revenue each customer contributes over a specific period. You can find this metric by dividing the total revenue by the number of customers in a certain period — say, a quarter or a year. ARPU is critical for LTV because it provides a baseline for understanding how much revenue, on average, a customer brings in. For subscription apps, of course, it will probably be close to the average subscription price minus the store fees.

Customer Lifetime (CLT) measures the average time a customer continues to subscribe and pay for your SaaS product. This metric can vary significantly between businesses and is influenced by how well your business retains customers. It’s calculated based on the average tenure of a customer before they churn.

Customer Churn Rate shows the share of the customers who cancel their subscriptions: essentially, 1 – Retention Rate. This metric is vital for calculating LTV because it directly impacts the customer’s lifetime: the lower the churn rate, the more time an average user will spend with the app, which increases their lifetime value. The metric is calculated as a percentage: just divide the number of customers lost during a certain period by the total number of customers you had at the start of the period and multiply by 100%.

Customer Acquisition Cost (CAC) stands for the all-encompassing cost of getting a new customer, with marketing and sales expenses included. While not directly used in the basic LTV calculation, it’s essential for understanding the profitability of a customer. Ideally, the LTV should be significantly higher than the CAC for a business to be sustainable.

Discount Rate. In more advanced LTV calculations, especially those that take into account future revenues, a discount rate is applied to account for the time value of money. This is particularly relevant for subscription apps with high upfront costs or investments in customer acquisition and less frequent (for example, annual) recurring revenue. The discount rate (often the inflation rate, or its derivative of some kind) converts future revenue into present value, providing a more accurate picture of a customer’s worth.

With these metrics, subscription app developers can estimate the LTV of their customer base. And now that we have them at hand, let’s talk more about different calculation methods in the next part of this guide.

How to calculate LTV for SaaS business?

Calculating Customer Lifetime Value for a subscription app or a general SaaS business can be done in several ways. Here, we limit our guide to two methods: one is simple and universal that helps you understand the logic of the metric, and the other is a bit more advanced, fine tuned to the subscription products. The latter is closer to the one Adapty in its predictive models; albeit, this one you can calculate by hand without using econometric methods.

Simple Method

The simple method for calculating LTV uses three key metrics: Average Revenue Per User (ARPU), Customer Churn Rate, and Customer Lifetime. The formula for this method is:

LTV = ARPU X Customer Lifetime, where:

- ARPU is the average revenue generated per user over a specific period: as we discussed earlier, just divide the total revenue over the number of customers in a certain period;

- Customer Lifetime, which is 1/Churn Rate.

Here’s an example: in a given month you gained 100 new users, and 20 left by the end of the month. The total revenue you’ve earned that month is $20 000. Plugging the numbers into the formula gives us:

- average revenue per user ARPU: $20 000 / 100 = $200;

- churn rate: 20 / 100 = 0.2 (or 20%); that brings customer lifetime to 1/0.2 = 5 months (always keep in mind the length of the period you’re using in the calculations);

- lifetime value, then, is $200 x 5 = $1 000.

A small, but important adjustment to the model might be accounting for the customer acquisition cost CAC: how much money you spent acquiring this user. For example, if it cost you $50 dollars to get a new customer, the actual LTV might be $1 000 – $50 = $950.

Advanced Method

The advanced method incorporates the discount rate for the time value of money, reflecting the principle that money today is worth more than the same amount in the future. This is more suitable for long-term projections and can provide a more nuanced view of LTV. The formula us:

LTV = t=1nARPU (1-Churn Rate)t-1(1 + Discount Rate)t, where t is a time period (often a month), and n is the total number of periods over which revenue is expected (often a year, so n = 12).

Don’t be afraid of how the formula looks. The notation just stands for sum, as we want to calculate the year-long Lifetime Value, adjusting for seasonal differences. Essentially, we just calculate the LTV with a simple method 12 times (one per each month) and then sum up the results, accounting for inflation or other expenses.

Let’s keep with the same example, now accounting for a 0.5% discount rate (which is often the case, since the effective annual inflation rate in a country might be 6%). We’d need something like Google Sheets or Excel to calculate it properly, and the updated LTV here is roughly $912.

2024 subscription benchmarks and insights

Get your free copy of our latest subscription report to stay ahead in 2024.

Calculating LTV with Adapty

Of course, the more accurate you want to be in your LTV predictions, the more complex will be the formulas: and the more advanced must be the tools to be able to calculate. That’s where Adapty comes into play.

Adapty is the go-to solution for monetizing subscription apps. It helps developers to greatly simplify the rollouts of paywalls and drive higher profits by constantly improving their apps’ performance and lowering the production costs with no-code solutions. By regularly AB-testing your paywalls you can find the one that converts better and thus brings more paying customers.

Another killer feature of the service, however, is subscription analytics. Adapty directly connects to the App Store and Play Store, so it can report data with a very high degree of accuracy. It analyzes cohorts (audience collected during a certain period of time) and tracks the key business metrics like revenue, retention, and average revenue per user.

More importantly, however, are the newly introduced LTV predictions. Adapty uses a series of machine learning algorithms and constant updates to provide a value that is as accurate as possible, based on the history of your app and the behavior (frequency and size of purchases, the share of paying customers) of your user base.

Start using Adapty to introduce this technology to your app.

What is a good LTV for subscription apps?

A “good” Customer Lifetime Value (LTV) varies for different verticals of apps and involves several factors, including business model, market segment, product type, and importantly, the Customer Acquisition Cost (CAC). We will provide some benchmarks later in the article, but here are the key factors you should pay attention to.

LTV to CAC Ratio

One of the most critical benchmarks for assessing LTV is the LTV to CAC ratio, sometimes denoted as ROMI (return on marketing investment). This ratio ensures that the cost of acquiring a customer is significantly lower than the value derived from them, indicating a healthy, scalable business model. A general rule is that a “good” LTV should be at least 3 times the CAC, but it’s okay to start with lower numbers during the first months of your app on the market.

Business Model and Pricing

The business model and pricing structure of a subscription app are also important. For example, apps with high-value, enterprise-level solutions might have a higher CAC but also significantly higher LTV due to larger contract values and longer customer lifetimes. Again, the ratio of gains to losses and its stability (or even growth) are more important.

Market Segment and Product Type

Different market segments and product types can also influence the benchmarks for a good LTV. Niche products serving specific industries may enjoy higher LTV due to specialized needs and less competition. In contrast, more generic products in highly competitive markets might struggle to achieve the same levels of customer loyalty and value. The exceptions are mobile games, but even that industry is expanding slower these days.

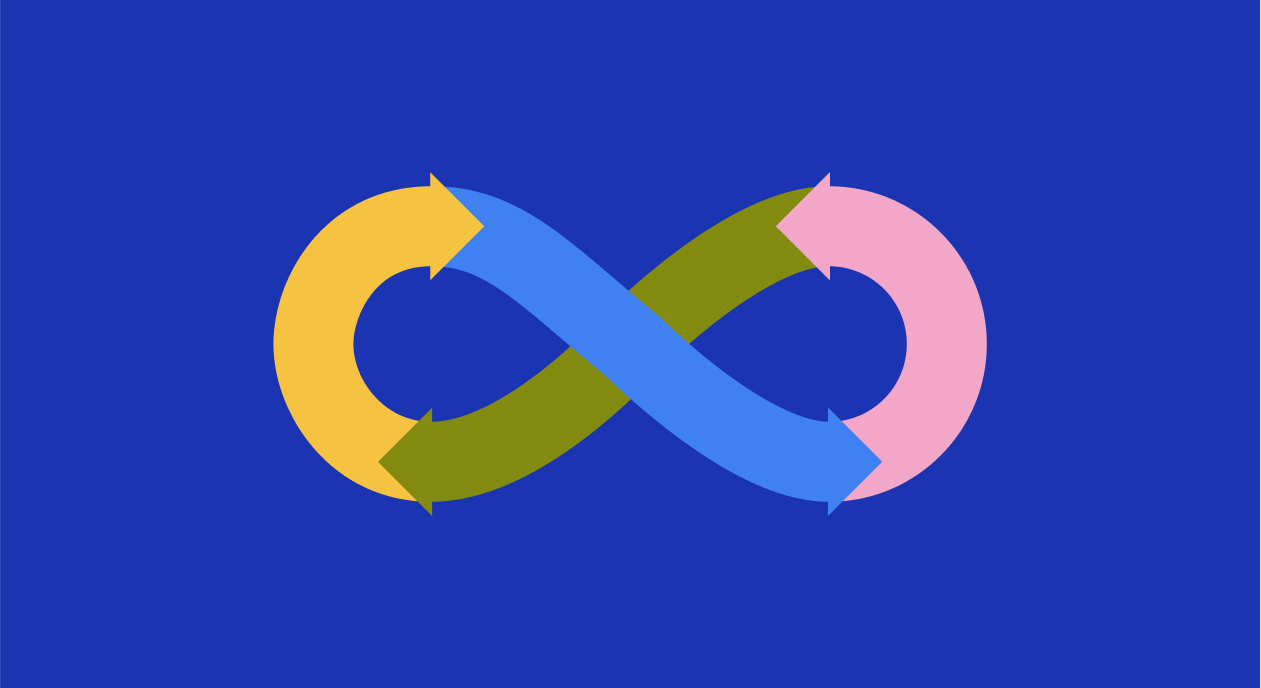

Customer Retention and Expansion

A good LTV is reflective of strong customer retention and the potential for account expansion. Subscription apps that offer additional value through upsells, cross-sells, or premium features can significantly increase the lifetime value of their customer base. High retention rates and the ability to grow customers over time are indicative of an app that delivers ongoing value, contributing to a higher LTV.

In summary, a good lifetime value is often a subject of a myriad of factors, including the LTV to CAC ratio, business model, market segment, and the retention metrics. When benchmarking, compare yourself to your peers in the industry and their subscription price:

- a good lifetime for a game app is 4-6 months, for a basic subscription app – 12+ months and for a niche subscription app – 18+ months and more;

- with the average subscription price in the US of around $10 –30 per month, a typical LTV varies from $50 to $450, with certain exceptions of corporate users.

More on the LTV to CAC ratio

For any app, the LTV to CAC ratio shows how effectively you’re turning marketing spend into profitable customer relationships. Subscription apps need also take into account that the length of their customer relationship directly correlates to the revenue they get, so it’s in their interest to keep the user engaged and motivated for as long as possible. Conversely, you can allow yourself to spend a bit more on attracting a customer or a player if you know that they will ‘pay you back’ by staying loyal to you and to the subscription.

That is important to keep in mind when launching an ad or a user acquisition campaign. Often marketing sees only the short-term gains and focuses only on the cost per install (CPI), without taking into account the quality of that install. Often, a seemingly more expensive install (for example, from an influencer) leads to a more informed and motivated customer who is more likely to subscribe. Cheap installs from paid ads, on the other hand, might not always convert to paying customers.

That’s why paying attention to this ratio rather than the raw numbers is key: it sheds light on whether your strategies for bringing in new customers are paying off. Of course, if you’re spending more on acquisition than what you’re earning from customers, your business might not be sustainable in the long term: allow, however, some time for the return on your investment and work on upselling the existing customers.

As we said before, an ideal LTV to CAC ratio is at least 3:1, indicating you’re earning three times what you’re spending to acquire customers. This sweet spot shows that your customer acquisition strategy is efficient and profitable. A ratio of 2:1 is on the lower end but still acceptable, suggesting your business is profitable but with limited room for additional expenses or errors.

Tips to increase customer lifetime value

Boosting the lifetime value of your app can be approached with several practical strategies:

Improve product value. Regularly update your app based on customer feedback, add new features, and ensure smooth operation. Like nurturing a garden, continuously improving your product keeps customers engaged and satisfied.

Enhance customer experience. Make every customer interaction delightful, from sign-up to support. Offer personalized service, user-friendly design, and proactive engagement to make customers feel valued and supported.

Implement upselling and cross-selling. Introduce customers to additional features or premium plans that complement their current use. Ensure these subscription offers are relevant and demonstrate their value to encourage upgrades.

Focus on customer retention. Retaining customers is more cost-effective than acquiring new ones. Use loyalty programs, discounts for longer-term subscriptions, engaging content, and community-building efforts to keep customers engaged and loyal over time.

Leverage data for decision making. Analyze customer behavior, feedback, and usage patterns to make informed improvements to your product and customer journey. Data-driven strategies lead to more effective enhancements in LTV.

While these strategies might sound universal and vague, a lot of ‘unique’ problems of certain apps often fall into one of these categories. Single out a subscription offer, try to evaluate in which part of the funnel customers tend to ‘fall out’, and you will see that it’s often either an issue of lacking value, or an uncomfortable experience. Cultivating a higher LTV is an ongoing journey with many steps that requires dedication, innovation, and a keen focus on delivering exceptional value to your customers.

Conclusion

Understanding and optimizing Customer Lifetime Value (LTV) is one of the more important goals to keep in mind. It’s the measure that shows the total value a customer brings to your business over time, guiding you toward sustainable growth strategies. From improving your product’s value and customer experience to smart upselling and focusing on retention, each strategy plays a vital role in enhancing LTV.

A thriving subscription app has many moving parts: it requires continuous care and strategic nurturing. Keep a close eye on your metrics, listen to your customers, and be ready to adapt your strategies as needed. By doing so, you’ll not only increase the value each customer brings but also build a stronger, more resilient business.

Let LTV be your north star, guiding you to make informed decisions that drive growth and profitability, and LTV/CAC ratio the speed at which you travel. With dedication and a focus on delivering exceptional value at every step of the customer journey, the potential is limitless. Keep growing, keep refining, and watch your app grow.