How to calculate customer acquisition cost (CAC): Benchmarks to know

Updated: September 9, 2024

17 min read

How many users could you acquire for your mobile app if you got $10,000 in funding? Or how much of your profits would you need to reinvest to grow your mobile app by a hundred users a month? Or simply, what does unit economics look like for your app?

Enter Customer acquisition cost (CAC) analysis. Customer acquisition cost – or the cost of acquiring a mobile app user – is a key marketing metric for user acquisition. Analyzing CAC tells you exactly how much money you spend to acquire an app user. While CAC is calculated primarily at the user level (for example, when a user installs your app, it’s counted as an acquisition), it’s common to calculate CAC for specific user actions, too, like purchases and in-app actions like registrations or in-app purchases. For example, in 2018-19, the average CAC for getting installs across both the app stores was $1.75 ($3.6 for iOS and $1.22 for Android, respectively). However, the CAC for registration was $3.52 ($7.55 for iOS and $2.17 for Android). And the same for securing an in-app purchase was a whopping $86.61 ($77.45 for iOS; 86.72 for Android). We’ll discuss these in detail in just a bit. But for now, note that knowing how much money you need to spend to get a user or get a user to do a specific action helps you set realistic user and revenue growth goals for your app.

So, let’s see what CAC exactly is, the different formulas used to calculate it, and the various levels at which CAC can be calculated. We’ll also examine how CAC ties to LTV and why the CAC-LTV ratio is crucial to ensure app growth. Finally, we’ll see what a CAC payback period is and why calculating it is essential for mobile apps.

Here goes.

What is CAC?

Acquiring mobile app users needs spending on a host of marketing and sales ops that work on the different stages of the mobile app conversion funnel. At the discovery stage, you need to spend on channels like ads or PR. Running ads or PR stories needs a good upfront investment.

Once users land on your app store listings, your on-page optimization takes investment. You need to spend money on creating compelling copy, quality graphics, and pricing analysis, among other things.

When users download your app, you need to invest in the engagement so they sign up for a trial, make in-app purchases, or stay subscribed (if it’s a subscription app). This means spending on solutions for onboarding and in-app messaging, among others.

Said another way: Acquiring a mobile app user takes substantial investment. Importantly, the cost of acquisition doesn’t end with acquiring a user. Often, it adds up until a user performs a desired in-app action like making an in-app purchase. More on this in just a bit, but let’s focus on all the spending leading up to the install for now.

Unless you know how much money you need to acquire a user (across all these sales and marketing activities and more), you can’t calculate how much value they bring to your business.

This is what the CAC metric helps decode. CAC is the total cost of acquiring an app user. This cost factors in all the marketing and sales expenses that go into getting them.

CAC gives you a complete picture of your user acquisition stage, money wise. Let’s now see how you can calculate your mobile app’s CAC before seeing why it’s so crucial.

How to calculate customer acquisition cost

The standard CAC formula

This is the most basic formula for calculating CAC. Here, you take the sales and marketing budget/spend for a period and divide it by the number of new customers acquired during that specific period.

For example, if you spent $1000 on your user acquisition sales and marketing efforts in January and acquired 100 users, your CAC becomes 1000/100=$10. So, you spent $10 on each user acquisition.

The paid CAC formula

When you invest in paid marketing campaigns, you should know which campaign worked the best for you. In these cases, you’d calculate your CAC at the campaign level.

The paid CAC formula helps here. So if you spent $500 on an ad campaign in the App Store and acquired 50 users, your paid CAC becomes: 500/50=$10.

The fully loaded CAC formula

When you calculate CAC using its standard formula, you only consider budgets or spending. However, the real spend is often much higher. It includes not just the direct marketing and sales costs but also overheads, for example, in the form of employee salaries or investment in tools, among others.

For example, if you consider the paid CAC calculation from above, you’ll see that it only factored in the actual ad spend ($500). It left out:

- Costs associated with the researching, copywriting, and designing that went into building the campaigns (in terms of employee salaries)

- Costs associated with tools used for running the campaigns or any other solutions you use in your mobile app sales/marketing tech stack

- Costs associated with any consultations/ that went into the campaigns

You get the drift.

Only when you add all these to your CAC calculations will you get your accurate and “real” cost of acquiring a user. The fully loaded CAC formula takes all these into account to give you a comprehensive estimate reflecting your direct and indirect costs of acquiring users.

Why factoring in an app’s monetization model is important for CAC calculations

For free apps that don’t offer in-app purchases, CAC analysis is quite straightforward and ends with the install.

For paid apps that don’t offer in-app purchases–these are apps that come with a one-time fee paid upfront in the app store–CAC analysis works similarly. You just need to price your app higher than the CAC you estimate to run profitably.

However, for 1) freemium apps, 2) premium apps with additional in-app purchases (often termed the “paymium” app monetization model), and 3) subscription apps, CAC analysis is more complex as there’s one more category of users here: “paying” users.

Mobile apps following the above monetization models treat installs as the first acquisition stage. For example, for a freemium app, a user who downloads the free version is only a “lead” in a sense. Likewise, for a paid app that further monetizes with in-app purchases, again, to an extent, the initial install is only like generating a lead. Similarly, for a subscription app that offers trials, acquisition only happens when a user successfully transitions to a paid plan from their trial.

For such apps, CAC is calculated by dividing spend by the number of paying users. Alternatively, such apps will calculate the CAC using standard formulas but will also calculate the cost of acquisition actions (like making an in-app purchase) to the mix to get more insights.

2024 subscription benchmarks and insights

Get your free copy of our latest subscription report to stay ahead in 2024.

How long does it take you to recoup your customer acquisition costs? All about CAC payback period and why it matters

One of the first questions you’ll find yourself asking after calculating your CAC is: How long does it take you to recover your CAC (i.e., the cost of acquiring a user)?

This is important because, obviously, you want to recover your CAC. It’s only after the CAC payback that a user will contribute to your profits.

Enter ARPU.

ARPU–or the average revenue per user–is a metric that tells you, on average, how much revenue each user gets you. To calculate your CAC payback period, divide CAC by ARPU.

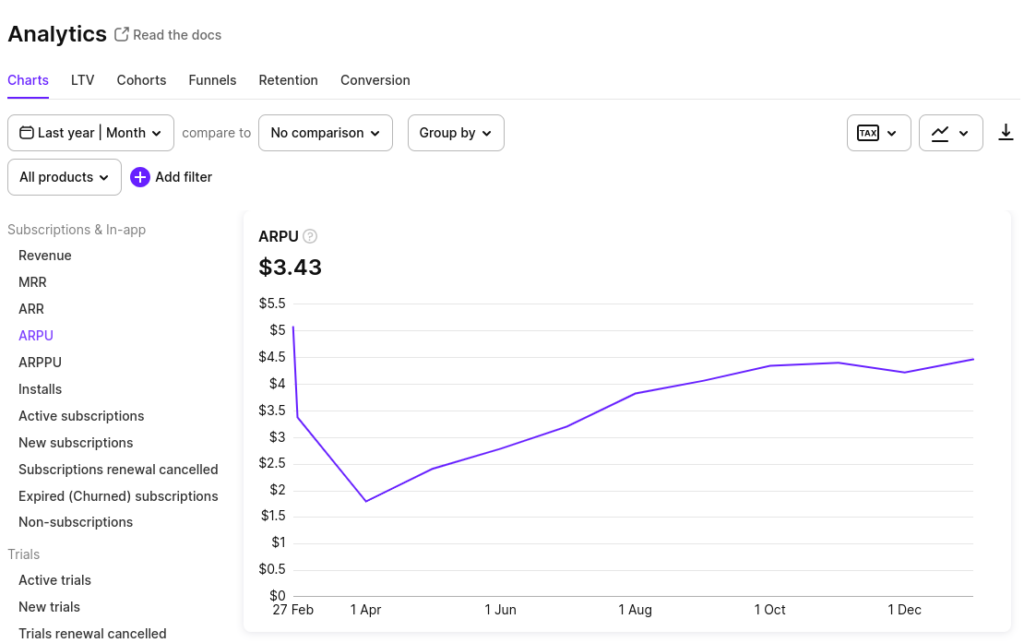

Below, you’ve Adapty reporting an app’s average monthly ARPU:

Suppose your CAC is $10, and your monthly ARPU is $3.5. So, in this case, you’ll take about 2.8 months, on average, to recover your CAC.

But WAIT.

As we saw earlier, CAC is also calculated at the paid user level for apps that use in-app purchases. In this case, you’d use your ARPPU to calculate your CAC payback period. ARPPU is the average revenue you make from your paying customers.

So, say your CAC for acquiring paid users is $50, and your ARPPU is $30; then, you’ll take about 1.5 months to recoup your CAC.

Another question you’ll want to answer after securing CAC payback is: How much do you make off each user?

How much do you make off each user? The CAC -LTV ratio

To understand how much profit you make off each user, you need your user’s lifetime value (LTV) data. Your LTV should be much higher than your CAC to ensure good profit.

Let’s take a real-world example to get this.

In this article on unit economics, we’ve rehashed Calm’s example that the Pujji brothers featured in one of their podcasts. Back then, the meditation app Calm apparently had an LTV of about $200, of which $80 got spent on things like maintaining the app and creating content, leaving the actual LTV at $120.

Its CAC stood at about $40.

So the LTV/CAC ratio came to be about 3:1 ($120/$40)… which is excellent. 3:1 is generally considered a profitable LTV:CAC ratio. This is especially true here since Calm’s CAC payback period is only about a year. This explains why Calm is such a successful and profitable app.

Here’s Adapty reporting an app’s LTV:

All that said, what does a good CAC look like for mobile apps?

First, there are no benchmarks for the CAC metric for mobile apps. This is because CAC varies considerably based on the different monetization models, sales cycles, and niches that apps have.

So, how do you tell if your CAC is healthy?

One sure way to tell this is to compare it with your LTV. So, calculate your LTV-CAC ratio:

- If you’re generating a 3:1 LTV-CAC ratio, i.e., your customer’s lifetime value is three times your spend on acquiring them, you’re doing well.

- If you’re managing 2:1 while not in the red, this might not ensure sustainable growth.

- If you’re doing about 1:1, you’re only recovering your acquisition costs and making no profits.

By the way, if you plan to sell your app in the future, your LTV-CAC ratio is one of the first things your potential investors will look out for! They want to see the profitable 3:1 ratio there.

How to optimize your CAC, CAC payback period, and overall LTV

Target your more profitable user segments

If you sell an annual subscription, you’ll recover your entire CAC for a user upfront with a single payment. So, look at your user base to identify segments that prefer the annual plan. Next, prioritize this user segment with your user acquisition campaigns.

Address churn proactively

If your users leave you before the CAC payback period, you lose all the money you spent to get them. So monitor churn. Use a solution like Adapty to understand your churn pattern. If you’ve a subscription app with a low trial-to-paid conversion rate, fix the trial, offer an extended trial, or give a better offer. Also, focus on the users in the grace period; you can easily save some of them from leaving.

Diversify your user acquisition channels

Try using channels like web search and referrals. Setting these up may take some investment upfront, but over time, they can help you acquire users for less.

Experiment with your products, pricing, and offers

Redistributing your user base can help optimize your CAC. For example, if you sell monthly subscriptions and your CAC payback period is six months, consider offering an annual or semi-annual subscription plan to break even with a single payment. Use a solution like Adapty that comes with a no-code paywall builder and quickly set up paywalls to experiment with newer plans. You’ll be surprised at how you can actually redistribute your user base to get more subscribers for a desired plan that eventually reduces your CAC payback period.

If you see that you take a very long time to recover your CAC with ad hoc in-app purchases, experiment with offers on your in-app purchases.

You can also prioritize “expansion revenue.” The best way to do this is to add more in-app purchases to recover your CAC and hit profits sooner.

Add experimentation to your user acquisition channels

If you use ads to acquire new users, your CAC will fluctuate based on your niche’s competition. For example, the meditation space is much more saturated now than a few years ago, especially before the pandemic. Factors like these are pretty much out of your control. However, paid CAC calculations for your different advertising campaigns can help you find the ones with the best returns. Experimenting with different kinds of ad campaigns and targeting can help lower the CAC here.

App store optimization, too, is a lot more competitive now, with most apps doing all the right things already. While experimenting with your app listings (to find better pricing, for instance) will add more overhead to your acquisition costs and your CAC, the upside is that your CAC will improve in the long term.

If you’re competing organically (through SEO and all) or through collaborations, sponsored content, and PR, again, add experimentation to the mix.

Invest in your processes to lower operational costs

Your processes, too, add to your CAC. So, invest in standardizing your sales and marketing processes to optimize your ongoing operational costs. Any savings here will reflect directly in your CAC.

Wrapping it up…

Acquiring new users consistently, cost-effectively, and sustainably is the key to growing a mobile app. And this is exactly what CAC analysis helps with. By analyzing your CAC, you can learn exactly what your investment in user acquisition translates to.

Also, as you may have realized, simply calculating the cost of acquiring a user (or getting an install) is only one part of the puzzle. Unless you use ad-based monetization where your user base directly translates to your revenue, you need to calculate CAC at a few more levels. For apps monetizing with in-app purchases, this means calculating the costs of acquiring “user actions” like making an in-app purchase.

Another thing to note is that your CAC analysis must also analyze your CAC metric’s relationship with your LTV, because that’s how you can calculate the actual revenue you make from a user across their app journey. The CAC payback period, too, is crucial. To get these insights easily, consider getting a solution like Adapty. More than 5000 apps trust Adapty for implementing in-app purchases, building and experimenting with paywalls, and getting accurate revenue analytics, including users’ lifetime value data. Contact our team for a personalized walkthrough of Adapty to see how it can support your app’s growth story.

Recommended posts