We live in a remarkable time when mobile marketing and attribution are changing drastically. What is more fascinating is that the App Store and Play Market are becoming the new Internet that governments are trying to regulate.

Recently, the American court has ruled that Apple must allow developers to use 3rd-party payment providers, such as Stripe in mobile apps. This is a groundbreaking event that was due since the emergence of the App Store. The reason is simple: before, developers had to pay 30% commission. However, recently Apple introduced a lower 15% cut if the revenue is below $1m (we have previously discussed the effect of this change on the market).

The benefits of using 3rd-party payment providers for iOS apps

Many believe that external payment services are a blessing for developers, saving from Apple’s monopoly and magically boosting revenue by 20-35%. If you were losing 15-30% before, now, with Stripe, you will be saying goodbye to the mere 2.9%.

I believe that alternative payment methods can bring more problems than benefits to both developers and users. Let’s explore the situation in detail.

1. No need to deal with the customer support

Apple supervises the payment process and doesn’t allow the developer in. Technically, at the moment, the user doesn’t pay the developer directly, they pay Apple. All returns, chargebacks, and other issues are taken care of by the platform. It’s a huge workload that requires a dedicated team, and the store does it for you.

2. No-hassle returns and chargebacks

Currently, you, as a developer, don’t have to worry about refunds or chargebacks. The difference between the two is that a refund is performed by the company itself, while a chargeback is requested by the user through their bank whenever a transaction seems suspicious.

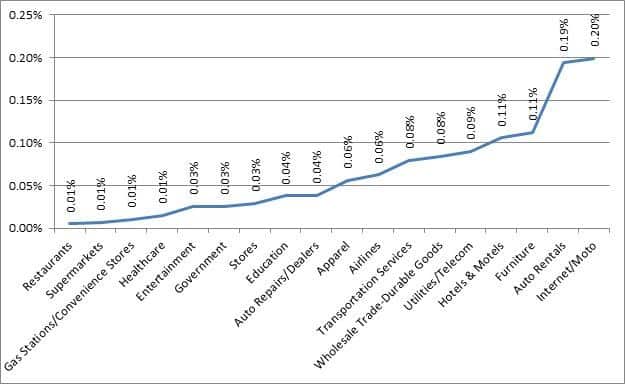

Even 1% of chargebacks is enough to get you blocked and banned by the payment provider. A common chargeback rate is 0.2%, which is 1 out of 500 payments. With refunds, you can have a higher rate before getting blocked, which starts around 10%. In my experience, I saw iOS apps with the refund rate as high as 30% and they weren’t blocked.

3. User-friendly interface and fast payments/subscriptions

Usually, a bank card is already linked to the user’s Apple account, which makes a purchase a no-brainer: confirm it with the Face or Touch ID and you are good to go. It’s way faster than following links and typing in new card details.

4. Still non-trivial, but already transparent unsubscription process

The situation with canceling subscriptions improved drastically in iOS 13. Now, if you delete an app with an active subscription, you are immediately offered to unsubscribe. If you want to unsubscribe without deleting the app, you have to find your way through the iCloud’s settings, which can be frustrating.

5. Worldwide payment collection

While some payment providers usually work better in certain countries (Stripe, Nexway), Apple does it well in all countries, relentlessly trying to bill you for a long time no matter what your geographical location is.

6. Apple automatically notifies users if the card linked to an account has expired

Bank cards are issued to last 4 years. Given a uniform issue date of all bank cards, 25% of all users will have their cards expired in a year. This means that, if those people have subscribed externally with a bank card instead of Apple’s in-app method, you will have to resubscribe them. In this situation, you are likely to lose a lot of subscribers. For iPhones the situation is simpler: if the card linked to the Apple ID has expired, the user will receive tons of notifications from Apple to update the payment method and, once they do it, they will be automatically charged again.

7. Antifraud

Surprisingly many payments are done using stolen cards. I don’t know how it works, but we’ve never encountered a canceled transaction based on accusations of fraud. Maybe Apple constantly checks cards for fraud and swiftly takes care of the problem.

In general, if a developer has large development and support teams, he can control all of the above internally. It might be more profitable than losing 30% of the revenue. However, for small developers (with a 15% cut), dealing with it can cause more pain than profit.

It’s more convenient to pay using Apple service if the price is the same in comparison to other payment methods:

- The purchase with Apple is secure. A deceitful developer won’t be able to steal your card details.

- Payment is ultra-fast. No need to enter card details.

- Unified and intuitive payment UI for all apps.

- One place to manage your subscriptions.

Thoughts about integrating external payment methods in apps

No matter the payment method, the subscription/purchase price will likely remain the same. I doubt that Apple will attempt to take control over the price. At the same time, it is more convenient to pay using Face or Touch IDs than filling in your card details each time.

It seems that developers might start using Apple Pay instead of in-app purchases because the user experience will remain the same, but the commission will be lower. At this point, it is unclear how Apple will handle this scenario.

Most likely, developers will have to offer Apple’s in-app purchases if they want to have an external payment option available. Likely it will work just like user authentication, where Sign In with Apple is mandatory.

It is unclear how technical support for purchases will work, how refunds and cases of fraud will be handled, and we are likely to see the rise of scammer apps that are very hard to unsubscribe from.

Final thoughts

I believe that eventually, developers will win the war over the right to use whatever payment method they want, which will result in popular apps getting alternative payment methods.