TL;DR

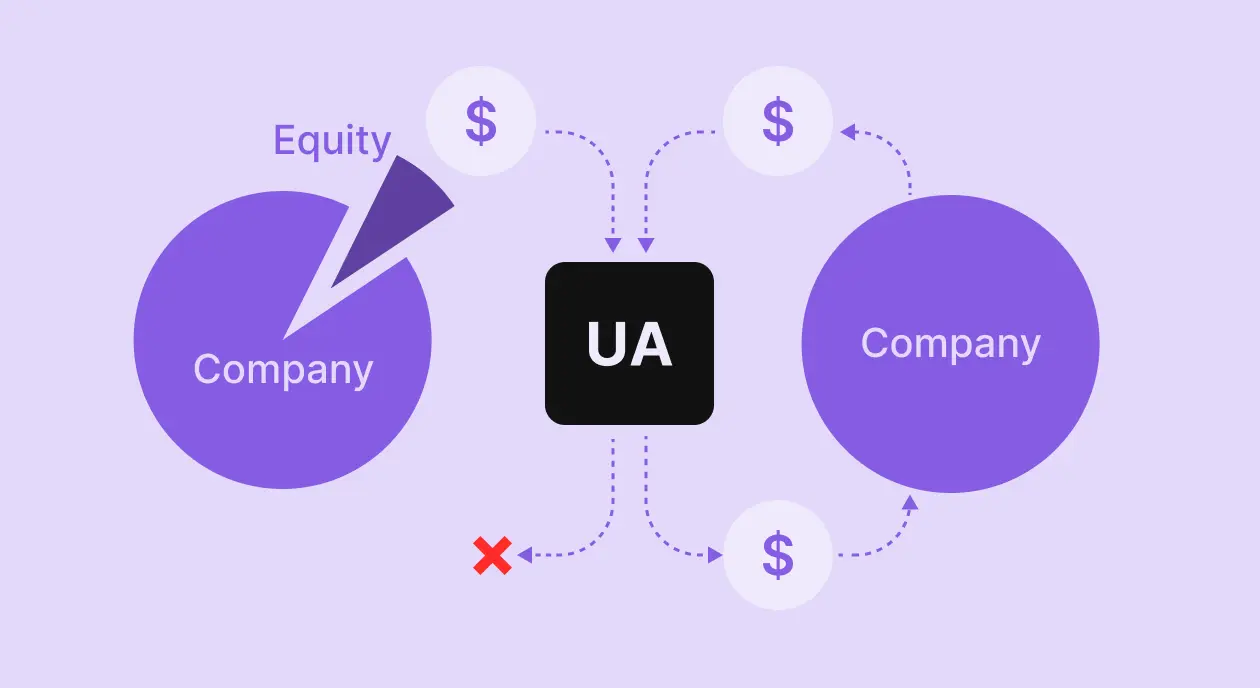

- If your UA machine works, funding it with equity is the most expensive option. You’re paying in ownership for predictable returns.

- Debt and non-dilutive capital let you scale without giving up control or board seats.

- Speed matters more than interest rate: a dollar today in a working UA loop beats cheaper capital 90 days from now.

- Five funding models exist for UA, each fits different cash cycles and risk profiles.

- Match your funding source to your ROAS payback window.

Why is equity the most expensive way to fund UA?

You’ve got a UA machine that works. Every dollar in returns $1.40 in 90 days. Your LTV curves are predictable. Your team knows exactly which campaigns to scale.

So you raise another round.

It feels like the smart step. More capital, more growth, more runway. But here’s what happened: you just sold 20% of your company to fund spend that would have paid itself back in three months.

Let’s run the math. You raise $500K at a $2.5M valuation, giving up 20% equity. That money goes into UA. It works, your campaigns return 140% ROAS over 90 days. Great outcome.

But that 20% you sold? At a $10M exit, it costs you $2M. At $25M, it’s $5M. At $50M, you just paid $10M for a $500K cash advance.

Equity is expensive capital disguised as free money.

Raising isn’t the mistake. Raising for the wrong thing is. Equity makes sense when outcomes are uncertain: building a new product, entering an unproven market, hiring a team before you have revenue. High risk deserves high-cost capital.

A working UA machine has known inputs and outputs. You put a dollar in, you know what comes back and when. You’re scaling something that already works.

Using equity to fund predictable returns is like taking out a mortgage to buy groceries. Technically possible. Financially insane.

The alternative is debt or more precisely, non-dilutive capital that matches the risk profile of what you’re doing. You borrow against revenue you’ve already earned or cohorts with proven LTV curves. You pay a fee measured in percentage points, not ownership stakes. You keep control.

Most founders don’t think this way because the startup ecosystem defaults to equity. Accelerators teach you to raise. VCs are the most visible capital source. The whole culture assumes that growth requires selling pieces of your company.

It doesn’t. Not for this.

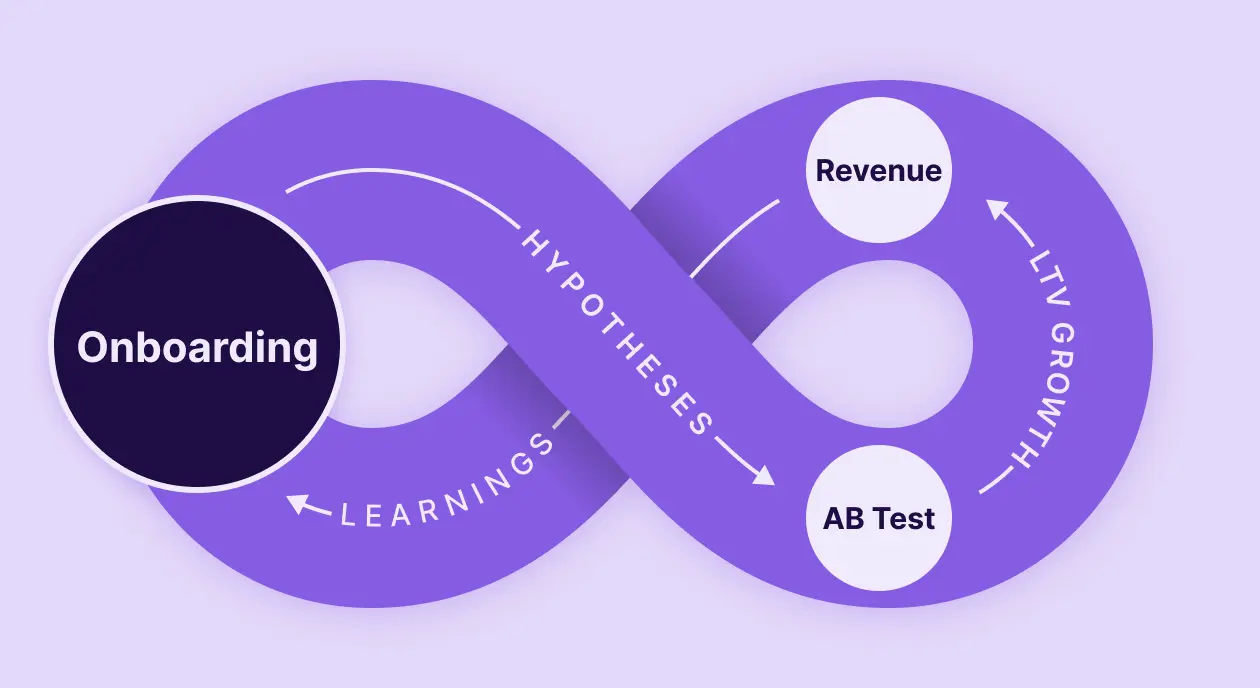

When does debt make sense for user acquisition?

Debt works brilliantly for specific jobs and terribly for others.

Debt works when you have predictability:

- Proven LTV curves. You know what a user acquired today will be worth in 30, 60, 180 days. Not hope. Data.

- Positive unit economics on at least one channel. Facebook, Google, TikTok, Apple Search Ads — doesn’t matter which. You need at least one channel where you can put money in and reliably get more money out.

- Payback windows under 12 months. Debt has a cost. If your LTV takes 18 months to materialize, the math gets harder. Under 12 months? Debt almost always beats equity.

If you have these three things, you have a UA machine. And machines don’t need venture capital, they need fuel.

Debt is wrong when:

- You’re still searching for product-market fit. If you’re iterating on core features, testing pricing models, or figuring out who your user actually is, that’s exploration. Exploration needs equity because most experiments fail.

- UA economics are unproven or volatile. Maybe your last three campaigns worked, but you haven’t scaled past $10K/month in spend. You don’t know if the economics hold at $50K or $100K. That uncertainty belongs on an equity balance sheet, not a loan.

- You need capital for R&D, team building, or market expansion. Hiring engineers, opening new geos, building v2 of your product — these are bets with uncertain timelines and outcomes. Equity is designed for exactly this.

The founders who get this right use both. Equity for the uncertain, high-upside work. Debt for the predictable, repeatable scaling.

The founders who get it wrong use equity for everything and give up 60% of their company before they realize there was another option.

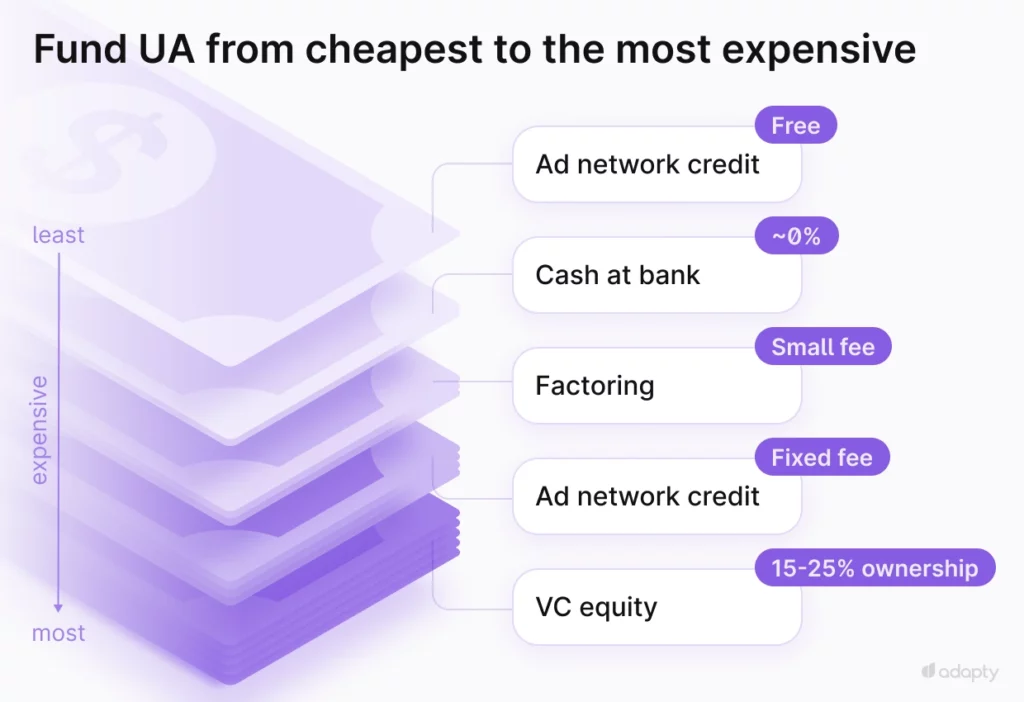

What are the best non-dilutive funding options for UA?

Not all non-dilutive capital is the same. Here’s how each option actually works, who it fits, and where it falls short.

1. Ad network credit lines

Platforms like Meta and Google offer credit lines to advertisers with established spend history. You run campaigns now, pay the invoice 30-60 days later.

Speed to capital: 2-4 weeks to build up a meaningful limit. You start small and earn higher limits over time.

Cost: Free. This is essentially an interest-free float from the ad platform.

Best for: Smoothing cash flow on platforms where you already spend consistently. If you’re doing $50K/month on Meta, a $30K credit line removes friction from your payment cycle.

Watch out for: Limits stay small relative to growth ambitions. A $50K credit line doesn’t help if you want to scale to $200K/month in spend. Also, late payments can suspend your line entirely and rebuilding takes months.

The bottom line: Use it to the max, but don’t rely on it as your primary growth lever.

2. Cash at bank / Free cash flow

You use profits from existing operations to fund new UA spend. No external capital involved.

Speed to capital: Immediate. The money’s already yours.

Cost: Opportunity cost only. That cash sitting in the bank could earn 4-5% in a money market account. If your UA returns 40%+ annually, the math is obvious.

Best for: Bootstrapped founders with profitable apps generating excess cash. Also works for funded companies whose investors explicitly support using operating cash for growth.

Watch out for: VC-backed founders often assume their bank balance is “free money.” It’s not. That cash came with expectations. Some investors get nervous when you spend aggressively, even on proven campaigns. Others have specific opinions about burn rate and runway. Know your board’s appetite before deploying operating cash into UA.

The bottom line: If you have it and can use it freely, this is the cheapest capital available.

3. Factoring / AR financing

You’ve already earned revenue, users paid for subscriptions, but Apple and Google haven’t sent the money yet. Apple pays 45 days after month-end. Google takes 30. Factoring lets you access that earned revenue immediately instead of waiting.

A factoring provider advances you a percentage of your receivables (typically 80-85%), then collects directly from the app stores when they pay out. You get the remaining balance minus a small fee.

Speed to capital: 1-2 days. This is the fastest external capital available for mobile apps.

Cost: Fixed percentage fee on the advance. Transparent and predictable.

Best for: Apps with short ROAS cycles (under 60 days) who need to redeploy revenue into UA faster than payment schedules allow. If your campaigns pay back in 30 days but you’re waiting 45 for Apple to settle, you’re artificially constrained.

Watch out for: Only works if you have meaningful receivables. If you’re doing $15K MRR, you can unlock maybe $12K. Helpful, but not transformative. Also less useful if your payback window is longer than the payment delay you’re solving for.

The bottom line: For short-cycle UA economics, this is often the optimal funding source — low cost, fast, and perfectly matched to the timing problem.

Adapty Finance offers factoring with approval in 1 day, advances up to 85% of your App Store and Google Play receivables, and weekly or on-demand payouts. No personal guarantees required.

4. Cohort-based financing / Revenue-based financing (RBF)

You borrow against the future revenue of user cohorts you’re about to acquire. The lender analyzes your LTV curves, agrees that users acquired this month will generate X revenue over the next 6-12 months, and advances you capital to acquire them. Repayment comes as a percentage of the revenue those cohorts actually generate.

Speed to capital: 1-2 weeks typically. Faster than VC, slower than factoring.

Cost: Fixed fee structure, but the effective interest rate varies based on how fast you grow. If your cohorts outperform projections, you repay faster, which increases the annualized rate. This is the tradeoff for flexible, revenue-linked payments.

Best for: Apps with longer payback windows (60-365 days) where factoring doesn’t fully solve the timing gap. Subscription apps with strong retention and predictable LTV curves are ideal candidates.

Watch out for: You need clean data. Lenders will dig into your cohort performance, attribution, and revenue tracking. If your analytics are messy, you won’t get approved or you’ll get worse terms. Also, if you already have other debt, RBF facilities can create conflicts with existing lenders.

The bottom line: The right tool for proven subscription economics with longer payback periods. More flexible than traditional loans, more patient than factoring.

Adapty Finance offers RBF with credit lines up to $2M, payback periods from 3-12 months, and fixed monthly fees plus revenue-based repayment. Because Adapty already processes your subscription data, underwriting is faster and based on real performance, not projections.

5. VC funding

You sell equity in your company to investors in exchange for capital. They become partial owners with rights, preferences, and often board seats.

Speed to capital: 3-6 months from first meeting to wire, typically. Faster if you have warm relationships and momentum. Slower if market conditions are tough or your metrics need explaining.

Cost: 15-25% ownership per round, plus governance implications. VCs expect returns of 3-10x their investment, which means they’re pricing your capital at an implied rate far higher than any debt instrument.

Best for: Building new products, entering unproven markets, scaling teams, R&D — anything with uncertain outcomes and long time horizons. VC is designed for bets, not for funding predictable returns.

Watch out for: VC money comes with expectations. Growth targets, board oversight, pressure toward exit timelines. Using VC to fund UA means bringing those expectations into a part of your business that should be mechanically predictable. Also, large VC funds often don’t fit UA-driven growth models. They need to deploy big checks into big outcomes, which doesn’t match the profile of efficient, debt-funded scaling.

The bottom line: Great for its intended purpose. Terrible for funding repeatable UA. If your campaigns already work, you’re paying 20% of your company for something that should cost 2-5% in fees.

How do UA funding options compare?

| Funding Option | Speed | Cost | Best for | Watch out for |

|---|---|---|---|---|

| Ad network credit | 2-4 weeks to build | Free | Cash flow smoothing | Low limits, fragile |

| Cash at bank | Immediate | ~0% (opportunity cost) | Bootstrapped or approved by board | Investor expectations |

| Factoring / AR financing | 1-2 days | Fixed % fee | Short ROAS cycles (<60 days) | Needs meaningful receivables |

| Cohort financing / RBF | 1-2 weeks | Fixed fee + revenue share | Longer payback (60-365 days) | Needs clean data |

| VC equity | 3-6 months | 15-25% ownership | R&D, new markets, team building | Overkill for predictable UA |

How to match funding to your stage

Use this as a decision framework:

Your ROAS payback is under 30 days: Max out your ad network credit lines. Use factoring to accelerate the rest. You’re in the best possible position—your UA essentially funds itself with a slight timing assist.

Your ROAS payback is 30-90 days: Factoring solves most of the gap. Consider adding cohort financing if you’re scaling fast and want to deploy more than your receivables support.

Your ROAS payback is 90-365 days: Cohort financing is your primary tool. Factoring helps with short-term cash flow but won’t cover the full cycle. Make sure your LTV data is bulletproof—lenders will scrutinize it.

Your UA economics are unproven: Don’t use debt. Seriously. If you don’t know your payback windows with confidence, you’re not ready for non-dilutive capital. Use equity, prove your model, then switch to debt for scaling.

You’re building something new (product, market, team): Equity. This is what it’s for.

The smartest founders often run multiple options simultaneously: ad credit for baseline spend, factoring for receivables acceleration, and cohort financing for the incremental scale.

Why does speed matter more than cost of capital?

One more thing most founders underestimate: the compounding cost of slow capital.

Consider a meditation app doing $85K MRR with proven 120% ROAS:

With traditional timing: January revenue earns $85K. Apple pays mid-March. February ad budget is whatever’s left in the bank, maybe $30K.

With factoring: January revenue earns $85K. February 1st, you have $72K (85% advance) available for UA. That $72K at 120% ROAS generates $86K in February revenue. Which becomes available March 1st. Which compounds again.

The difference isn’t 45 days of float. It’s the compounding effect of deploying capital 4-6x faster across the entire year.

A slightly higher fee paid for immediate capital almost always beats cheaper capital that arrives months later. The founders who understand this have a structural advantage over everyone still waiting for their next equity round to close.

How do you get started with non-dilutive funding?

If you’re running a mobile app with working UA economics and you’re still funding growth with equity, you’re likely overpaying by 10-100x.

The alternative:

- Audit your payback windows by channel

- Map your options against the capital stack

- Start with the fastest, cheapest non-dilutive source that fits your cycle

- Save equity for the uncertain stuff

Adapty Finance offers both factoring and cohort-based financing for mobile apps. If you’re doing $15K+ MRR with subscription revenue, you can check eligibility and get approved in as little as one day.

→ Check your eligibility at adapty.io/finance