TL;DR: Apple pays you 45 days late. Google takes 30. Meanwhile, your best campaigns are running out of budget. Adapty Finance unlocks up to 85% of your earned revenue within 1-2 days. No loans, no equity, zero platform risk.

You’re hitting your numbers. User acquisition works. Revenue climbs month over month. But here’s what actually happens: you’re always 6 weeks behind your own success.

Apple pays 45 days after the month-end. Google takes 30. While you wait, your best campaigns stall, your team slows down, and competitors with faster cash flow pull ahead.

We’ve seen this story hundreds of times working with Adapty customers. You’ve got proven unit economics, clear growth levers, and the data to back it up, but you’re artificially constrained by payment timing that made sense in 2008, not 2025.

That’s why we built Adapty Finance.

What is Adapty Finance?

Adapty Finance transforms your earned-but-not-yet-paid App Store and Google Play revenue into immediate working capital.

This isn’t a loan. It’s not equity financing. It’s your money, faster.

Here’s how it works:

- Your app generates subscription revenue.

- We advance you up to 85% of that earned revenue within 1-2 business days.

- When stores pay out on their normal schedule, we collect our advance plus a transparent fee.

- You get the remaining balance the same day stores settle with us.

The result: Your revenue cycles 4-6x faster instead of waiting for payment schedules that don’t match how growth works today.

Why did we build this?

Over the past five years helping thousands of apps optimize their subscription revenue, we kept hearing the same frustration:

“We know exactly which campaigns drive profitable users. We have the LTV data. We could 2x our ad spend profitably tomorrow, if we just had the cash flow to do it.”

Traditional financing doesn’t work for app businesses. Banks don’t understand subscription metrics. VCs want equity for what should be a simple cash flow tool. Invoice factoring companies think “App Store Connect” is some kind of networking event.

But we understand your business model inside and out. We’ve seen your revenue patterns, your seasonal fluctuations, your churn curves. We know the difference between healthy growth constraints and actual problems.

So we decided to solve this ourselves.

Here’s what we built:

Real-world impact

Let’s run through a realistic scenario:

Meditation app – January performance:

- Monthly recurring revenue: $85,000

- New user acquisition cost: $12

- 6-month LTV: $47

- ROAS target: 120%+

| Traditional timing | With Adapty Finance |

| January revenue earned: $85,000 | January revenue earned: $85,000 |

| Apple payout arrives: Mid-March | Advance available February 1st: $72,250 (85% of earned revenue) |

| Available for February ad spend: Whatever’s left in the bank (maybe $30K?) | Apple payout arrives March: We collect our fee, forward your remaining balance Available for February ad spend: $72K+ instead of $30K |

| Growth constraint: Severe | Growth constraint: Eliminated |

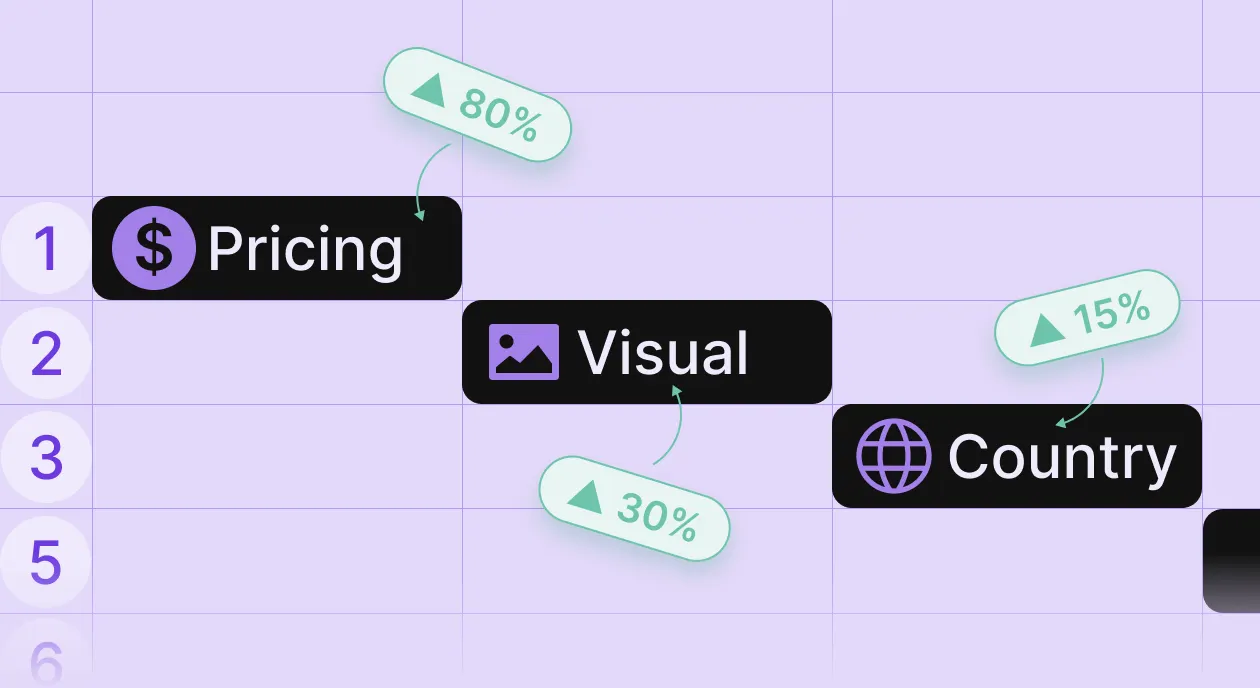

That extra $40K+ in February ad spend, with proven 120% ROAS, generates an additional $48K in February revenue. Which becomes available for March 1st. Which compounds again in March.

The founders are breaking the artificial ceiling on their growth trajectory.

Security and compliance

The question we get most: “Is this safe for my developer accounts?”

Absolutely. Adapty Finance operates as a legitimate financial intermediary, similar to how banks factor invoices or how Stripe Capital advances against payment processing volume.

We’re not manipulating app store algorithms, violating terms of service, or creating any platform risk. Your relationship with Apple and Google remains exactly the same. The stores pay us directly (with your authorization), we take our agreed portion, and immediately forward your remaining balance.

From Apple’s and Google’s perspective, you’ve simply updated your payment recipient, which is completely normal and supported in their standard business processes.

Eligibility and requirements

Who can apply:

- Mobile app founders with $15,000+ monthly revenue

- Must be incorporated as a legal entity (individual developers excluded due to licensing requirements)

- Apps distributed through major stores (Apple App Store, Google Play)

- Standard business documentation for verification

Application process:

- Schedule a call with an Adapty Finance representative.

- Provide required business documentation.

- Review and sign agreement.

- Receive first advance within 1-2 business days.

Advance terms:

- Amount: Up to 85% of earned revenue per fiscal period

- Speed: 1-2 business days from approval

- Frequency: Weekly or on-demand draws available

- Fee structure: Transparent fixed percentage on advanced amounts

- No hidden costs: No setup fees, maintenance charges, or surprise penalties

Getting started

Ready to break free from payment schedule constraints?

The application process is straightforward, with most approvals completed within 24 hours of document submission.