If free apps don’t charge users, how do they make money? Well, while the core features of these apps are free, many offer premium experiences for fees. That’s how they monetize.

Free apps also bring in revenue from other players—advertisers, brands, affiliates, sponsors, or even donors. On top of that, free apps also use data monetization to make revenue.

Monetizing free apps is all about balancing user value with revenue generation to ensure they evolve into a sustainable business. So, let’s break down how free apps make money—with examples of apps that do it well. But before that, here’s a quick overview of the three kinds of apps you’ll find in the app stores.

The marketplace: Free apps vs. freemium apps vs. paid apps

According to Statista, as of January 2025, nearly 97% of apps in the Google Play Store are free, while 95% of apps in the App Store are also free. This means that free apps make the majority on both app stores, and less than 5% of apps on both stores are paid. Note that app stores don’t have separate categories for free and freemium apps, but they are different.

Here’s the kicker: approximately 98% of all mobile app revenue worldwide is generated by apps that are free to install. In 2024, global app revenue reached $522.7 billion, with projections to climb to $613 billion in 2025 and $673.8 billion by 2027.

Free apps

These apps deliver exactly what they promise in their descriptions, with no charges—either at the time of download or afterward.

Freemium apps

Like free apps, freemium apps are also free to download. But freemium apps also carry premium features, functionalities, or content that users need to pay to access. These apps offer users something valuable for free while giving them the option to pay for more. Common monetization strategies include in-app purchases and in-app advertising.

Paid apps

Paid apps are the simplest model in some ways—you pay a flat fee upfront to download the app or sign up for a subscription, and that’s it. There are no ads, no upgrades, and you get access to everything the app has to offer from the get-go. While this model has fewer opportunities to scale compared to free or freemium apps, it can be a good choice for apps that offer high value or niche functionality that users are willing to pay for upfront.

Are free apps the same as freemium apps?

No and yes.

Ideally, a free app should never require you to pay for anything because, well, it’s a “free” app.

With such apps, you don’t or shouldn’t:

- Hit any paywalls.

- Have to make any in-app purchases to access anything inside the app.

- Get bombarded with ads pushing you to the paid version.

These apps are free in the true sense.

And as you can tell, these are different from freemium apps. With freemium apps, you usually get the base features for free, but certain premium features, ad-free app experiences, or content are locked behind a paywall.

That said, freemium apps are still technically free. In that sense, freemium apps aren’t that different from free apps. For this article, we’re going to treat freemium apps as free apps! As noted above, even app stores don’t separate free and freemium apps into different categories.

With that out of the way, let’s see how free or freemium apps make money before seeing the actual monetization strategies in detail.

Zooming in on the free app model: How do free apps make money

The core idea behind the free app model is to offer the app at no cost to users, focusing on building a large user base quickly.

And then once the app gains traction and a solid user base, monetization happens through methods like advertising, affiliate marketing, or in-app purchases.

Here are the most common monetization strategies that free apps use in 2025:

| Monetization model | Best for | Share of revenue | Key challenge |

|---|---|---|---|

| In-app advertising | High-volume apps, games | 67% of global app revenue | User experience balance |

| Subscriptions | Content, productivity, fitness | 45% from only 4% of apps | High churn (70-90% Y1) |

| In-app purchases | Games, lifestyle apps | $150B globally (2024) | 15-30% store commission |

| Affiliate marketing | E-commerce, review apps | 16% of e-commerce sales | Unpredictable conversions |

| Sponsorships | Niche, high-engagement apps | Variable (negotiated) | Securing partnerships |

| Data monetization | Large user bases | Variable | Privacy/legal concerns |

| Hybrid models | Gaming, social, lifestyle | 35% of apps now use | Complexity in implementation |

Most free apps combine several of these strategies to maximize revenue. In fact, 35% of apps now use hybrid monetization models, combining subscriptions with consumables, ads, or other revenue streams.

How do free apps make money: Top 9 free app monetization strategies

Let’s now explore how free apps make money through these monetization strategies in more detail.

1. In-app purchases

This is when users download a basic free app but can buy extra features, content, or virtual goods from within the app. While the core app is free, users can enhance their experience with these additional purchases. In-app purchases can range from anything from new levels or extra lives in a game to premium filters in a photo app.

In 2024, global in-app purchase (IAP) revenue on iOS and Google Play reached $150 billion, according to Sensor Tower’s State of Mobile 2025 report. Both Apple and Google levy app store commissions of around 15-30% of your revenue (15% for small developers earning under $1M annually).

You’ve two types of in-app purchases that offer different monetization opportunities:

- Consumables: These are items that can be used up within the app, such as in-game currency, extra lives, or boosts. The strength of this model lies in its ability to drive repeat purchases, as users need to buy these items frequently. The downside, though, is that this can lead to user fatigue if the purchases feel like a constant requirement to enjoy the app.

- Non-consumables: These items are permanent upgrades, such as unlocking a new feature, level, or exclusive content. Non-consumables provide a more stable revenue stream because users only need to purchase them once. However, the monetization potential is lower compared to consumables, as the revenue from these items is typically a one-time payment per user.

Building a value ladder for in-app purchases

Creating a seamless value ladder is the best way to maximize in-app purchases in free apps. Here, you start by offering free features that genuinely solve a problem or deliver value and then introduce premium options as natural extensions to enhance the experience.

Imagine a lifestyle app designed for fitness and wellness enthusiasts. Here’s how your value ladder could work:

Free tier (entry-level value): You start by offering an app that offers basic features like workout tracking, a few guided meditation sessions, and a water intake tracker. These tools are enough to help your users build healthy habits and see initial results.

Mid-tier premium experiences (first step up): Once users are engaged, you can offer them premium features such as personalized workout plans, exclusive meditation sessions, and progress reports with advanced analytics. For example, after completing five workouts, you can assume that the user is engaged and introduce consumables like:

- Workout boosters: One-time purchases for exclusive workout challenges (e.g., “Unlock a 7-day fitness challenge for $1.99.”)

- Meal plans: Weekly personalized meal plans for $3.99 each.

- Subscription plans: You could also pitch an accessible subscription plan here: “Great progress! Want to unlock a tailored workout plan to hit your goals faster? Go premium for just $4.99/month.“

High-tier premium experiences (top of the ladder): To committed users, you could then upsell access to your entire wellness app through a simple subscription plan. For example, to users who hit key milestones (like completing a 30-day streak), you could pitch something like: “You’ve crushed your fitness goals—let’s take it to the next level! Unlock personalized workouts, guided meditations, live classes, and more for $9.99/month.”

By mixing consumables (quick, low-cost buys) with non-consumables and subscription options, you can cater to casual users while creating opportunities for recurring revenue from power users.

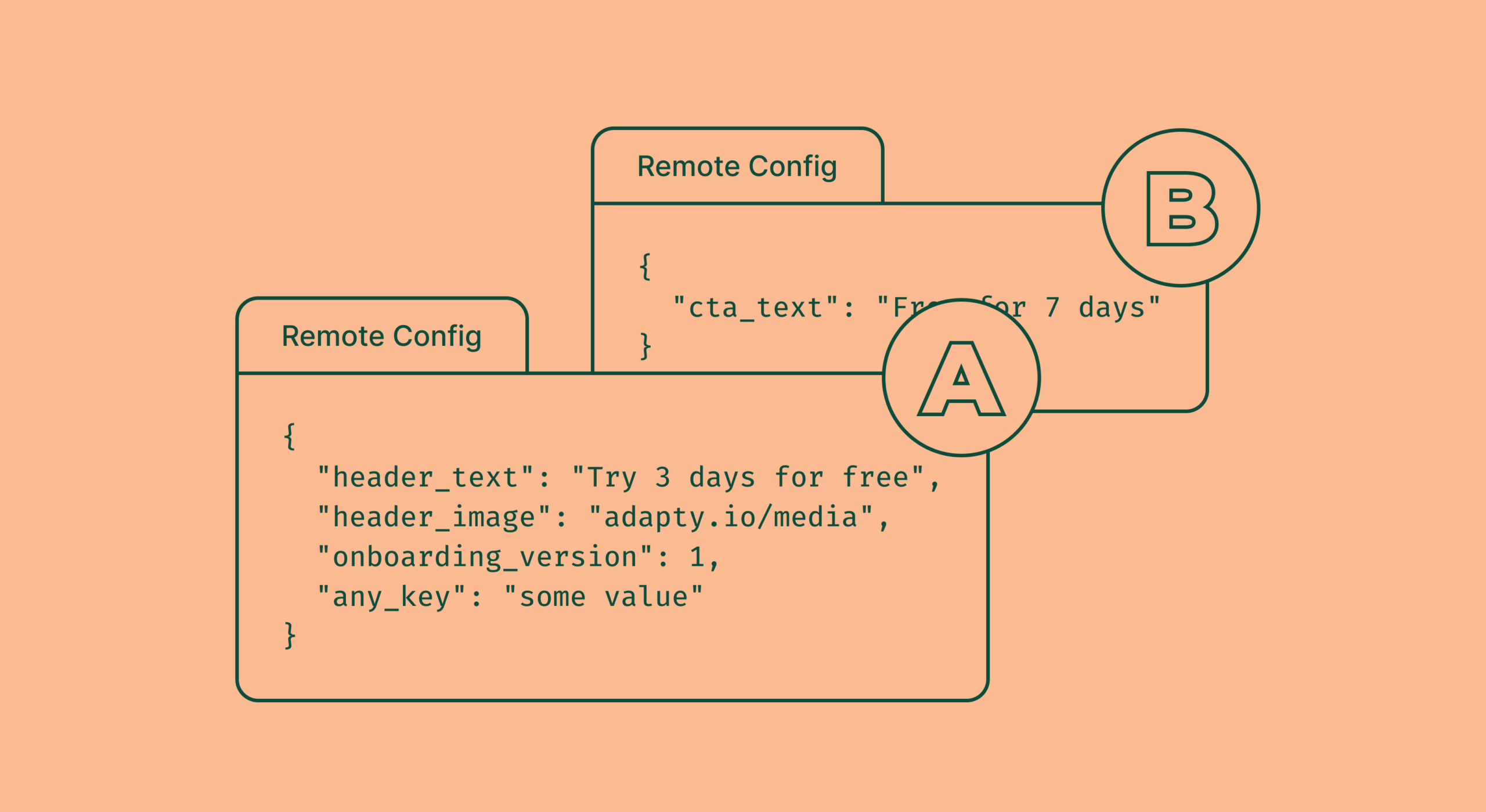

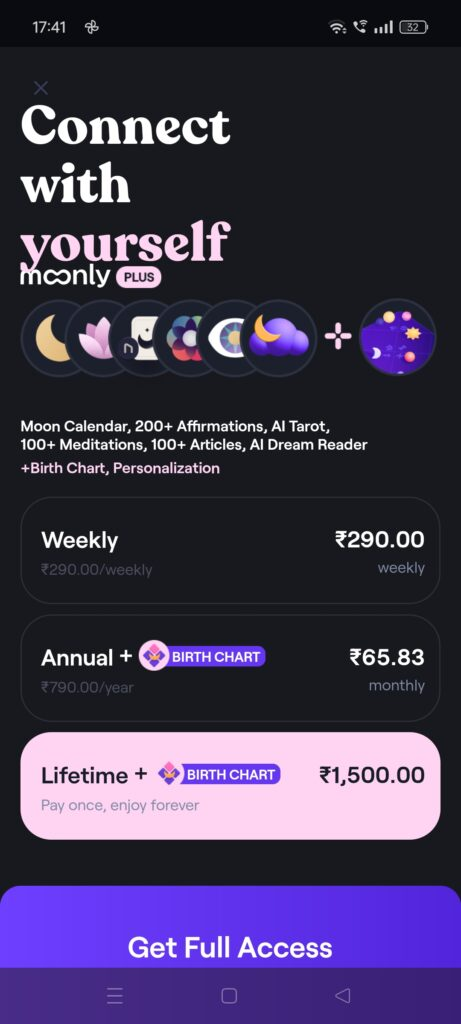

Here’s Moonly app offering a mix of in-app purchases (including one-time non-consumables and subscriptions!):

2. Paid subscriptions

While technically a form of in-app purchase, paid subscriptions deserve special mention. Subscriptions allow users to access premium versions of their apps for a recurring fee, often on a monthly, quarterly, or yearly basis.

Here’s why subscriptions have become the dominant monetization model: only about 4% of total mobile apps use a subscription model, yet they account for 45% of global app revenue. Top apps like Disney+, YouTube Premium, and Netflix in content-rich categories like entertainment lead the way, but subscriptions work across virtually every category.

Subscription performance benchmarks

| Metric | Benchmark |

|---|---|

| Trial-to-paid conversion (with credit card required) | 43% |

| Trial-to-paid conversion (without credit card) | 14% |

| Average trial-to-paid conversion | 24% |

| Monthly subscription churn (SaaS average) | 5-7% |

| Year 1 retention (annual plans) | ~30% average, 60-75% top quartile |

| Year 1 retention (monthly plans) | ~11.4% |

| Year 1 retention (weekly plans) | ~3.4% |

| First month cancellation rate (annual) | ~30% |

| Resubscription rate within 12 months | >10% |

| Top 5% apps vs bottom 25% revenue gap | 400x difference |

One of the key strengths of the subscription model is its potential for steady, long-term growth. Since users pay regularly, it’s easy to forecast revenue and reinvest in app improvements, new features, or customer support.

Subscriptions also foster customer loyalty, as users are more likely to engage with the app because they’re regularly paying for it. Higher customer loyalty often leads to a higher customer lifetime value (CLV), as users continue to pay for the app over an extended period.

However, while subscriptions offer great potential for revenue, user retention is a significant challenge. The data shows that nearly 30% of annual subscriptions are canceled in the first month, and on monthly plans, barely 10% of payers reach the second year. On weekly plans, less than 5% make it to month 6.

Subscription conversion strategies

Let’s return to our lifestyle app example. Here are proven conversion strategies:

- Free trials: Offer a 7-day free trial of your premium plans to let users experience your entire app. Trials requiring credit card upfront convert at 43% vs 14% without. Trials are one of the key reasons freemium app users upgrade.

- Annual plan incentives: Annual subscribers are 2.4x more profitable than monthly subscribers, and annual plans reduce churn by 51% compared to monthly. Offer discounts of 30-40% on annual plans—59% of mobile subscribers prefer annual plans when offered such discounts.

- Pause features: Offering a “pause subscription” option instead of cancel reduces cancellations by 18%.

- Offers and discounts: “Upgrade to Premium today and save 20% on your first 3 months!” Offers are one of the top reasons that freemium users buy premium plans.

- Seasonal marketing: Introduce seasonal or time-limited premium features, such as a “30-Day New Year fitness challenge” or “Summer shape-up program.” These create urgency and show your users what they’re missing. Check out our holiday marketing tips.

3. In-app advertising

In-app advertising is one of the most popular monetization strategies for free apps. Instead of charging users directly, app developers display ads within the app, earning revenue based on user interactions with the ads (views/clicks). In-app advertising is the leading mobile app monetization method, generating 67% of global mobile app revenue.

In 2024, global mobile ad spend reached approximately $400 billion, with projections to reach $820 billion by 2033. Mobile gaming alone generated $92 billion in ad revenue in 2024.

eCPM benchmarks by ad format

eCPM (effective Cost Per Mille) tells you how much revenue you earn per 1,000 ad impressions. Here’s what you can expect by ad format:

| Ad format | iOS (US) | Android (US) | Best use case |

|---|---|---|---|

| Rewarded video | $19.63 | $16.49 | Engaged users willing to watch for rewards |

| Interstitial | $14.32 | $10-15 | Natural transition points (between levels) |

| App open | $10.51 | $8-10 | Session start |

| Native ads | Variable | Variable | Content feeds, seamless integration |

| Banner | $0.45 | $0.68 | Persistent, non-disruptive placement |

| Offerwall (Gaming) | $400-1,500 | $400-1,500 | High engagement, gaming apps |

Regional variations matter: Japan leads in interstitial eCPMs (peaking at $10.78), while emerging markets like Vietnam and Brazil are showing the fastest growth, though at lower absolute rates.

Many things work for in-app advertising. For example, users get to enjoy an app’s core features without any financial commitment. Also, as the user base grows, the number of ad interactions increases, leading to more revenue opportunities. This model scales well with app growth, making it a long-term strategy for many apps.

Ad format strategies for our lifestyle app example

If our lifestyle app were to use in-app advertising, ads could look like these:

- Interstitial ads: Full-screen ads that appear between transitions, such as after a workout or before a new session. These command premium CPMs ($10-15) but must be timed well to avoid harming user experience.

- Banner ads: Small ads displayed at the top or bottom of the screen while users interact with the app. Lower eCPMs (<$1) but less intrusive.

- Rewarded ads: Optional ads users could watch to unlock rewards, like additional workouts, live sessions, or premium content. These have the highest eCPMs ($15-20) and highest user acceptance since they’re opt-in.

The key is making ads feel less intrusive by aligning them with the user experience and offering rewards for engagement.

Ad revenue calculation

Here’s a simple formula to estimate your potential ad revenue:

| Monthly Ad Revenue ≈ (Daily Active Users × Sessions per User × Ads per Session) × (eCPM / 1000) × 30 Days |

For example, an app with 100,000 DAU, 2 sessions per user, 3 ads per session at $5 eCPM:

- (100,000 × 2 × 3) × ($5 / 1000) × 30 = $90,000/month

4. AI apps monetization: The fastest-growing segment

AI apps represent the fastest-growing monetization segment in 2024-2025, and they deserve special attention. ChatGPT set a record as the fastest app to reach 100 million active users (just two months) and has fundamentally changed user expectations around AI-powered tools.

ChatGPT revenue and monetization model

| Metric | Value |

|---|---|

| Revenue (2024) | $2.7 billion (285% increase YoY) |

| Mobile app revenue (Jan-Jul 2025) | $1.35 billion (6x increase from 2024) |

| Weekly active users | 700 million |

| Estimated paying subscribers | 15-20 million |

| Revenue per install (60 days) | $0.63 (2x overall median of $0.31) |

ChatGPT’s tiered subscription model:

| Tier | Price | Target audience |

|---|---|---|

| Free | $0 | Casual users, limited access |

| Plus | $20/month | Power users, faster responses |

| Pro | $200/month | Professionals, expanded limits |

| Team | $25-30/user/month | Small businesses |

| Enterprise | Custom (~$60/seat) | Large organizations |

Emerging AI monetization strategies

OpenAI and other AI companies are exploring additional revenue streams beyond subscriptions:

- In-chat purchases: OpenAI introduced the ability to complete transactions without leaving ChatGPT, taking a commission on each purchase. Currently limited to Etsy sellers but expanding to Shopify merchants.

- Conversational ads: Called “intent-based monetization” internally, this approach integrates product recommendations naturally into conversations rather than displaying traditional ads.

- Agentic commerce: AI autonomously making purchases on behalf of users based on their preferences and history.

- API revenue: Developers pay usage-based fees to integrate AI models into their own applications.

Key insight for app developers: AI apps achieve $0.63 revenue per install after 60 days—double the overall median of $0.31 and matching only Health & Fitness apps. If you’re building an AI-powered feature, the subscription-first approach with tiered pricing has proven most effective.

5. Hybrid monetization models

Here’s a critical trend: subscriptions aren’t enough anymore. According to RevenueCat’s State of Subscription Apps 2025 report, 35% of apps now mix subscriptions with consumables or lifetime purchases.

| App category | Hybrid model adoption |

|---|---|

| Gaming | 61.7% |

| Social & Lifestyle | 39.4% |

| Overall | 35% |

Why hybrid models work

Hybrid monetization allows apps to capture different user segments more effectively:

- Free users: Monetized through advertising

- Casual spenders: One-time purchases, consumables

- Committed users: Monthly or annual subscriptions

- Power users: Premium tiers, lifetime purchases

This approach reduces reliance on a single revenue source, decreases churn, and improves overall LTV. Users who may not commit to a full subscription might still be willing to make smaller purchases, providing an additional revenue layer.

Common hybrid combinations

- Subscriptions + Consumables (most popular): Base subscription plus one-time purchases for extras

- Freemium + Advertising: Free tier with ads, paid tier without

- Subscriptions + Ad-supported tier: Multiple tiers including a cheaper ad-supported option (like Netflix, Spotify)

- IAP + Rewarded Video Ads: Gaming favorite—purchase currency or watch ads for rewards

Example: A meditation app could offer:

- Free tier with ads and limited sessions

- $4.99/month subscription for unlimited ad-free sessions

- One-time purchases for specialty meditation packs ($2.99 each)

- Annual subscription at $39.99 (33% discount)

6. Affiliate marketing

Affiliate marketing is another way free apps monetize. Here, apps partner with other businesses to promote their products or services. If a user clicks on an affiliate link and makes a purchase, the app earns a commission.

Commission rates by category

| Category | Commission rate |

|---|---|

| Physical products (Retail) | 5-15% |

| Digital products | 20-50% |

| SaaS/Software | 20-70% (often recurring) |

| Finance/Fintech | $50-$200 flat per lead |

| Fashion | 5-15% |

| Beauty | 10-18% |

| Health and wellness | 8-15% |

This is a win-win situation—users get recommendations and app developers earn a cut of the sales.

While this is a low-effort revenue stream without having to directly sell products, it’s not without challenges. This method relies on users clicking and making purchases through affiliate links, which can be unpredictable. Besides, tracking can be challenging too. Such an app also needs to “earn” the trust of its user base so its recommendations aren’t seen as ads.

For our lifestyle app example with affiliate marketing, the app would need to provide free access to features like workout tracking, basic fitness plans, and habit trackers while integrating affiliate links for relevant products and services. For example, users following and tracking yoga sessions could be pitched products like a yoga mat or blocks via affiliate links. The key lies in matching products to user behavior.

7. Sponsorships

Sponsorships also work well to monetize free apps. Many aspects make this monetization model effective:

- Non-intrusive: Sponsorships can seamlessly integrate into the app experience without irritating users, as traditional ads often do.

- Flexible implementation: Branding app sections, hosting sponsored challenges, or featuring product placements.

- Brand credibility: Partnerships with well-known brands can enhance an app’s credibility while providing users with added value, like exclusive offers.

However, this model also has challenges. The biggest one is that revenue ties directly to securing sponsorships, which may not be consistent or guaranteed, especially for smaller apps with less reach.

If our free lifestyle app were to use sponsorships to monetize, we could go with these options:

- Free features with sponsored content: For example, “Join Nike’s 30-day fitness challenge!”

- In-app branding: Includes branded workout routines, challenges, or product placements.

- Sponsored app sections: For instance, “This meditation experience is powered by Calm.”

8. User data monetization

Here, free apps collect valuable data on how users interact with them, such as data on the features they use most frequently, how often they engage with content, their preferences, location, and even their behavior patterns.

This data is then aggregated and sold to third-party companies looking to better understand user behavior, target specific demographics, and optimize their marketing strategies.

The primary strength of this model lies in its ability to generate revenue without directly charging users for the app itself. By selling anonymized or aggregated data, app developers can monetize user activity while keeping the core experience free.

Privacy and compliance requirements

However, this comes with significant legal and ethical challenges. Privacy concerns are at the forefront, as users must trust that their data is being handled securely and anonymously.

Key regulations to comply with:

- GDPR (Europe): Requires explicit consent, data minimization, and right to erasure

- CCPA (California): Gives consumers right to know what data is collected and opt-out of sale

- App Store/Play Store policies: Both platforms have strict requirements around data collection disclosure

Best practices:

- Clearly explain in the privacy policy what data is being collected, how it’s being used, and how it’s protected

- Provide users control over their data—option to opt-out or delete their information

- Collect only necessary data, avoiding excessive or intrusive tracking

- Use anonymization and aggregation to protect individual privacy

- Consider privacy-first alternatives like contextual advertising

The key to using this monetization strategy successfully lies in striking a balance between monetizing data and respecting user privacy (all while staying on the right side of law).

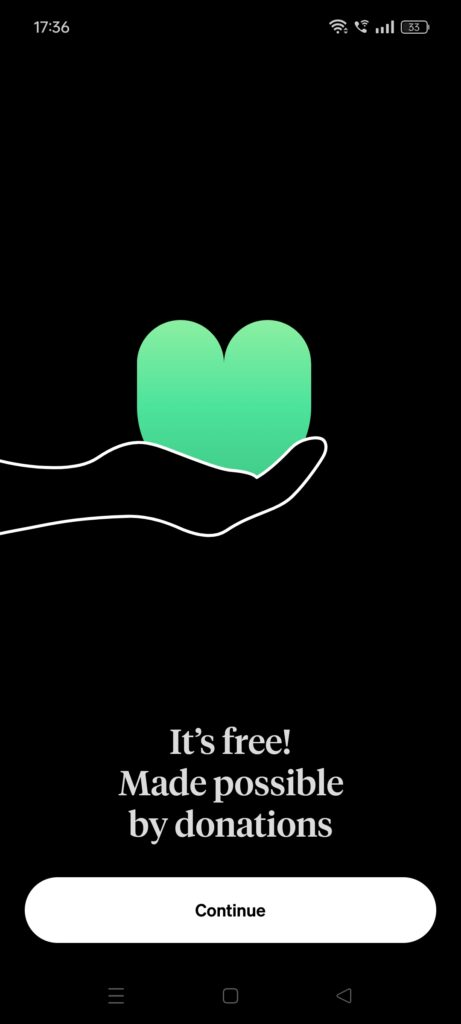

9. Donations

Yet another way free apps make money is through donations. Donation models typically work best in apps that serve specific niches:

- Non-profit or social-good apps: Users may feel compelled to support causes they care about, such as mental health or environmental issues.

- Creative apps: Apps centered on independent journalism, music, or art may appeal to users who want to support the creators behind the platform.

- Educational apps: Online learning resources can attract donations from users who appreciate having access to free services and want to help keep them available.

Here’s how “How We Feel”—a truly free app—monetizes using donations. The app provides mental health tools completely free, with optional donations to support continued development.

Revenue comparison: iOS vs Android

When deciding where to focus your monetization efforts, platform differences matter significantly:

| Metric | iOS | Android |

|---|---|---|

| Share of consumer spend | 67% | 33% |

| Average spend per app | $12.77 | $6.19 |

| Average in-app purchase | $1.07 | $0.43 |

| Subscription revenue share | 73% | 27% |

| Billing error rate | 15.1% | 28.2% |

| Download volume | Lower | Higher |

Key insight: iOS consistently generates higher revenue despite Android’s larger market share. However, Google Play leads in download volume, making it important for user acquisition. The billing error rate difference (28.2% on Android vs 15.1% on iOS) suggests potential payment processing challenges on Android that can impact involuntary churn.

Top monetizing app categories

| Category | Primary model | Key revenue metric | Recommended strategy |

|---|---|---|---|

| Mobile gaming | IAP + Ads (Hybrid) | $92B ad revenue | Rewarded video + consumables |

| Social media | In-app advertising | $134B ad revenue | Native ads + sponsored content |

| Entertainment/Streaming | Subscriptions | 6.7% monthly churn | Tiered subs + ad-supported tier |

| Health and fitness | Subscriptions + IAP | High 1-year plan preference | Annual subs + consumables |

| AI/Productivity | Subscriptions | $0.63 RPI (2x average) | Tiered subscriptions |

| Education | Freemium + Subscriptions | High trial conversion | Free trials + annual plans |

How much can your free app make?

Let’s get specific about revenue potential based on real benchmarks:

By user base size

| Monthly active users | Banner ads only | Mixed formats | Optimized (rewarded + interstitial) |

|---|---|---|---|

| 10,000 | $150-300/month | $500-1,500/month | $2,000-5,000/month |

| 100,000 | $1,500-3,000/month | $5,000-15,000/month | $20,000-50,000/month |

| 1,000,000 | $15,000-30,000/month | $50,000-150,000/month | $200,000-500,000/month |

By subscription model

| Monthly active users | 2% conversion @ $9.99/mo | 5% conversion @ $9.99/mo | 5% conversion @ $49.99/yr |

|---|---|---|---|

| 10,000 | $2,000/month | $5,000/month | $2,000/month + lower churn |

| 100,000 | $20,000/month | $50,000/month | $20,000/month + lower churn |

| 1,000,000 | $200,000/month | $500,000/month | $200,000/month + lower churn |

The reality check

Here’s what the data shows about app revenue distribution:

- Only ~17% of apps reach $1,000 monthly revenue

- Of those that reach $1k, 59% reach $2,500

- Of those that reach $2.5k, 60% reach $5,000

- The top 5% of apps generate 400x more revenue than the bottom 25%

This gap has grown significantly—last year it was 200x. Success in app monetization follows a power law distribution, making optimization and differentiation critical.

Wrapping it up…

So that’s how free apps make money in 2025! As you just saw, it’s absolutely possible to generate significant revenue, even from apps that are completely free to download and use.

The landscape has evolved significantly:

- Hybrid is the new normal: 35% of apps now combine multiple monetization strategies. Pure subscription or pure advertising models are giving way to mixed approaches.

- AI apps are setting new benchmarks: With revenue per install at 2x the average, AI-powered features represent a significant opportunity.

- Subscriptions dominate revenue but face challenges: 4% of apps using subscriptions generate 45% of revenue, but churn remains brutal—plan accordingly.

- Regional and platform differences matter: iOS generates 67% of revenue despite lower market share. eCPMs vary dramatically by region.

- The gap between winners and losers is widening: Top performers now make 400x more than bottom quartile apps.

The trick is to strike the right balance—delivering value to your users while tapping into revenue streams that make sense for your app and audience. With the right approach, you can grow your app, keep users happy, and turn “free” into a thriving business model.

Ready to start monetizing? Check out how Adapty can help you add in-app purchases to your free app so you can start monetizing within hours!