The mobile app market has exploded to $673 billion in 2025, with projections reaching $780 billion by 2029. One revenue stream consistently dominates all projections: app subscriptions.

Subscription revenues increased to $66.8 billion in 2024 across iOS and Google Play, with iOS responsible for 73% of that revenue. In 2025, subscription-based apps account for 85% of total App Store revenue and 72% on Google Play. Consumer spending on in-app purchases reached a staggering $150 billion in 2024 — a 13% year-over-year increase and the highest growth since 2021.

The numbers are clear: subscriptions aren’t just growing — they’re becoming the dominant business model for mobile apps.

But here’s the challenge: freemium apps convert at just 2.18% median, while hard paywall apps see 12.11% median conversion. The gap between top performers and average apps is widening — the top 5% of newly launched apps now make over 400x more revenue than the bottom 25%.

So what exactly gets free mobile app users to cross the paywall and become paying subscribers? Let’s dive into the data-driven strategies that actually work.

Understanding conversion benchmarks: Where do you stand?

Before optimizing your conversion funnel, you need to know what “good” looks like. Here’s the reality of freemium conversion in 2026:

| Monetization model | Median conversion | Top 10% (P90) | Best for |

|---|---|---|---|

| Hard paywall | 12.11% | 25%+ | Clear upfront value |

| Freemium | 2.18% | 6-8% | Network effects, viral growth |

| Free trial (opt-out, CC required) | 49-60% | 70%+ | High-intent users |

| Free trial (opt-in, no CC) | 18-25% | 40%+ | Volume acquisition |

Conversion rates vary dramatically by category:

| Category | Download-to-Paid (Median) | Download-to-Paid (P90) |

|---|---|---|

| Health and fitness | 4.2% | 12.1% |

| Business | 3.8% | 10.1% |

| Education | 3.1% | 8.7% |

| Productivity | 3.5% | 9.2% |

| Gaming | 0.8% | 3.2% |

| Media and entertainment | 1.9% | 5.4% |

The takeaway? Your category matters more than generic benchmarks. A 3% conversion rate might be excellent for gaming but mediocre for business apps. Focus on outperforming your own past results and category peers.

The 8 drivers of premium conversion

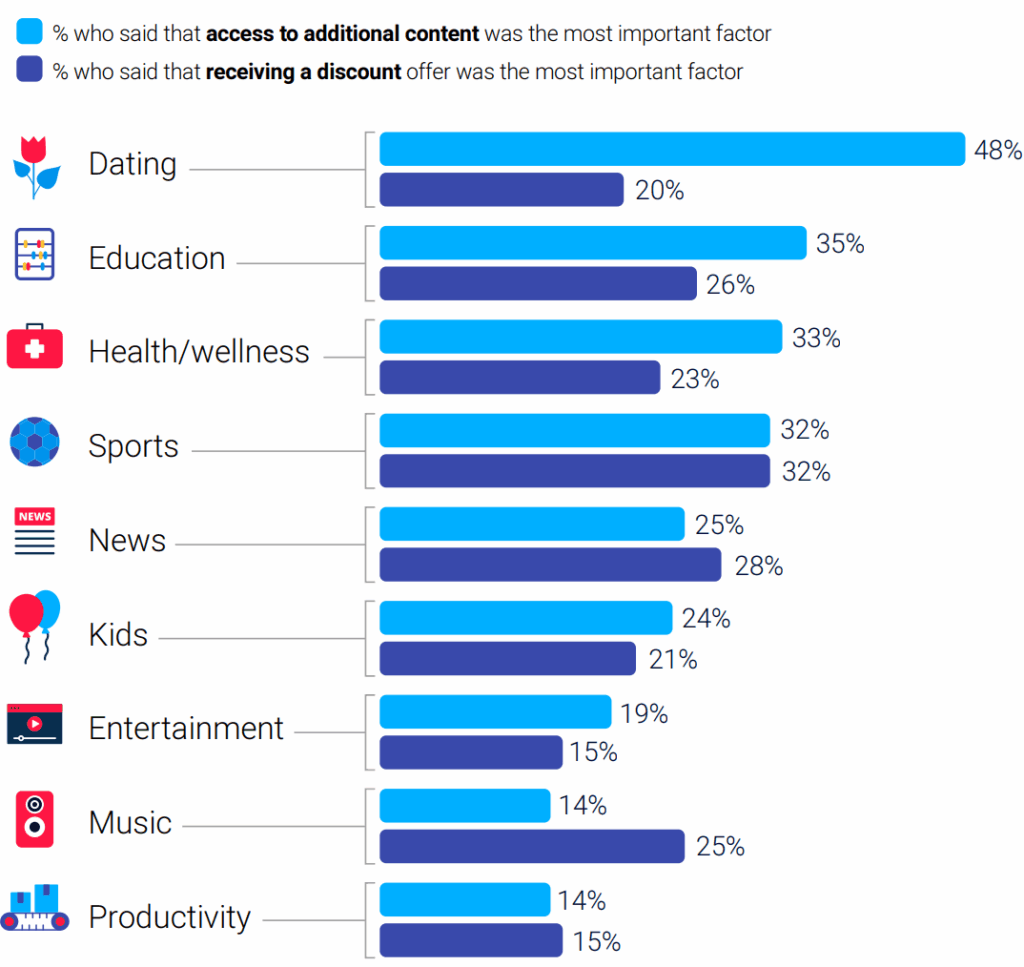

Research across thousands of app subscribers reveals what actually motivates users to pay. Here’s the breakdown:

| Conversion driver | % of conversions | Key insight |

|---|---|---|

| Unlock premium content | 26% | #1 driver across all categories |

| Special offers/discounts | 23% | Even new users convert with irresistible offers |

| Extended features/tools | 20% | Feature gating must show clear value |

| Trial expiration | 17% | Loss aversion is powerful |

| Ad-free experience | 6% | Growing with privacy awareness |

| Privacy/security | 6% | Post-ATT, users pay for data protection |

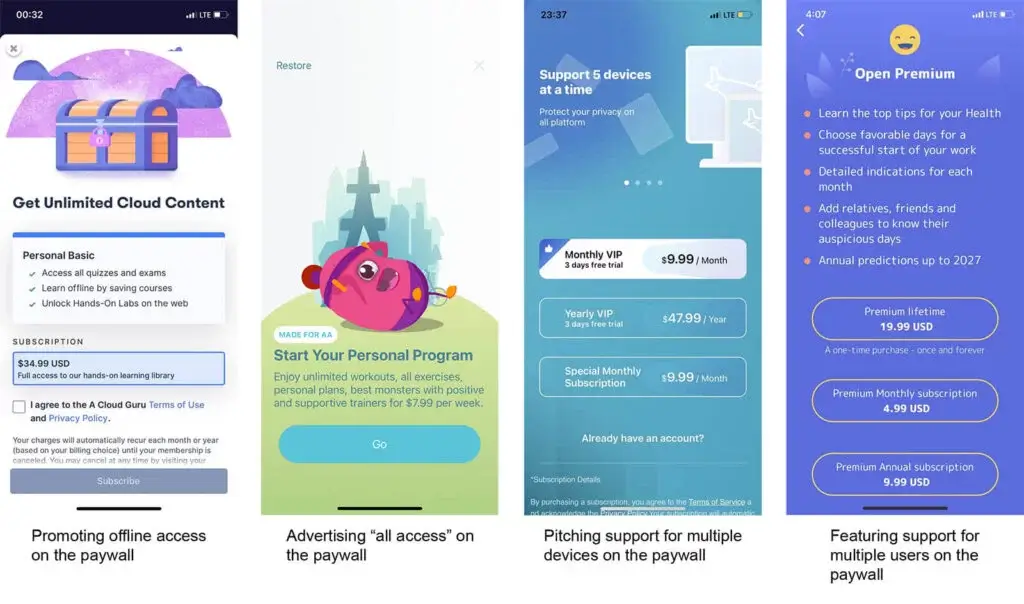

| Offline access | 6% | Critical for travel/education apps |

| Multi-device sync | 6% | Important for productivity |

Let’s explore each driver and how to maximize its impact.

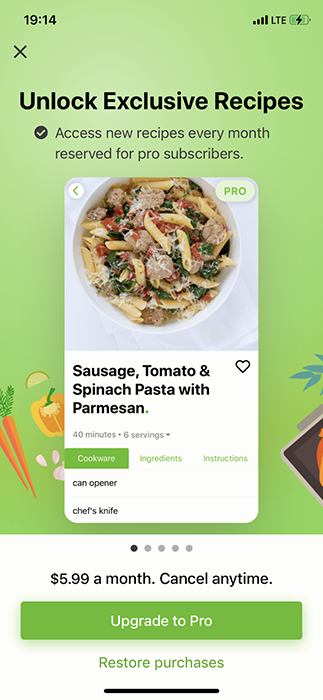

1. Unlocking access to premium content

26% of subscribers upgrade specifically to access full content — making this the #1 conversion driver across all categories.

Exclusive premium content doesn’t just entice free users to upgrade; it keeps them paying. When apps deliver valuable content regularly, 44% of subscribers continue with premium plans, while 25% cancel if content becomes stale or loses value.

Content-driven industries naturally drive the most conversions: health and wellness, news, entertainment, and education. But content gating works across all categories — it’s about identifying what users value most.

The New York Times Lesson:

When NYTimes started metering content in 2011, they offered 20 free articles monthly. They reduced it to 10, then to 5. The lesson? Finding the right free-to-premium content balance requires experimentation.

Best practices for content gating:

- Give enough free content to demonstrate value (but not so much users never need to upgrade)

- Make premium content visibly better, not just “more”

- Use progressive content unlocking — show users what they’re missing

- Update premium content regularly to justify ongoing subscription

2. Taking advantage of subscription offers

23% of users subscribe because they received an offer they couldn’t refuse.

Here’s the insight that changes everything: users who haven’t even fully explored your app will still upgrade if the offer is compelling enough. One survey participant recalled: “I had signed up for a free trial because I got some kind of offer on it. I didn’t even really know what it was all about but my kids ended up loving it so I kept it.”

What makes an irresistible offer?

- The discount itself — and your base pricing (premium pricing actually converts better: 2.66% vs 1.49% for low-priced apps)

- The presentation — layout, design, urgency cues

- The messaging — copy that speaks to user motivations

- The timing — when users see the offer matters as much as the offer itself

Pricing insight: Lower price points show better trial-to-paid conversion (47.8% vs 28.4% for high-priced apps), but premium pricing attracts higher-quality subscribers. Test to find your optimal balance.

3. Maximizing free trial conversion

17% of subscribers convert because their free trial is expiring — driven largely by loss aversion and fear of losing progress.

Trial length dramatically impacts conversion:

| Trial duration | Conversion rate | Best for |

|---|---|---|

| 1-4 days | 26.8% | Gaming, simple utilities |

| 5-9 days | 37.3% | General apps (52% of all trials) |

| 10-16 days | 42.1% | Content-heavy apps |

| 17-32 days | 48.8% | Education, health and fitness |

| Top performers | 60%+ | Regardless of trial length |

Category-specific patterns:

- Gaming apps overwhelmingly favor shorter trials — 96.3% last 4 days or less

- Education & Health apps extend trials to 5-9+ days (80%+), recognizing users need time to experience progress

- Media & Entertainment often go beyond 9 days, giving users time to evaluate content libraries

The credit card question:

| Trial type | Conversion rate | Trade-off |

|---|---|---|

| Opt-out (CC required) | 49-60% | Fewer sign-ups, higher quality |

| Opt-in (no CC) | 18-25% | More sign-ups, lower conversion |

The most important insight: 80-90% of all trials start on Day 0. Your onboarding experience is make-or-break. High-performing apps convert downloads to trials at 2-3x the median rate through strong onboarding and well-timed paywalls.

4. Ad-free experiences and privacy

6% of users upgrade specifically for ad-free experiences — but this number is growing as privacy awareness increases.

The old 2015 statistic that “67% won’t pay for ad-free” no longer reflects reality. Post-ATT (App Tracking Transparency), users increasingly see ads as privacy violations, not just annoyances. Privacy-centric apps saw a 29% rise in installs in 2025, especially among users aged 18-34.

The privacy premium:

In research on app purchasing decisions, 6% of users who chose paid apps cited perceived privacy and security risks in free apps. Users commented that premium apps seemed less susceptible to “data mining” and felt “paid apps are safer.”

To leverage the privacy-for-premium model:

- Encrypt user data end-to-end

- Minimize data collection (and be transparent about what you do collect)

- Comply with GDPR, CCPA, and local regulations

- Give users granular control over their data

- Communicate your privacy practices clearly on the paywall

Ad tracking opt-out rates are holding steady at 74% on iOS. Users are voting with their settings — and increasingly, with their wallets.

5. Unlocking premium features and tools

20% of subscribers upgrade to access premium tools, features, and capabilities.

The breakdown:

- Additional tools/features: 6%

- Offline access: 6%

- Multi-device sync: 6%

- Additional users/collaboration: 2%

The freemium balancing act:

As Harvard Business Review explains: if your app offers 20 features and you make 5 available free while putting 15 behind the paywall, you need to ensure:

- The 5 free features are good enough to attract installs

- The 15 locked features create compelling upgrade reasons

Warning signs:

- Not attracting new users? Your free tier isn’t valuable enough

- Tons of users but no upgrades? Your free tier is too generous

The math that matters: “You would do better to convert 5% of 2 million monthly visitors than to convert 50% of 100,000 visitors.” Freemium success hinges on volume — get your free tier right to maximize top-of-funnel.

6. AI apps: The new freemium frontier

AI apps generated $4.5 billion in 2024 — a staggering 136% year-over-year growth. This is the fastest-growing category in mobile, and it requires a different monetization playbook.

AI Chatbot and AI Art Generator apps alone approached $1.3 billion in IAP revenue in 2024. Most AI apps see revenue per install above $0.63 after 60 days — matching Health & Fitness and double the overall median of $0.31.

Why AI monetization is different:

Unlike traditional apps, AI apps have variable operational costs — every API call, every generation, every token costs money. This makes pricing strategy more complex but creates opportunities for value-based pricing.

Successful AI monetization models:

| AI app | Model | Key strategy |

|---|---|---|

| ChatGPT | Tiered subscription ($20/month) | Strict free-tier limits |

| Midjourney | Tiered subscription ($10-$120) | Generation limits by tier |

| Claude | Subscription + usage | Extended context for premium |

| Notion AI | Bundled (included in Business+) | AI as core feature |

| Jasper | Tiered + credits | Usage-based flexibility |

| Grammarly | Freemium subscription | Feature gating |

The winning formula for AI apps:

Research shows the optimal AI monetization balance is 75% predictable subscription + 25% usage-based (credits/tokens). This gives users cost predictability while capturing value from heavy users.

Critical insight: 25% of SaaS buyers plan to replace applications if AI isn’t included soon. AI isn’t just a feature — it’s becoming table stakes.

7. Hybrid monetization: Beyond pure subscriptions

35% of apps now mix subscriptions with consumables or lifetime purchases. Pure subscription models are no longer enough.

Hybrid adoption by category:

- Gaming: 61.7% use hybrid models

- Social & Lifestyle: 39.4% use hybrid

- Health & Fitness: 56% use mixed trial strategies

Why hybrid works:

Combining subscriptions with consumables (one-time purchases for premium content, AI-generated insights, or feature unlocks) captures different user segments. Users who won’t commit to subscriptions might still make smaller purchases, creating an additional revenue layer.

Hybrid model structures:

- Base subscription + premium add-ons

- Subscription + consumable credits

- Subscription + lifetime purchase option

- Freemium + IAP + optional subscription

The key insight: subscriptions aren’t disappearing — they’re becoming one piece of a larger monetization puzzle.

8. The psychology of conversion

Understanding why users convert is as important as what you offer. Here are the psychological triggers that drive premium conversion:

| Trigger | How it works | Implementation |

|---|---|---|

| Loss aversion | Users prefer avoiding losses over gaining benefits | Show what they’ll lose when trial ends, not just what they’ll gain |

| Endowment effect | Users value what they already “own” | Let users customize, save progress, build history during trial |

| Sunk cost fallacy | Users continue based on past investment | Track progress, streaks, achievements prominently |

| Social proof | Users follow others’ actions | Display subscriber counts, ratings, testimonials |

| Scarcity | Limited availability increases value | Time-limited offers, exclusive features, countdown timers |

| Anchoring | First price seen influences perception | Show highest tier first, then discount |

| Status quo bias | Users prefer current state | Make premium the default after trial |

| FOMO | Fear of missing out | Limited-time features, exclusive content, community access |

How top apps apply these principles:

- AllTrails tells users they’re “3x more likely to hike with premium” — addressing the “Will I use it?” fear while adding positive framing

- Canva shows everything users will lose when cancelling — pure loss aversion

- Duolingo uses streaks and progress tracking to create sunk cost investment

Important note: Apply these principles ethically. The goal is to demonstrate genuine value, not manipulate users into purchases they’ll regret.

9. Win-back offers: Recovering churned subscribers

Apple introduced Win-back offers in WWDC 2024 — a powerful new tool for re-engaging churned subscribers.

How win-back offers work:

- Target lapsed subscribers with special discounts or free trials

- Configure eligibility rules based on lapse duration and subscription history

- Offers can be promoted directly on the App Store’s Today, Games, and Apps tabs

- Reach users outside your app through StoreKit Messages API

Setting up win-back offers:

- Go to App Store Connect → Subscriptions → Subscription Group

- Click Win-back Offers → Create Win-back Offer

- Configure discount type (free trial, pay-as-you-go, pay-up-front)

- Set eligibility rules (how long churned, time since subscription)

- Submit for review

Best practices:

- Combine win-back offers with messaging about new features since the user left

- Segment offers by churn reason (billing failure vs voluntary cancellation)

- Test different discount levels and durations

10. Regional conversion strategies

Conversion rates vary significantly by region. Optimize your approach for your target markets:

| Region | Download-to-paying | P90 | Key insight |

|---|---|---|---|

| North America | 5.5% | 10.5% | Strongest market, premium pricing works |

| Europe | 4.5% | 8.2% | 24% YoY IAP revenue growth in 2024 |

| Japan/South Korea | 2.0% | 5.1% | Highest LTV per user |

| Latin America | 1.8% | 4.2% | Growing rapidly, price-sensitive |

| Southeast Asia | 1.5% | 3.8% | Volume over value, localization critical |

iOS vs Android:

| Metric | iOS | Android |

|---|---|---|

| Share of consumer spending | 68% | 32% |

| Average revenue per app | $12.77 | $6.19 |

| Day 35 conversion | Higher | Lower |

| Download volume | Lower | Higher |

| Growth in emerging markets | Slower | 7% increase in 2025 |

Strategy implication: iOS for monetization, Android for reach. Many successful apps optimize separately for each platform.

Paywall optimization: Where and when

80-90% of all trials happen on Day 0. Your paywall timing and placement are critical.

Paywall placement strategies:

| Strategy | When to use | Conversion impact |

|---|---|---|

| Immediate hard paywall | Clear upfront value, utility apps | Highest conversion, lowest volume |

| After onboarding | Most apps | Balances volume and conversion |

| After first value moment | Content, productivity apps | High intent when users see value |

| Soft paywall (feature-gated) | Apps with viral potential | Lower conversion, higher volume |

| Delayed paywall | Apps needing habit formation | Risk of never converting |

A/B test everything:

- Paywall timing (Day 0 vs Day 3 vs after first milestone)

- Layout and design

- Pricing display (annual vs monthly first)

- Copy and messaging

- Social proof elements

- Discount presentation

Putting it all together: The conversion framework

Here’s a step-by-step framework for optimizing your freemium-to-premium conversion:

Step 1: Benchmark yourself

- Know your category’s conversion rates

- Track your own metrics over time

- Identify your biggest drop-off points

Step 2: Optimize your free tier

- Valuable enough to attract users

- Limited enough to create upgrade motivation

- Showcases your premium features

Step 3: Perfect your onboarding

- Get users to value in under 2 minutes

- 80-90% of trials start on Day 0 — don’t waste it

- Personalize the experience based on user intent

Step 4: Design your paywall

- Test timing and placement

- Apply psychological triggers ethically

- A/B test copy, pricing, and design

Step 5: Optimize trial experience

- Choose the right trial length for your category

- Test opt-in vs opt-out

- Create urgency as trial ends

Step 6: Consider hybrid monetization

- Add consumables or lifetime options

- Capture users who won’t subscribe

- Test credit/token systems for AI features

Step 7: Reduce churn and win back

- Monitor early warning signs

- Implement win-back offers

- Continuously improve based on churn feedback

Conclusion

Converting free users to paying subscribers ultimately comes down to demonstrating clear value and presenting the right offer at the right time.

The data is clear:

- Hard paywalls convert 6x better than freemium — but freemium captures more users

- 80-90% of trials start on Day 0 — onboarding is everything

- Longer trials convert better — but optimize for your category

- 35% of apps now use hybrid models — subscriptions alone aren’t enough

- AI apps are the fastest-growing segment — with unique monetization challenges

- Psychology matters — but apply it ethically

The gap between winning apps and the rest is widening. The top 5% make 400x more than the bottom 25%. The difference? Relentless optimization of every step in the conversion funnel.

How do you find what works for you? Test. A/B test your paywall, your pricing, your trial length, your messaging, your timing. Industry benchmarks can only guide you — your data tells the truth.