TL;DR: Apple replaced its simple €0.50 fee with a multi-layered external payment system including 2% acquisition fees, 5-13% store service fees, and a 5% Core Technology Commission – all to avoid additional EU penalties.

Apple just beat the deadline. With hours to spare before facing new EU penalties, the tech giant announced sweeping changes to its European App Store in-app purchase fee structure on June 26. But instead of simplifying, Apple introduced what might be the most complicated commission system in App Store history.

The changes were designed to satisfy European regulators who fined Apple €500 million in April for violating the Digital Markets Act. Apple’s response was to technically comply while creating a system so complex it might discourage developers from using external payments.

Is this genuine compliance or strategic resistance? Let’s unpack Apple’s latest moves and see whether they solve the regulatory standoff or just create more confusion.

The new EU App Store fee structure breakdown

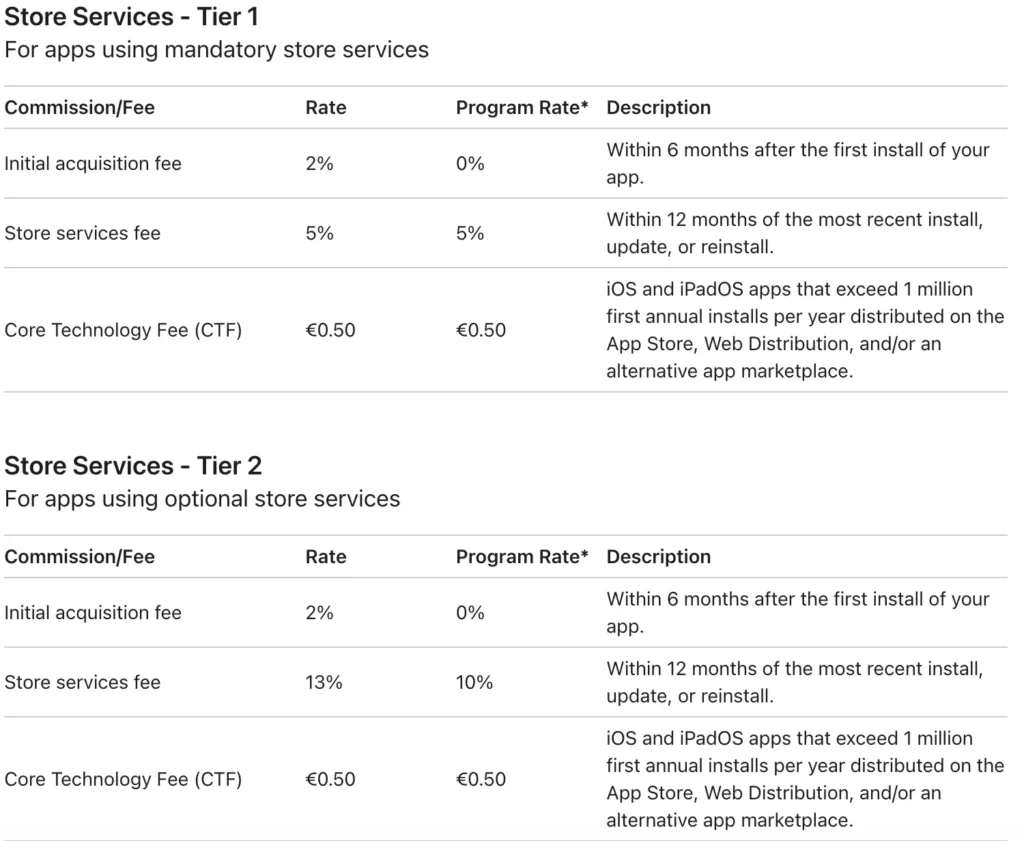

Apple’s new EU external payment fee structure replaces one simple charge with multiple overlapping fees for developers who want to use non-Apple payment systems.

Initial acquisition fee: 2%

For the first six months after a user downloads your app, Apple takes 2% of any digital sales made through external payment systems. This applies to new users only, existing customers don’t trigger this fee.

Core Technology Commission (CTC): 5%

This new 5% fee replaces the old flat €0.50 charge per install. It applies to apps using Apple’s development tools and platform, regardless of where purchases happen. The fee is charged within 12 months of the most recent install, update, or reinstall.

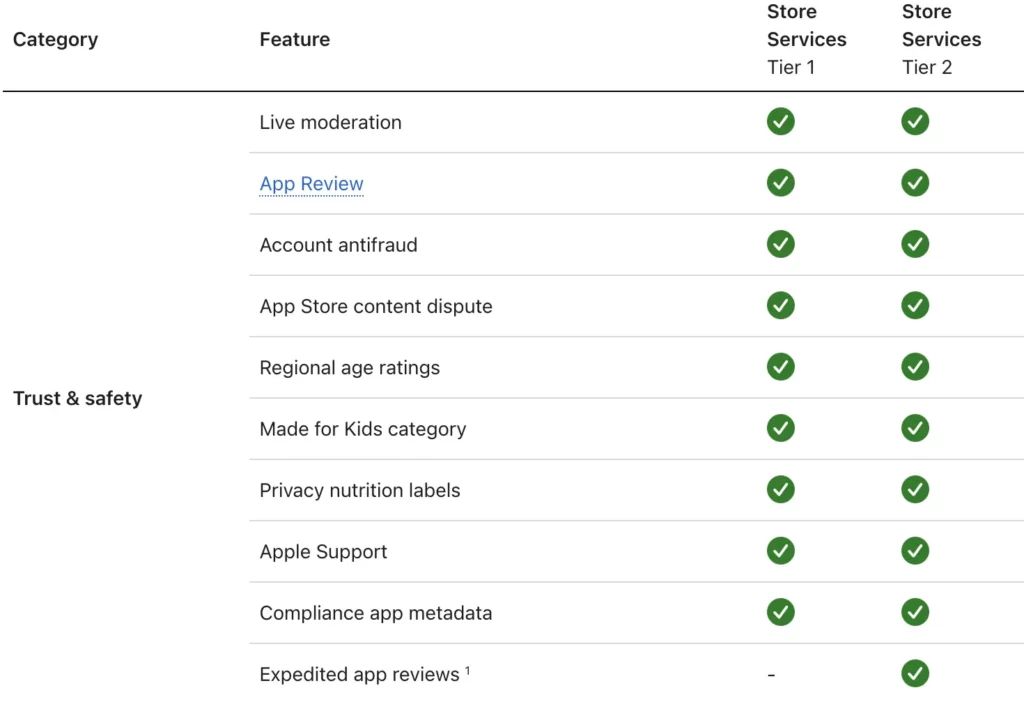

Store services fee:

Apple split its app store services into two packages:

- Tier 1 (5% fee): Basic package including app reviews, manual updates, and fraud protection. This tier is mandatory for any app that promotes external payment options.

- Tier 2 (13% fee): Full package adding marketing tools, automatic updates, app recommendations, analytics dashboards, and promotional features.

Small business program members get a discount, paying 10% instead of 13% for Tier 2 services.

The transition timeline

Developers currently paying the €0.50 Core Technology Fee have until January 1, 2026 to switch to the new percentage-based system. After that date, everyone moves to the CTC structure.

Under the new system, a developer using external payments could pay up to 20% in combined fees (2% + 13% + 5%) compared to Apple’s standard 30% App Store commission. However, the math gets complicated depending on timing, user type, and service tier choices.

Cost analysis: should you switch?

The new fee structure creates winners and losers depending on your app’s business model and user base. Let’s figure out which category you fall into:

Scenario 1: High-volume apps with established users

Apps with mostly existing users benefit the most from external payments:

- No 2% acquisition fee on existing customers

- Can choose Tier 1 services (5%) to minimize costs

- Total external payment fees: 10% (5% + 5% CTC)

You save 20%. Pay 10% instead of 30% App Store commission

Scenario 2: Growing apps with new user acquisition

Apps actively acquiring new users face higher costs:

- 2% acquisition fee applies for first 6 months on new users

- Need Tier 2 services (13%) for growth features

- Total fees: 20% (2% + 13% + 5% CTC)

You save 10%. Pay 20% instead of 30% App Store commission

Scenario 3: Small Business Program members

Developers already in Apple’s Small Business Program (under $1M annual revenue) currently pay 15% App Store commission:

- Reduced Tier 2 fee: 10% instead of 13%

- Total maximum fees: 15% (10% + 5% CTC)

The same 15%.

Platform comparison

Apple offers better terms on other platforms. macOS, tvOS, visionOS, watchOS only charge a 3% fee for external payments, making iOS the most expensive platform for alternative payments.

When do external payments make sense?

External payments are worth considering only if you meet all three criteria:

- Most of your revenue comes from existing users (so you avoid the 2% acquisition fee).

- You can work with basic App Store services instead of premium features.

- Your team can handle the technical complexity of managing your own payment system.

Hidden costs to consider

Apple’s fees are just the beginning. You’ll also pay payment processor fees (typically 2-3%), need fraud prevention systems, handle customer support for payment issues, and maintain payment infrastructure. These hidden costs can add another 3-5% to your total expenses.

So while Apple’s new fees range from 10-20%, your actual cost for external payments could be 13-25% when you include everything.

The bottom line: Should you switch?

For most developers, the answer is not yet.

| Switch if you’re: → A high-volume app with mostly existing users → Already handling payment processing infrastructure → Comfortable with 10-15% total costs vs. 30% App Store fees | Don’t switch if you’re: → A growing app that needs new user acquisition → Relying on App Store marketing and discovery features → A small team without payment processing expertise |

Apple’s complex fee structure successfully discourages most developers from leaving. The 10-20 percentage point savings sound good until you factor in the operational complexity, hidden costs, and reduced App Store benefits.

External payments work best for large, established apps that can absorb the complexity and already have strong direct relationships with their users.

Technical implementation details

Apple created two distinct pathways for developers who want to use external payments, each with different rules and requirements.

Option 1: Alternative Terms Addendum

This is for apps that mention external deals but don’t include direct payment links. Think of it as the “information only” option.

- Apps can tell users about promotions, discounts, or subscription offers available elsewhere

- No clickable links or direct payment processing within the app

- Developers still pay the Core Technology Commission but avoid some additional fees

→ Check the official Apple documentation

Option 2: StoreKit External Purchase Link Entitlement

This is the full external payment option with actionable links that users can click.

- Apps can include multiple external payment links with tracking parameters

- Links can redirect users to websites, alternative app stores, or other apps

- Developers can design custom promotional campaigns within their apps

- Full fee structure applies (acquisition fee + store services fee + CTC)

→ Check the official Apple documentation

Reporting and compliance requirements

Developers using external payments must integrate Apple’s External Purchase Server API to report transactions. This allows Apple to calculate and collect its commissions on purchases made outside the App Store.

The system tracks user acquisition sources, purchase timing, and service tier usage to determine which fees apply to each transaction.

Is this really compliance or just theater?

The response to Apple’s changes has been swift and largely critical, with industry leaders questioning whether Apple is genuinely complying with EU regulations.

Epic Games CEO Tim Sweeney immediately criticized the changes on X. He called Apple’s approach “blatantly unlawful in both Europe and the United States” and accused Apple of making “a mockery of fair competition in digital markets.”

Sweeney argued that “Apps with competing payments are not only taxed but commercially crippled in the App Store,” pointing to the complexity as evidence that Apple is deliberately discouraging external payments.

Developer community concerns

Early developer reactions focus on three main issues:

- Small development teams worry about managing multiple fee calculations and compliance requirements.

- Many developers question whether the potential 10-20% savings justify the operational overhead.

- Concerns that Apple’s approach may not satisfy EU regulators, creating future uncertainty.

While EU officials haven’t formally responded to Apple’s latest changes, the timing suggests regulatory pressure was effective. Apple announced these changes just hours before the June 26 deadline, indicating the company took the threat of additional penalties seriously.

However, the complexity of the new system may invite further scrutiny. EU regulators previously criticized Apple for creating barriers that discourage competition, and this multi-layered fee structure could be seen as another form of that behavior.

What led to this showdown?

This latest fee restructuring is the culmination of a year-long regulatory battle between Apple and European authorities over digital market competition.

The Digital Markets Act

The EU’s Digital Markets Act, which took effect in 2024, targets “gatekeeper” platforms like Apple’s App Store. The law requires these platforms to allow fair competition and prevent companies from favoring their own services over competitors.

Apple’s initial resistance

Apple’s first response to the DMA was minimal compliance. The company allowed external payment links but charged a 27% commission on purchases made outside the App Store – barely different from the standard 30% App Store fee.

Apple also introduced warning screens that appeared when users clicked external links, with language designed to discourage users from leaving Apple’s payment system. These screens warned about security risks and loss of Apple’s customer protection.

The €500M penalty

In April 2025, EU regulators lost patience with Apple’s approach. The European Commission fined Apple €500 million for failing to comply with DMA requirements, specifically citing Apple’s anti-steering provisions that prevented developers from freely promoting alternative payment options.

The fine amount was calculated based on the “gravity and duration” of Apple’s non-compliance, with regulators arguing that Apple’s fee structure and warning screens effectively nullified the benefits the DMA was meant to provide.

The June 26 deadline

Following the fine, Apple was given 60 days to demonstrate meaningful compliance or face additional penalties. The June 26 deadline created urgency that forced Apple’s hand, leading to these last-minute comprehensive changes.

Apple’s broader legal strategy

These EU changes are part of Apple’s global regulatory challenges. The company is simultaneously fighting similar battles in the United States with Epic Games and facing regulatory pressure in other markets including South Korea, Japan, and Australia.

Key global regulatory battles:

- United States: Apple found in contempt for violating Epic Games court order, appeals rejected by federal appeals court

- South Korea: New payment law targeting Apple and Google, with ongoing regulatory scrutiny

- Japan: Antitrust regulator increasing scrutiny of App Store practices

Apple has consistently argued that its App Store policies protect user security and privacy, while critics contend that Apple uses these justifications to maintain lucrative monopolistic practices.

Conclusion

This complex restructuring benefits Apple more than anyone else. While developers can theoretically save 10-20 percentage points on fees, the operational complexity and hidden costs mean most will stick with Apple’s standard App Store terms. Apple successfully turned regulatory compliance into a competitive moat.

Large, established apps with existing user bases emerge as the only clear winners, potentially saving meaningful money if they can navigate the complexity. Everyone else faces a system designed to discourage switching.

The critical question is whether EU regulators will accept this elaborate compliance effort or demand further simplification. Apple’s strategy bets that technical compliance is sufficient, even if the practical barriers remain high.

If regulators push back, Apple may face additional fines and pressure for more fundamental changes. If they accept this approach, other tech giants will likely adopt similar strategies of complex compliance that technically meets requirements while preserving business advantages.

This case will influence digital market regulation globally. Apple’s ability to maintain revenue streams while appearing to comply with competition laws provides a playbook for other platforms facing regulatory pressure.

For developers, the message is clear: while external payment options now exist in the EU, Apple has ensured that using them requires significant business justification. The 30% App Store commission remains the path of least resistance for most developers.

The ultimate test will be whether this regulatory theater produces real competition or simply creates the illusion of choice while preserving the status quo.

References

- Alternative payment options on the App Store in the European Union

- Using alternative payment options on the App Store in the European Union

- Update on apps distributed in the European Union

- Apple’s DMA Compliance Report

If you’re an iOS developer tracking App Store revenue, knowing when Apple actually pays you is just as important as understanding fee structures. Check out our handy Apple fiscal calendar 2026 to see all upcoming payment dates at a glance.