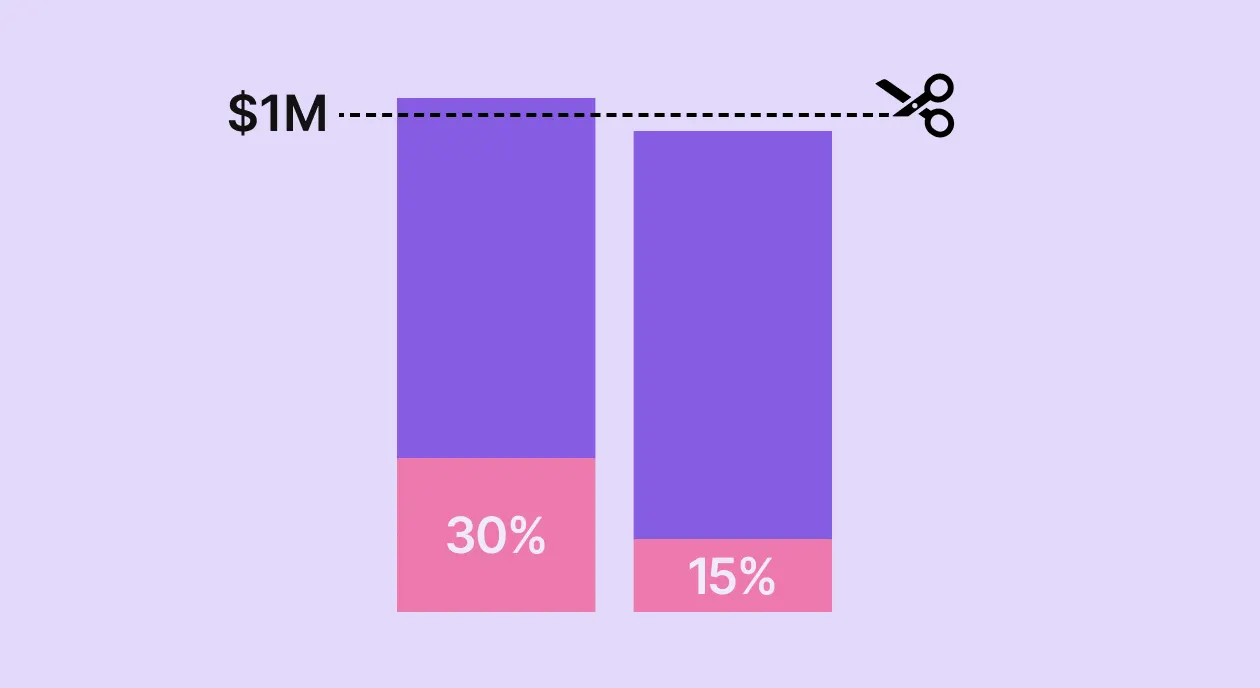

When Apple launched the App Store in 2010, they implemented the same 30% commission structure that iTunes had used for musicians. For over a decade, this “Apple tax” was simply the price of doing business on the world’s most lucrative app marketplace.

Then came 2020 – a year of antitrust lawsuits from the U.S. Department of Justice, the European Commission, and a very public battle with Epic Games. Apple’s response? The App Store Small Business Program, which slashes commissions in half for qualifying developers.

If you’re earning under $1 million annually from the App Store, this program could put an extra 15% of every sale back in your pocket. Here’s everything you need to know to take advantage of it.

How the program works

The concept is straightforward: instead of Apple’s standard 30% commission on paid apps and in-app purchases, qualifying developers pay just 15%. That’s a significant difference – on a $10 subscription, you keep $8.50 instead of $7.

Here’s how eligibility breaks down:

- New developers automatically qualify when they start selling on the App Store

- Existing developers qualify if they earned $1 million or less in proceeds during the previous calendar year

- Cross the threshold? If you surpass $1 million during the current year, the standard 30% rate kicks in for all future transactions

- Fall back under? If your proceeds drop below $1 million in a subsequent year, you can re-qualify for the 15% rate the following year

One important distinction: Apple calculates eligibility based on proceeds, not gross sales. Proceeds are your sales minus Apple’s commission and certain taxes – essentially what lands in your bank account.

Commission comparison

| Status | Apple Commission | You Receive | Example ($10 sale) |

|---|---|---|---|

| Standard rate | 30% | 70% | $7.00 |

| Small Business Program | 15% | 85% | $8.50 |

| Subscriptions after year 1 (standard) | 15% | 85% | $8.50 |

| EU alternative terms (subscriptions year 2+) | 10% | 90% | $9.00 |

Associated Developer Accounts

Here’s where things get interesting and where some developers trip up.

Apple requires you to disclose all Associated Developer Accounts when enrolling. These are Apple Developer Program accounts that:

- You own or control (including majority ownership over 50%)

- Own or control your account

- Where you have ultimate decision-making authority

- Where another member has ultimate decision-making authority over your account

Why does this matter? Because proceeds from all associated accounts are combined when calculating the $1 million threshold. Running multiple apps across different developer accounts won’t help you stay under the limit if those accounts are associated.

When you enroll, you’ll need to provide for each associated account:

- Organization or individual name

- Team ID

- Account Holder email address

- Description of your relationship with that account

Who is eligible for the App Store Small Business Program?

The vast majority of developers selling digital goods and services on the App Store qualify. If you’re reading this article, you probably do too.

To be eligible, you must:

- Be an Account Holder in the Apple Developer Program

- Accept the latest Paid Apps agreement (Schedule 2) in App Store Connect

- Have earned no more than $1 million in total proceeds, including all Associated

Developer Accounts, during the prior calendar year - Not exceed $1 million during the current calendar year

There’s also a bonus for EU developers: if you’re on the alternative terms in the EU under the Digital Markets Act, you can get an even lower 10% commission for subscriptions after their first year.

How to apply for the App Store Small Business Program

The enrollment process is refreshingly simple:

- Visit the enrollment page at developer.apple.com/app-store/small-business-program/enroll/

- Sign in with your Apple Developer account credentials

- Review your information – Apple will auto-fill your name, email, and Team ID

- Declare Associated Developer Accounts if applicable

- Submit your enrollment

After submitting, you’ll receive a confirmation email that your enrollment is being reviewed. Once approved, your adjusted commission rate takes effect 15 days after the end of the fiscal month in which you were approved.

For example: approved on February 10th? Your 15% rate begins March 14th. The 15-day rule is tied to Apple’s fiscal months, which don’t align with regular calendar months. Check the Apple fiscal calendar to see exactly when your reduced rate will take effect.

Estimating your eligibility

Not sure if you’re under the $1 million threshold? Here’s how to calculate:

If your bank account is in USD: Add up all App Store payments deposited in the prior calendar year, then adjust for any taxes and adjustments shown in App Store Connect’s Payments and Financial Reports section.

If your bank account is in another currency: Convert each month’s deposits to USD using a publicly available exchange rate that corresponds with the end of each fiscal month in Apple’s fiscal calendar. Then adjust for taxes and adjustments.

Don’t forget to add proceeds from any Associated Developer Accounts.

Is the App Store Small Business Program worth it?

Absolutely, but there’s a nuance most articles don’t address.

For developers comfortably under the $1 million mark, the program is a no-brainer. That extra 15% compounds significantly over time. On $500,000 in annual sales, you’re keeping an additional $75,000.

But what about developers approaching the threshold?

Some developers deliberately cap their growth to avoid losing the reduced rate. This is almost always the wrong strategy. Yes, crossing $1 million means paying 30% on future transactions, but you’re still earning more in absolute terms than you would by artificially limiting growth.

The real consideration is whether you have alternative monetization strategies. Companies like Paddle point out that web-based payments – where Apple has no jurisdiction – can help you grow revenue without counting toward the App Store threshold. A hybrid approach (App Store for existing customers, web checkout for new acquisitions) lets some developers maintain their small business status while scaling aggressively.

That said, these strategies add operational complexity. You’ll need to handle payments, refunds, chargebacks, and global sales tax yourself or use a merchant of record service.

For most developers, the simpler path is to take full advantage of the 15% rate while you qualify, build the best product you can, and consider it a success if you “graduate” to the standard tier.

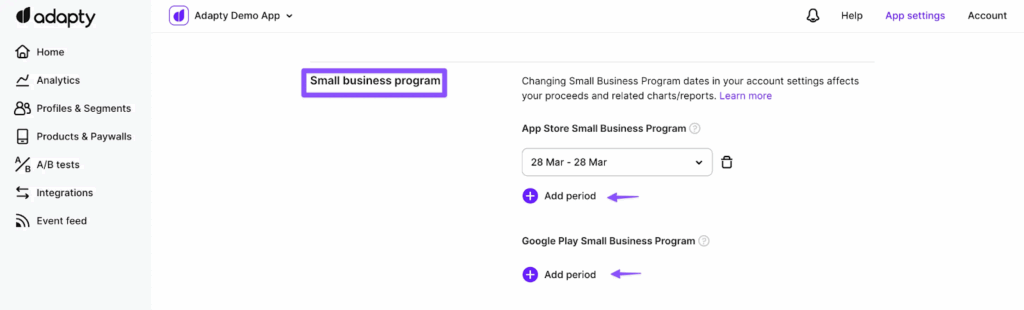

How to inform Adapty?

If you’re using Adapty for subscription management, keeping your Small Business Program status updated is crucial. The reduced commission rate affects how Adapty calculates your proceeds in charts, reports, and integration events.

Here’s how to configure it:

- Navigate to App Settings → General tab in your Adapty Dashboard

- Find the App Store Small Business Program section

- Click Add period to specify your membership dates

- Enter your period range:

- Entry Date: When your membership began (can be past or future)

- Exit Date: When you left or were removed from the program (if applicable)

You can add multiple periods if your membership status has changed over time.

Important timing consideration: If you set an entry date in the past, Adapty won’t re-send webhooks and integration events with corrected pricing data for transactions that already occurred. To ensure accurate data flows to your integrations, set your effective entry date as soon as possible.

If you leave the program, enter your exit date promptly. Without it, Adapty will continue calculating your commission at the reduced rate – skewing your analytics.

Details: https://adapty.io/docs/app-store-small-business-program

How Adapty calculates your app’s earnings

Adapty determines your proceeds by applying the appropriate commission rate based on your Small Business Program membership status:

- Members: 15% commission deducted (you receive 85% of sale price)

- Non-members: 30% commission deducted (you receive 70% of sale price)

- EU alternative terms members: 10% commission on subscriptions after first year

The membership status is set per app in Adapty, recognizing that developers may have multiple apps across different companies with different eligibility statuses.

When you configure your membership periods, Adapty automatically applies the correct commission rate to all transactions within those date ranges. This ensures your charts accurately reflect actual revenue rather than estimates.

For Google Play developers, Adapty also supports the reduced service fee program with similar configuration options.

Final thoughts

The App Store Small Business Program represents a meaningful opportunity for independent developers and small studios. If you qualify, there’s no reason not to enroll, and if you’re using Adapty, keeping your membership status updated ensures your analytics reflect reality.

The extra 15% won’t build your app for you, but it can fund the marketing, development, and experimentation that separates successful apps from abandoned projects.